The 2019 full-year bottom-up EPS estimate for the S&P 500 started in early October at $178.45 and ended his week at $167.54. Only once during the calendar 4th quarter did the calendar 2019 EPS estimate increase sequentially and that was November 30th’s $176.15 which was then followed by December 7th’s $176.25.

For the last 6 months, the calendar 2019 EPS estimate has been on a downward trajectory each week.

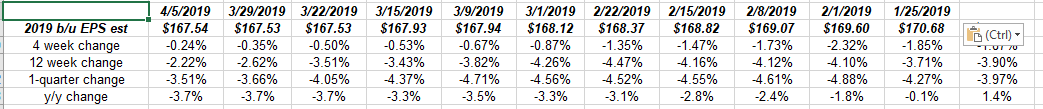

As you can see in the attached link, the spreadsheet shows the negative revisions for various time periods for the 2019 EPS estimate are getting “less negative” and as readers can see looking at the actual EPS estimate for 2019, the jump was the first – from $167.53 last week to $157.54 this week – was the first since the aforementioned period noted above.

With the 2018 EPS estimate now written in stone at $161.93 versus the current consensus EPS estimate for 2019 at $167.54, the expected bottom-up growth rate for S&P 500 earnings for 2019 is +3.5%.

My own opinion is that’s too low, with the Fed on hold.

S&P 500 Weekly Earnings Data: (Source: IBES by Refinitiv)

- Fwd 4-Q est: $173 vs last week’s $167.20.

- PE ratio: 17x

- PEG ratio: 2.70x

- S&P 500 earnings yield: %.98% vs last week’s 5.90%

- Year-over-year growth of fwd est: +6.7% vs last week’s +2.6% (will be explained shortly)

Summary / conclusion: The big jump in the forward 4 quarter estimate to $173, now includes Q2 ’19 through Q1 ’20. Similarly, the 4-quarter trailing estimate now includes Q2 ’18 through Q1 ’19.

Expected earnings growth for Q1 ’19 per the IBES data is -2.2% for the S&P 500 as a whole, with Technology, Materials and Energy falling 6%, 15%, and 20% respectively, while Health Care is expecting the highest y/y growth in sector earnings at just 4.5%.

Here is how the next 5 quarters look for S&P 500 earnings growth:

- Q1 ’20: +15%

- Q4 ’19: +9.0%

- Q3 ’19: +2.7%

- Q2 ’19: +2.8%

- Q1 ’19: -2.2%

Remember, the S&P 500 laps the tax cuts for the first three quarters of 2019 and then laps the earnings softening in Q4 and Q1 ’20.

Like 2016, expect the Q1 ’19 to be the low-water point for S&P 500 earnings growth this year.

Here is a blog post from late February ’19 that talks about first quarter weakness in S&P 500 earnings.