Sometimes when you stare at something for too long the more imperfections you will find. A beautiful model has a small discoloring on her skin under her chin, a classic old house shows a need for paint on one window, a gorgeous meal has a drop of sauce in the wrong plate. It is how our minds are programmed.

The opposite of that is relying on a first impression. It is often the most lasting thought in your mind. Think about it. How many things do you see each day and not examine closely and in depth, yet you can remember them. Did your first impression get you in trouble? Likely not. But finding that imperfection and then acting on it may have.

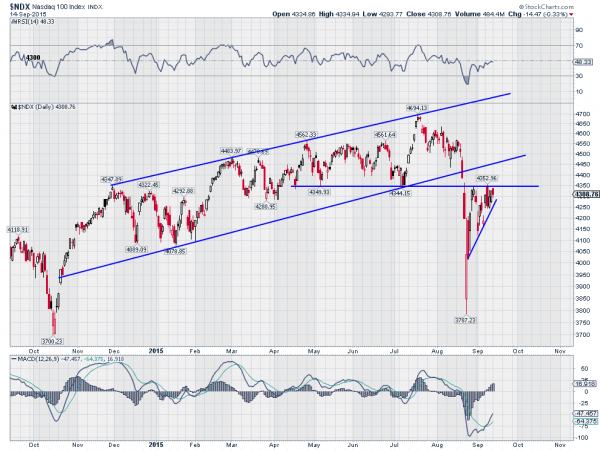

Charts can work the same way. First looks can often give a great quick read, while deep digging can lead you to find all sorts of reasons either not to act or to create doubt about a move. So with that thought I wanted to share some first impressions of the Nasdaq 100 chart.

1. The Nasdaq 100 fell out of a rising channel in late August.

2. The spike down over 2 days made a higher low compared to October 2014, but can also be a Double Bottom.

3. Both momentum indicators reset to lower levels than October 2014 and are now entering a bullish phase.

4. Prior support since April has become resistance.

5. Since the spike down an Ascending Triangle has been building against that resistance.

So, the Nasdaq 100 spiked down from a rising channel to a higher low, resetting momentum indicators, and quickly bounced to prior support, now resistance. That does not sound so ugly. That sounds like normal action in a healthy market. There are numbers all over the chart but we did not use 1 number for this quick read. No discussion if it is a pullback, correction or bear market. Just following price action.

How do I react to it? It makes sense to protect the downside. But the long term trader and investor should be looking at the upside. And a break back over that resistance will give them a lot more confidence.

By the way, this was my 5000th blog post published, and what inspires the sale below. It makes me think of the first one on why charts matter and the reason I started. It has been a long journey. Thanks for reading along with me.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.