Hurricane Irma, which is now a Category 4 storm, is making its way toward the Sunshine State Florida and the Southeast United States after wrecking Caribbean Islands. The storm, one of the strongest Atlantic Ocean hurricanes ever recorded, is expected to hit the United States this weekend.

Hurricane Irma might lose some of its intensity when it hits Florida but will still have enough strength to cause major damages. The administration and the utilities are preparing themselves to deal with these extreme weather conditions.

Lessons Learned from Hurricane Wilma

Florida is no stranger to devastating hurricanes and extreme weather. Hurricane Wilma hit Florida in October 2005 and resulted in mass scale power outages. Overall damages were valued in excess of $20 billion. People were without power for weeks as thousands of wooden power poles were uprooted by the storm.

The utilities operating in the region have learned a difficult lesson from Wilma and worked to strengthen the infrastructure to counter natural calamities in the future. Utilities like Duke Energy Corp. and NextEra Energy have invested billions of dollars to strengthen their operations.

Florida Public Service Commission, post the Wilma devastation, had directed utilities to fortify infrastructure and provide power to customers during natural disasters.

Utilities Showed Resilience Against Hurricane Harvey

According to Electric Reliability Council of Texas’ report, none of the major utilities in this area have suffered any notable damages in their generation fleet or power generating system, thanks to the advanced infrastructural development.

Florida Utilities Ready to Face Irma

As Irma might cause massive damages to the utility infrastructure, Utility workers, who worked tirelessly to keep the utility service running in Texas after Hurricane Harvey, are gradually moving toward Florida.

Stocks to Bet on

Duke Energy (NYSE:DUK) : Duke Energy has regulated utility operation in Florida and has invested more than $5 billion since 2004 to strengthen its power delivery system in the Southeast. The company has been preparing for the storm by strengthening its distribution lines, vegetation management and automation of the grid.

Duke Energy has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

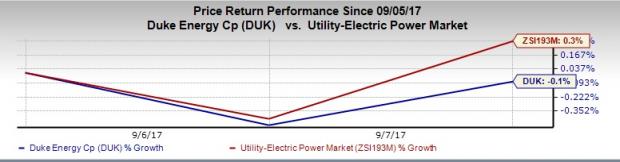

Duke Energy's shares have lost 0.1% over the last three days versus 0.3% gain of the industry it belongs to.

NextEra Energy Inc. (NYSE:NEE) : NextEra Energy provides retail and wholesale electricity services to approximately 4.9 million customers in eastern and southern Florida through its subsidiary Florida Power & Light Company (FPL). It currently carries a Zacks Rank #3 (Hold).

The company is ready to shut down its four nuclear reactors as a precautionary measure as the storm approaches. The spokesperson of FPL said that the company has nearly 15,000 crew members to help in restoration of power in Florida. Since 2006, FPL has invested nearly $3 billion to strengthen its electricity transmission and distribution capabilities in the state.

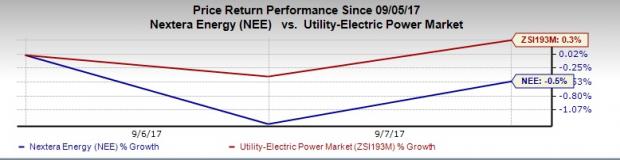

NextEra shares lost have 0.5% over the last three days versus 0.3% gain of the industry it belongs to.

Our Take

As the old saying goes, “Nature Always has the Last Laugh.” However, through the technological advancements we now have the ability to correctly predict the intensity of the storm and where it is going to hit. This gives us the chance to prepare well ahead of time. Every storm is unique and destruction caused by Hurricane Harvey is a stark reminder what nature can do to us.

Florida has seen ample investment in solar energy from Duke Energy, NextEra Energy and Tampa Electric. The solar panels are built to survive in harsh conditions, but will they be able to survive in Hurricane Irma’s 150+ mph strong winds?

Hurricanes likes these are a big threat to Florida’s plan of adding more green energy in its system. It could put to test the investments made in Florida electricity infrastructure over the last decade. We need to wait and see whether the power infrastructure is capable of holding its ground during Irma’s onslaught and the impact of Hurricane Jose, a Category 3 storm currently following the path of Irma.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

NextEra Energy, Inc. (NEE): Free Stock Analysis Report

Duke Energy Corporation (DUK): Free Stock Analysis Report

Original post

Zacks Investment Research