Leading retailer, Five Below, Inc. (NASDAQ:FIVE) , is slated to report second-quarter fiscal 2017 results on Aug 30, 2017, after the market closes.

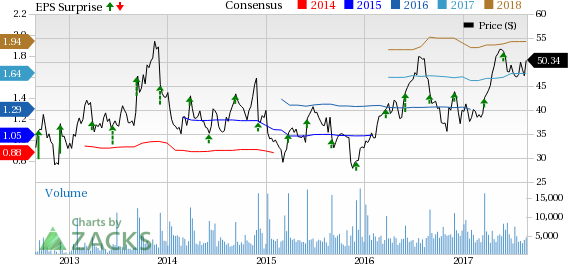

The question lingering in investors’ minds now is, whether the company will be able to deliver positive earnings surprise in the to-be-reported quarter. Notably, its earnings have outpaced the Zacks Consensus Estimate for the last seven quarters now, with a trailing four-quarter average of 6.3%.

Let’s delve deep to see how things are shaping up for this announcement.

Which Way are Estimates Treading?

Let’s look at the earnings estimate revisions in order to figure out a clear picture of what analysts are thinking about the company right before the earnings release.

The Zacks Consensus Estimate of 26 cents for the fiscal second quarter has remained stable in the last seven days, while the same climbed by a penny to $1.64 for fiscal 2017. These estimates, in turn, represent a growth of over 40% from the year-ago quarter and roughly 26% from fiscal 2016.

Furthermore, analysts polled by Zacks expect revenues of $277.2 million and $1.23 billion for the to-be-reported quarter and the fiscal year, respectively.

Zacks Model Shows Unlikely Earnings Beat

Our proven model does not conclusively show earnings beat for Five in the quarter under review. This is because the stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. This is not the case here, as you will see below.

Currently, Five carries a Zacks Rank #2 but has an Earnings ESP of -0.64% that makes surprise prediction difficult. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Factors Influencing This Quarter

Five at its first-quarter conference call projected fiscal second-quarter sales to be in the band of $273-$280 million. In fact, this guidance is based on comparable sales growth of 5-8% as well as store openings.

Furthermore, management forecasted earnings in the range of 24-27 cents per share for the impending quarter.

We note that management remains impressed with a solid start of the year, which outpaced its expectations. Going forward, it remains optimistic about its strategic initiatives such as store-expansion endeavor, marketing and merchandising efforts as well as enhancement of customers’ shopping experience. Additionally, Five’s focus on building its infrastructure and systems along with expansion of the eCommerce business is encouraging.

Evidently, these initiatives have already started driving the company’s results. Five’s sales have surpassed the Zacks consensus mark in six of the trailing seven quarters.

Also, these attributes are being reflected in the company’s share price performance. The stock was up 27.2% in the last six months against the industry’s decline of 14.2%. In fact, its shares have outperformed the broader Retail-Wholesale sector’s gain of 8.5% as well. Currently, the sector is placed at the top 19% of the Zacks classified sectors (3 out of 16).

However, stiff competition along with macroeconomic headwinds might subdue the company’s performance in the near term. In addition, a tough retail landscape where consumers are splurging online and store traffic has been hit hard, retailers are struggling to compete with eCommerce bigwigs. These might weigh upon the company’s results.

Stocks Poised to Beat Earnings Estimates

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

G-III Apparel Group, Ltd. (NASDAQ:GIII) currently has an Earnings ESP of +4.76% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Dave & Buster's Entertainment, Inc. (NASDAQ:PLAY) currently has an Earnings ESP of +2.75% and a Zacks Rank #3.

Zumiez Inc. (NASDAQ:ZUMZ) currently has an Earnings ESP of +16.67% and a Zacks Rank #3.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Zumiez Inc. (ZUMZ): Free Stock Analysis Report

Dave & Buster's Entertainment, Inc. (PLAY): Free Stock Analysis Report

Five Below, Inc. (FIVE): Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII): Free Stock Analysis Report

Original post