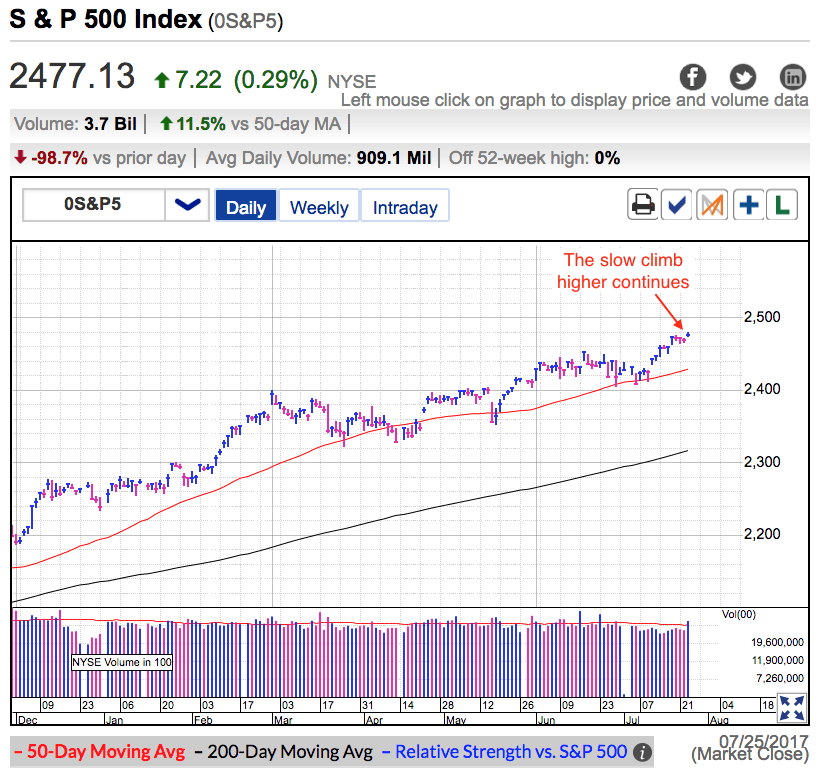

The S&P 500 added modest gains Tuesday, easily erasing the last three days of nominal selling and pushing us back into record territory. Earnings reports were good enough and the Senate voted to allow debate on healthcare reform. That put traders into a buying mood and pushed us closer to the psychologically significant 2,500.

While Wednesday's strength broke a three-day losing streak, a 4-point dip over three days hardly qualifies as a selloff. In fact the last three days of restrained selling is actually quite bullish. The market opened the door and gave owners an invitation to take profits, yet the vast majority chose to stay put. They don’t want to sell because they are patiently waiting for higher prices. No matter what the pundits tell us should happen when complacency is this widespread, when confident owners don’t sell, supply stays tight, and prices remain firm. This calm cannot last forever, but it will last far longer than most people expect.

While it is still early in earnings season, if there was a major problem with the economy, it would have shown up by now in the companies that have already reported. The same goes for the other side, if we were going to have a blowout quarter, we would know that by now too. Instead earnings have been good enough to keep our slow climb higher going, but not so great as to launch us higher.

Politics in D.C. is a circus as usual, but it hasn’t been bad enough to affect the markets yet. In fact the market seems to be largely ignoring politics. I’m not sure if that’s because traders are giving Trump and the GOP benefit of doubt and assume everything will work out in the end, or the market has such low expectations for Trump and Co. that this shit show is hardly a surprise. Either way the market is ignoring politics for the time being and so should we. It will matter at some point, but this is not that point and a trader can lose a lot of money jumping on a good trade too early.

For most of the last eight years people have been saying buy-and-hold is dead, but paradoxically this has been one of the greatest times to buy-and-hold. This is especially true over the last few months. This half-full market simply won’t sell off and that makes it hard to find swing-trading opportunities. Only the most nimble day-trader can take advantage of these five-point, two-hour long dips. The rest of us are better off sticking with our positions.

That means continuing to hold our buy-and-hold stocks, or sticking with cash while waiting for a better trading opportunity. (Ideally a diversified trader has a bit of both.) The choppy nature and quick reversals in this market make trading dangerous because it is far too easy to get tricked into buying high and selling low. The key to long-term success doesn’t come from our winners, but avoiding giving back all of our profits during slow times. It is hard for a trader to sit on his hands, but that is the best call here.

The path of least resistance remains higher. Trade accordingly. 2,500 is easily within reach, even if it takes us a little while to get there. Things will get a lot more interesting this fall once big money managers return from vacation. The S&P 500 is up 10% for the year, but the chances of us finishing the year at these levels is highly unlikely. Either everything will go according to plan and Trump’s policies will shift the economy into the next gear, or our leaders will fail us and the air will come out of the Trump rally. While I don’t know which way we will go, I do know good trading opportunities are just around the corner.