Yesterday’s cheer translated to today’s jeer as the broad market rally ran out of steam today. It capped off a week of optimism in the small caps but cold reality for the large caps of the Dow. I know I’m being a bit dramatic but overall I’d say things got chilly for the blue chips. Tech is still pushing the limits.

Check out Dave’s Daily Dive video above where I break down the market action today!!!

Each day I, Dave Bartosiak of Zacks.com (Twitter @bartosiastics) dive into the charts, pointing out key price action and levels for you to watch.

But it doesn’t stop there because the highlight of today’s video, which you can see for free by clicking above, is where I uncover five Zacks Rank #1 (Strong Buy) and Zacks Rank #2 (Buy) stocks that are breaking out to new 52-week highs today. These stocks have a ton of momentum behind them and are charging higher. The list of stocks I cover today include:

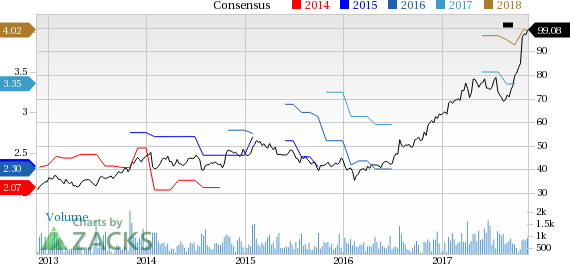

Cabot Microelectronics (CCMP)

Cabot Microelectronics Corporation, together with its subsidiaries, develops, manufactures, and sells polishing slurries and pads used in the manufacture of advanced integrated circuit (IC) devices in the semiconductor industry in a process called chemical mechanical planarization (CMP). The CMP technology is a polishing process used by IC device manufacturers to planarize or flatten the multiple layers of material that are deposited upon silicon wafers.

DXC Technology (DXC)

DXC Technology Company, together with its subsidiaries, provides information technology services and solutions primarily in North America, Europe, Asia, and Australia. It operates through three segments: Global Business Services (GBS), Global Infrastructure Services (GIS), and United States Public Sector (USPS). The GBS segment offers technology solutions comprising consulting, applications services, and software.

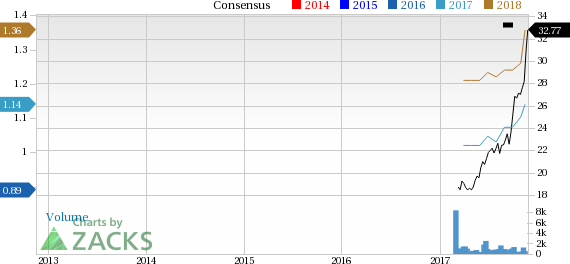

Hamilton Lane (HLNE)

Hamilton Lane Incorporated is an investment firm specializing in direct and fund of fund investments. It provides following services: separate accounts (customized to each individual client and structured as single client vehicles); specialized strategies (fund-of-funds, secondaries, co-investments, taft-hartley, distribution management); advisory relationships (including due diligence, strategic portfolio planning, monitoring and reporting services); and reporting and analytics solutions.

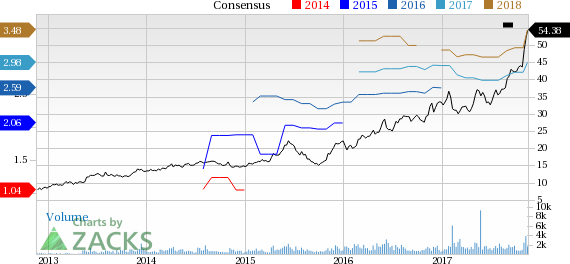

Kronos Worldwide (KRO)

Kronos Worldwide, Inc. produces and markets titanium dioxide pigments (TiO2) in Europe, North America, the Asia Pacific, and internationally. It produces TiO2 in two crystalline forms, rutile and anatase to impart whiteness, brightness, opacity, and durability for various products, such as paints, coatings, plastics, paper, fibers, and ceramics, as well as for various specialty products, such as inks, food, and cosmetics.

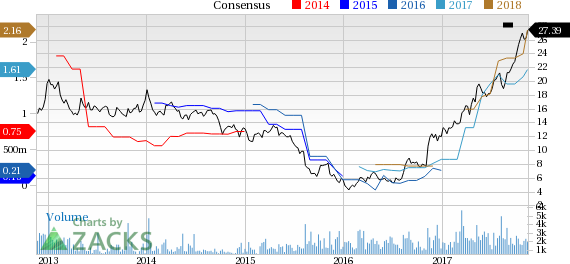

Orbotech (ORBK)

Orbotech Ltd. provides yield-enhancing and process-enabling solutions for the manufacture of printed circuit boards (PCBs), flat panel displays (FPDs), and semiconductor devices (SDs) in China, North America, Europe, Japan, Korea, and internationally. It operates through three segments: Production Solutions for the Electronics Industry, Solar Energy, and Recognition Software.

Now See All Our Private Trades

While today's Zacks Rank #1 new additions are being shared with the public, other trades are hidden from everyone but selected members. Would you like to peek behind the curtain and view them? Starting today, for the next month, you can follow all Zacks' private buys and sells in real time from value to momentum . . . from stocks under $10 to ETF and option moves . . . from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors. Click here for all Zacks trades >>

Orbotech Ltd. (ORBK): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Cabot Microelectronics Corporation (CCMP): Free Stock Analysis Report

Hamilton Lane Inc. (HLNE): Free Stock Analysis Report

DXC Technology Company. (DXC): Free Stock Analysis Report

Original post

Zacks Investment Research