Fiserv Inc. (NASDAQ:FISV) recently announced the launch of Instant Issue Advantage, a tablet solution that enhances in-branch issuance and activation of payment cards within a short span of time. As customers can immediately start using these cards, engagement and satisfaction levels are anticipated to improve.

This is significant for banks as delay in card issuance as well as activation can result in customer loss. Customer retention has become a major concern for banks amid intense competition from fintechs and traditional retailers offering disruptive financial services.

We believe that instant issuance and activations of cards can act as a differentiator in this regard. The instant service will help in establishing banks as the primary financial institutions as compared with the aforesaid organizations, whose offerings are primarily online based. They are also not well-equipped to issue instantly activated cards due to the regulatory and certification process and PCI compliance procedures.

Moreover, per Fiserv, the Consumer Preferences research highlights the gap between people receiving their cards and activating them. Only 63% of consumers activated their debit card the day it arrived in the mail. This habit significantly hurts interchange revenues, which can be improved through in-branch issuance and activation.

Additionally, Fiserv’s expertise in effectively addressing challenges – primarily fraud – which banks and financial institutions face in case of instantly issued cards is a game changer. The adoption of company’s solution will mitigate risks related to issuance and activation of instant cards.

Expanding Product Portfolio: Key Catalyst

Fiserv remains focused on expanding its product portfolio. The company recently launched Integrator Advance that offers multiple tools, including research-based segmentation, cross-sell intelligence, campaign management and reporting in a single platform.

Moreover, the company commands a leading position in the financial and payment solutions business backed by a broad customer base and key contract wins. In the second quarter of 2017, the company added six DNA clients, four among which have over $1 billion in assets and expects to add at least 10 more in 2017.

Fiserv’s digital banking solutions are gaining momentum among the banks and credit unions. Recently, DNA solution was selected by SEFCU, which is among the top 50 credit unions in the United States, with approximately $3.5 billion in assets and more than 350K members in communities across New York.

Further, investment in digital-oriented technologies is likely to improve the company’s competitive position in the long haul.

Zacks Rank & Key Picks

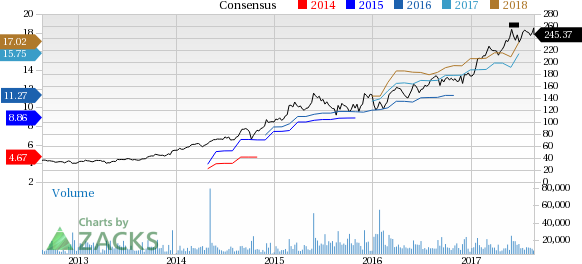

Fiserv carries a Zacks Rank #3 (hold). Total System Services (NYSE:TSS) , Western Union (NYSE:WU) and Vantive (NYSE:VNTV) , all carrying a Zacks Rank #2 (Buy) are some better-ranked stocks in the broader sector. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth rate for Total System Services, Western Union and Vantive is currently pegged at 12.5%, 10% and 14.3%, respectively.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Total System Services, Inc. (TSS): Free Stock Analysis Report

Fiserv, Inc. (FISV): Free Stock Analysis Report

Vantiv, Inc. (VNTV): Free Stock Analysis Report

Western Union Company (The) (WU): Free Stock Analysis Report

Original post