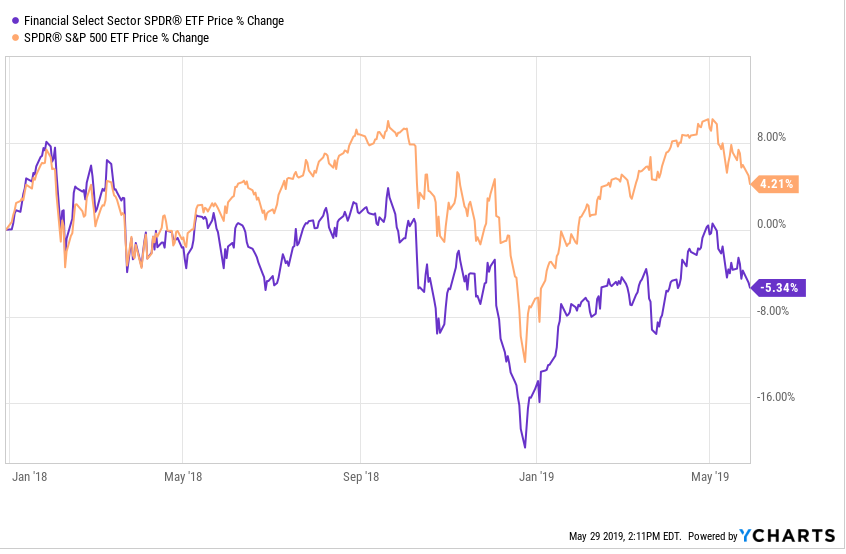

Frustrating Financials

Financial’s are clients second largest sector weighting behind Technology for the last several years. The above chart shows the XLF versus the SPY from Jan 1 ’18. Certainly the flat to inverted yield curve isn’t helping.

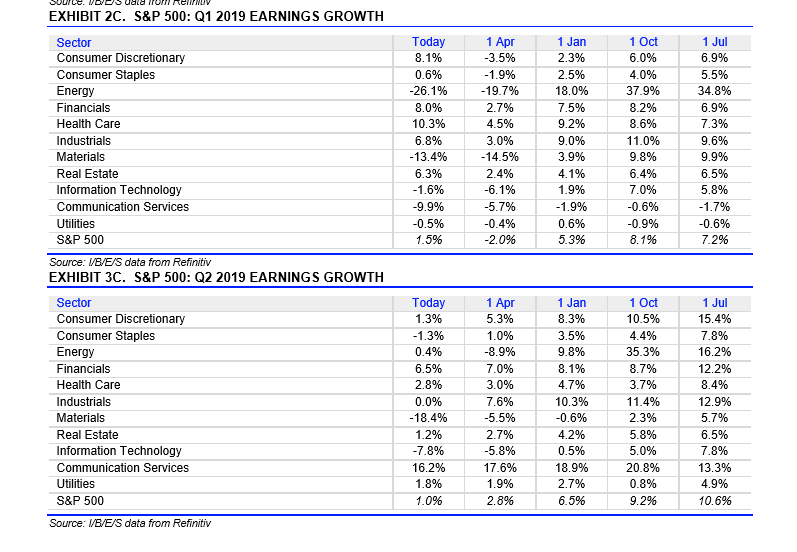

The Financial sector is showing 8% earnings growth for Q1 ’19 with all Financial’s having reported Q1 ’19 results, plus Q2 ’19 expectations are showing very small revisions for the Financial sector despite the market malaise. Still like the sector, since the earnings growth for Financials is well above the S&P 500.

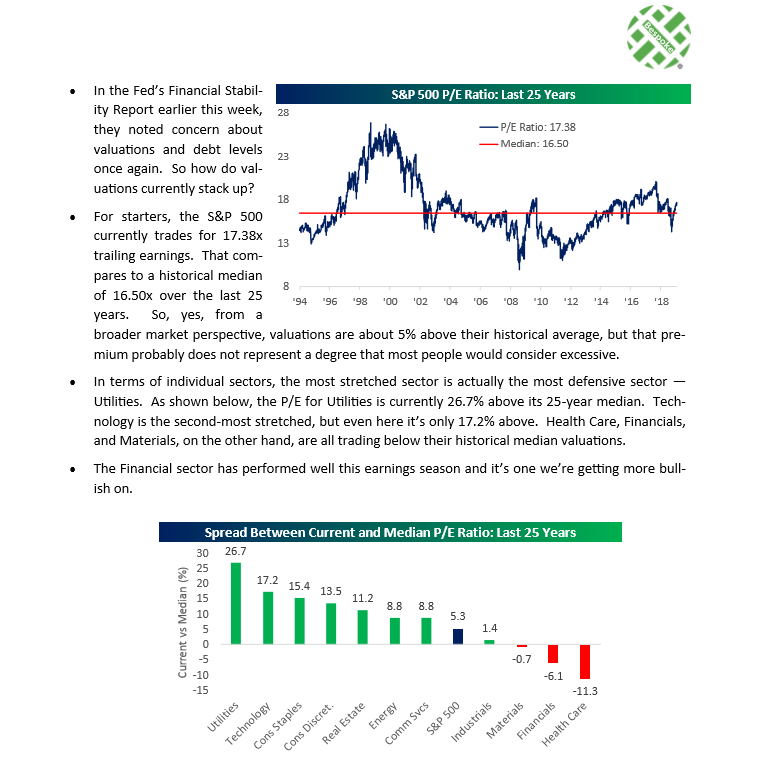

Utilities – screamingly overvalued?

Never owned Utilities for clients in any size really, and wouldn’t do so now after reading above from Bespoke’s May 10th newsletter. Note the average PE for Financial’s and Health Care too.

Finally, the US dollar:

“Treasury releases report on macroeconomic and foreign exchange policies of major trading partners of the United States. . . Treasury found that nine major trading partners continue to warrant placement on Treasury’s “Monitoring List” of major trading partners that merit close attention to their currency practices: China, Germany, Ireland, Italy, Japan, Korea, Malaysia, Singapore, and Vietnam. . . While China does not disclose its foreign exchange intervention, Treasury estimates that direct intervention by the People’s Bank of China in the last year has been limited. Treasury continues to urge China to take the necessary steps to avoid a persistently weak currency."

The Report concluded that while the currency practices of nine countries were found to require close attention, no major U.S. trading partner met the relevant 2015 legislative criteria for enhanced analysis. "Starting with this Report, Treasury will review and assess developments in a larger number of trading partners in order to monitor for external imbalances and one-sided intervention.”

(Source: Briefing.com)

I read this about 3 am this morning and the first thought was that if the US was going to take a dim view of currency debasing, then it isn’t likely the dollar would be expected to weaken much, and frankly that’s not great for the S&P 500 at this point in the cycle.

I’d much rather have the dollar weaken here to take the pressure off the S&P 500.

The strong dollar is another incremental negative in a market that is full of them right now.

Summary/conclusion: Financial’s represent a value play here and given the above Bespoke graph showing relative PS ratio’s, I like the sector even more. Something will have to give though. Utilities seem way overvalued, or at the very least overbought.