More and more “risk on” sectors are signaling that the stock market is topping.

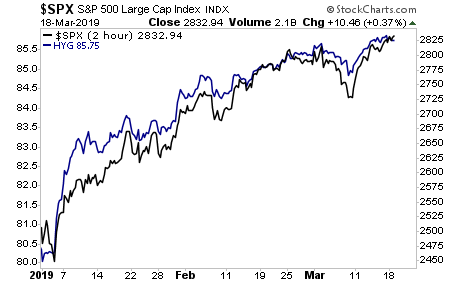

High Yield Credit lead stocks to the upside during this rally. It’s now stalled and is rolling over.

S&P 500 Vs. HYG

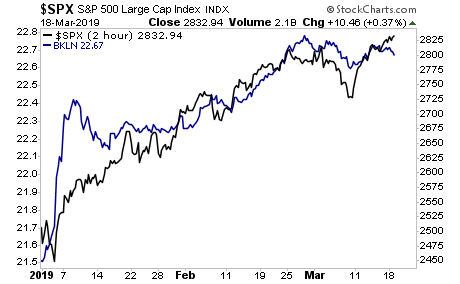

The same is true for leveraged loans (loans made to companies at risk of default). This sector peaked in late February and has already begun to correct.

S&P 500 Vs. PowerShares Senior Loan Portfolio (NYSE:BKLN)

This Might Be the Single Best Options Trading System in the Planet

Since inception in 2015, this trading system has produced average annual gains of 41%.

I’m not talking about a single trade… I’m talking gains of 41% per year on the ENTIRE portfolio.

We’re on another winning streak, having closed out a 9%, 12% and another 12% gain in the two weeks alone.

To lock in one of the last slots…

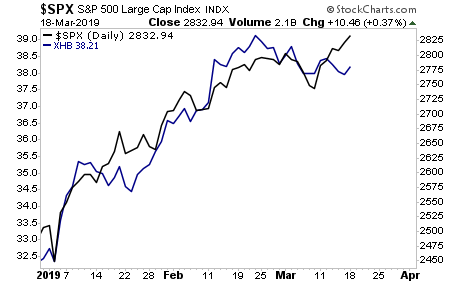

It’s the same story for housing.

S&P 500 Vs. XHB

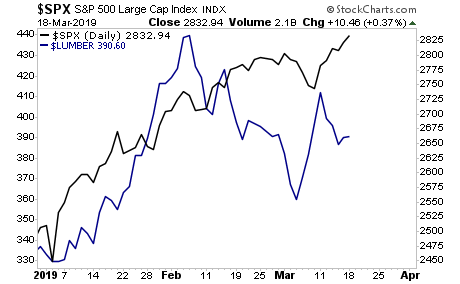

Lumber.

S&P 500 Vs. Lumber

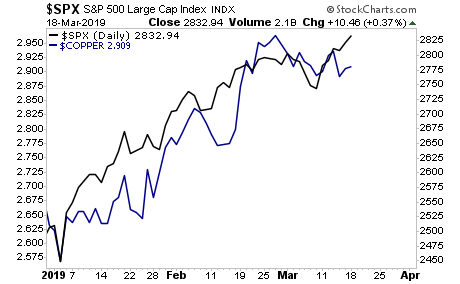

And {{8831|Copper}}.

Stocks are pricing in economic perfection: an environment in which growth is high and inflation controlled. Every other risk asset is pricing in a weak economy that will soon trigger a significance “risk off” event AKA possible crash.