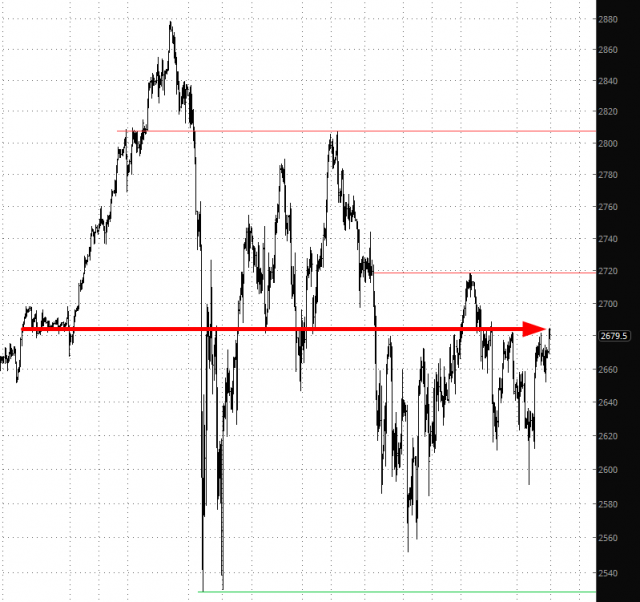

Looking at the ES, it’s interesting that over a period of five months, we have gone…………….nowhere. Sure, there’s been volatility (albeit ever-diminishing) and about a 350 point range, but just look at that arrow. With all the mayhem that’s been going on, the S&P 500 was a little under 2700 in mid-December and it’s a little under 2700 right now. It’s getting dull again!

My attention remains focused on interest rates, and frankly the bonds are just about the only thing in the red this morning! As I am typing this, but ZB is down about half a percent, and the objective remains the same: to snap below that lower red horizontal and set up the next phase of the bond bear market, already well underway. (And whose rising interest rates will be of aid to my real interest shorts).

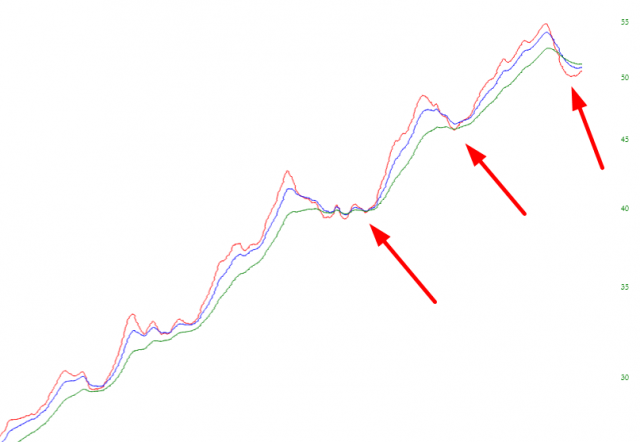

Finally, I’ll point out that utilities (that is, XLU) remains a favorite short of mine. Looking at the trio of exponential moving averages, you can see how this most recent breakdown is more pronounced than the prior ones.

Time to go out for a walk and pray to any god listening for a peaceful, stress-free day!