An affiliate of diversified energy company FirstEnergy Corporation (NYSE:FE) , Toledo Edison announced that it has made investments in the infrastructural improvement of its electric distribution system.

Details of the Project

Toledo Edison will soon finish installing two underground transformers and two control boxes among other infrastructural upgrades. The unit is presently engaged in maintenance work to enhance service reliability and prevent service disruptions during the fall and winter months, when it becomes difficult to work underground.

This FirstEnergy subsidiary has an existing customer base of 300,000 in northeast Ohio. These grid enhancement projects are expected to help retain existing customers as well as bring in new ones.

The modernization drive, which is part of Toledo’s $800,000 maintenance budget for this year, includes the replacement of underground wires at several locations.

Utility operations are subject to adverse weather conditions such as cyclones and storms that can severely damage transmission lines and delivery systems. Utilities also have to weather sudden outages, physical attacks, cyber hacking, and normal wear and tear resulting from years of usage. As a result, these companies are scaling up maintenance investment to minimize energy loss from infrastructural damage, thereby ensuring better service reliability and customer service.

Last week, three other units of FirstEnergy announced investments to modernize the electric system and thereby improve service reliability (Read: FirstEnergy’s (FE) Units on Infrastructure Upgrade Drive)

Sector Overview

Utility companies benefit significantly from the regulated nature of their business, which allows a high degree of certainty to their top lines. Additionally, their businesses are domestically inclined which protects them from adverse changes in foreign currency. The Dow Jones Utility Average (DJU) is up 25.5% year to date (till Jul 11, 2016).

The demand for utility services varies with economic cycles. However, their fortunes do not oscillate in tandem with the economic cycles since these companies deal with basic amenities and cannot ever go out of business.This also enables them to give out consistent dividends, making them attractive bets among investors.

Zacks Rank& Stocks to Consider

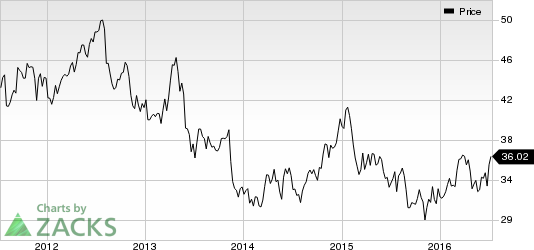

FirstEnergy currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the utility space include Black Hills Corporation (NYSE:BKH) with a Zacks Rank #1 (Strong Buy) and Alliant Energy Corporation (NYSE:LNT) and DTE Energy Company (NYSE:DTE) , both carrying a Zacks Rank #2 (Buy).

FIRSTENERGY CP (FE): Free Stock Analysis Report

DTE ENERGY CO (DTE): Free Stock Analysis Report

BLACK HILLS COR (BKH): Free Stock Analysis Report

ALLIANT ENGY CP (LNT): Free Stock Analysis Report

Original post