The FED kept rates unchanged and essentially suggested 3 rate cuts on the table for 2024.

Both the commodities and equities markets took that as a sigh of relief.

SPY made new all-time highs and gold and gold miners flew.

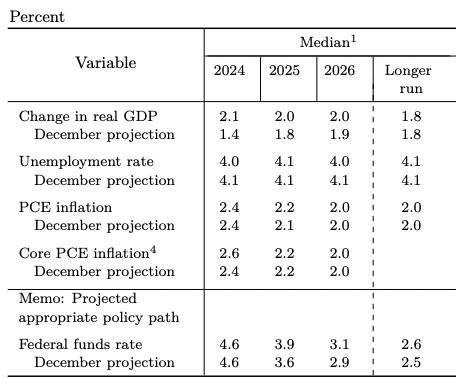

For 2025, the FED sees the jobs rate as holding steady at 4.1%.

They see inflation dropping to 2.2% as measured by the PCE numbers.

And they see the Fed Funds rate dropping significantly by 2026 and in the longer run.

However, the FED is committed to a 2% inflation rate.

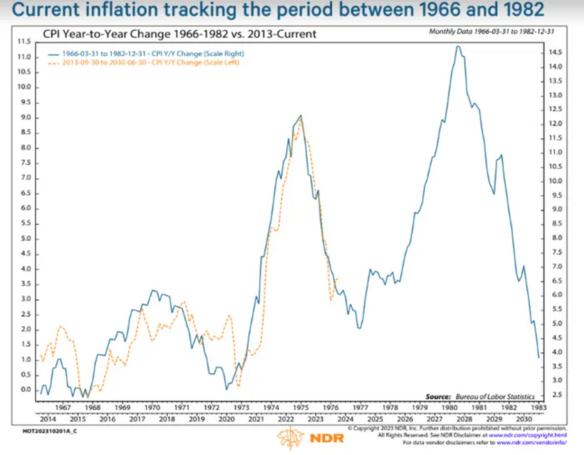

And the most interesting part-Powell said that there could be seasonal effects in inflation data.

Sounds like many words to say one word- “transitory”.

Powell is watching the labor market and will become more dovish if the unemployment rate rises.

He feels confident that the policy rate has peaked.

But also wants us to understand that “higher for longer” is not off the table.

Some analysts took the minutes as a more hawkish FED, while the initial market reaction interpreted the meeting as dovish.

Powell did a great job pandering to both doves and hawks.

Our focus remains the same as far as the next direction.

Junk Bonds-they rallied (HYG) and remain risk-on.

Long Bonds (TLT)-Still at the tipping point, holding 92.00 support yet not very clear on the next moves. Could they spoil the fun? Or drive everything up even higher?

And then there are the other indicators for inflation.

Gold Miners GDX-They ran up nearly 5% and cleared a 50-week moving average for the first time since December. If GDX (NYSE:GDX) clears the January high, whoa.

Silver also ran and is priced well over the January 6-month calendar range high.

Sugar-still not 1979 exciting but can be if clears over 22 cents a pound and keeps going.

Are we readying for a “no landing” where everything runs up and inflation remains in control?

Or like our overlay chart, did the FED just relay they want lower rates to pay off the ginormous debt in favor of worrying about the hyperinflation potential?

ETF Summary

- S&P 500 (SPY) 510 pivotal

- Russell 2000 (IWM) 202 if holds good sign

- Dow (DIA) 385 support 400 resistance

- Nasdaq (QQQ) 428 the 50-DMA support

- Regional banks (KRE) 45-50 range

- Semiconductors (SMH) 214 support 224 resistance to clear

- Transportation (IYT) 68 area support

- Biotechnology (IBB) 140-142 resistance 135 support

- Retail (XRT) 73 support 77 resistance

- iShares iBoxx Hi Yd Cor Bond ETF (HYG) 77 big number to hold. Over 78 risk ON