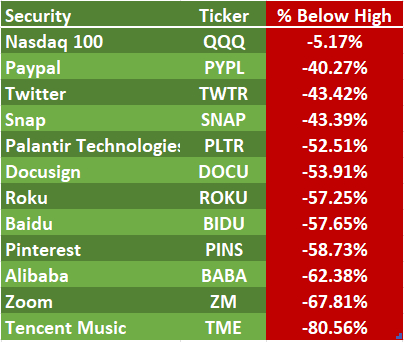

Growth and technology firms led the way in 2020, but many of last year’s winners are now in bear market territory. As of this past Friday only about 40% of Nasdaq 100 constituents were trading above their respective 50-day moving averages, indicating market breadth has weakened substantially from the November peak. While the QQQ ETF that tracks this index is only about 5% off its all-time highs, some notable growth and technology names are faring far worse as we can see below.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

QQQ is presently testing support at its own 50-day moving average, and it remains to be seen if Santa will bring the Christmas sleigh and stocks will rally into December. There’s nothing magical about moving averages – they are simply reference points that investors should keep in mind. Despite the underperformance of some individual holdings, QQQ is still up over 23% for the year.

While the former leaders shown above have been in panic mode lately, three stocks we will analyze below are showing relative strength beneath the surface. When buying pressure is exceeding selling pressure for a stock – particularly during a time when most equities are falling – it’s a clear indication that institutional buying is strong and sellers are few and far between. Following the money is a good way to let the market do the talking instead of incorporating stories or opinions.

Let’s take a more detailed look at three market leaders that are showing some immunity to the recent volatility.

CDW (NASDAQ:CDW) Corporation (CDW)

CDW Corp. provides information technology products and services to government, business, education and healthcare customers. Headquartered in Vernon Hills, IL, CDW’s hardware products include notebooks, mobile devices, data storage, video monitors, printers and desktops. CDW also provides licensing management and software solutions.

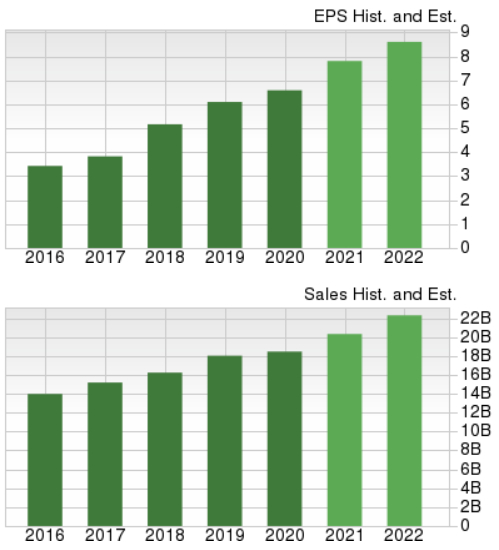

The company believes that its addressable markets in the US, UK and Canada represent more than $325 billion in annual sales. Last year, net sales for CDW improved 2.4% year-over-year to $18.47 billion. Both revenues and earnings for CDW have been steadily trending upward, with current full-year estimates at $20.33 billion and EPS of $7.81 representing annual growth rates of 10.07% and 18.51%, respectively.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

These are the trends investors like to see when investing in the stock. CDW, a Zacks #2 (Buy) stock, has posted a trailing four-quarter earnings surprise of 12.17%, helping push the stock over 50% higher on the year. CDW has exceeded earnings estimates in each of the last twenty quarters.

Investor Alert: Legal Marijuana Looking for big gains?

Now is the time to get in on a young industry primed to skyrocket from $13.5 billion in 2021 to an expected $70.6 billion by 2028.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could kick start an even greater bonanza for investors. Zacks Investment Research has recently closed pot stocks that have shot up as high as +147.0%.

You’re invited to immediately check out Zacks’ Marijuana Moneymakers: An Investor’s Guide. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL): Free Stock Analysis Report

HP Inc. (HPQ): Free Stock Analysis Report

Invesco QQQ (QQQ): ETF Research Reports

CDW Corporation (CDW): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research