Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

It was a wild ride Thursday, and it continued right into the overnight Globex session Friday. The ES traded all the way down to 2631.00 at 5:00 am, down -17.00 handles, and then rallied all the way up to 2647.75 before the 8:30 open. Total Globex volume was 405,000. On 8:30 bell the ES caught another bid and traded up to 2648.75, up +17.75 handles from the Globex low. After the early high was made, the ES sold off down to 2642.75, and then rallied back up to 2646.00. Total volume at 9:55 am was 580,000.

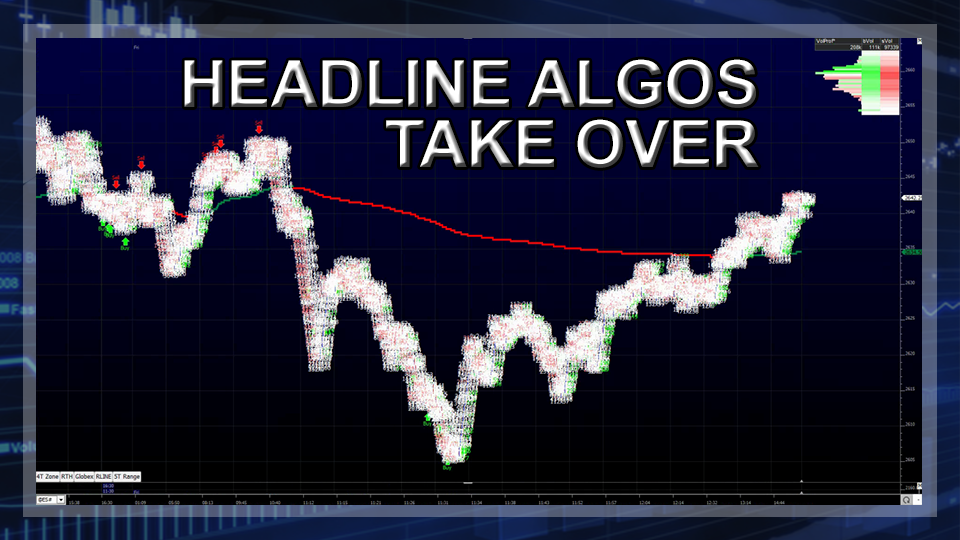

The next move was up to a new high at 2650.75, and then back down to 2645.00. There was one last blast up to a lower high at 2650.50, then at 10:11 am the news algos took over when a headline came out that CBS reporter Brian Ross reported that Michael Flynn was preparing to testify that President Trump directed him to make contact with Russians, and in a matter of minutes the ES sold off all the way down to 2618.00.

After the break, the ES rallied back up to the 2634.00 area, and then sold off back off down to 2618.00 when another headline came out saying that Flynn had agreed to cooperate with the government as part of plea deal. No sentencing date was set – the special counsel office will file a status update in three months.

The VIX, which was down early on, started to rally as the ES got hit by several more sell programs, taking it all the way down to 2605.00. Then, out came another headline from attorney Ty Cobb saying Flynn’s false statements to the FBI mirrored his false statements to the White House, which led to his resignation, and the ES went flying up to 2627.25 before selling back off down to 2613.50.

The speed of the moves was incredible. After the push back down, another headline came out saying “Senate tax bill: It will include a measure on the state and local tax break that Collins has been pushing,” and the ES shot back up to 2634.00, and then eventually 2640.00.

When the MiM came online and moved from $400 million to sell to $800 million to sell, the ES traded back down to 2633.25, and then rallied up to 2643.00. At 2:45 the NYSE imbalance showed MOC sell $900 million, and the ES traded 2642.25 on the 3:00 cash close.

It all added up to increased volatility, exactly what futures traders have been begging for. In the end the S&P 500 futures (ESZ17:CME) settled at 2644.00, down -4.00 handles, or -0.15%; the Dow Jones futures (YMZ17:CBT) settled at 24,238, down -36 points, or -0.14%; the Nasdaq 100 futures (NQZ17:CME) settled at 6346.25, down -22.75 points, or -0.35%; and the Russell 2000 (RTYZ17:CME) settled at 1537.60, down -7.80 points or -0.50 % on the day.

As always, please use protective buy and sell stops when trading futures and options.