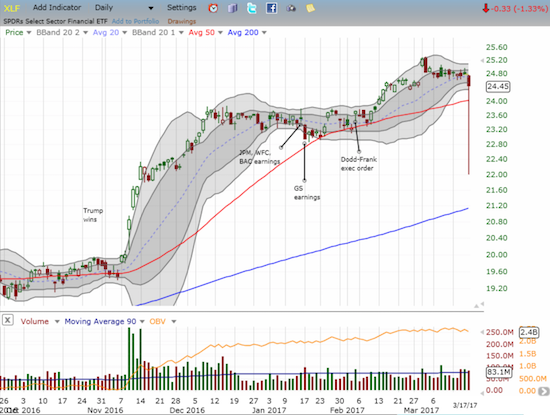

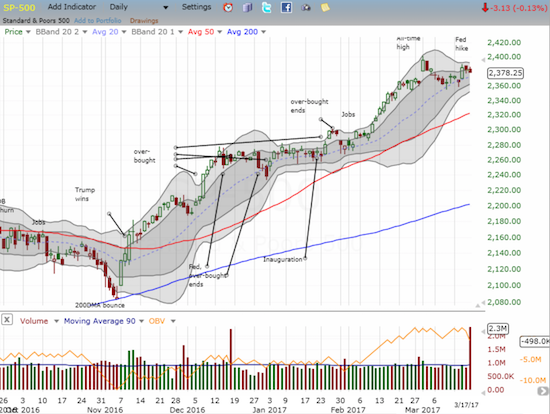

After the U.S. Federal Reserve hiked interest rates, the market’s expectations on future rate hikes relaxed a bit. That relaxation prevented financials from getting the expected rate hike boost. That under-performance continued on Friday, March 17 as the Financial Select Sector SPDR Fund (NYSE:XLF) fell almost 1% while the S&P 500 (SPDR S&P 500 (NYSE:SPY)) trickled down by 0.2%.

The S&P 500 (SPY) experienced a large surge in volume (from quadruple witching?) as it fell for the second day and continued a post-Fed reversal.

The Financial Select Sector SPDR Fund (XLF) completed a full reversal of its bullish breakout from March 1st and looks poised for its first down month since September.

(I assume the long tail on XLF is a reporting error)

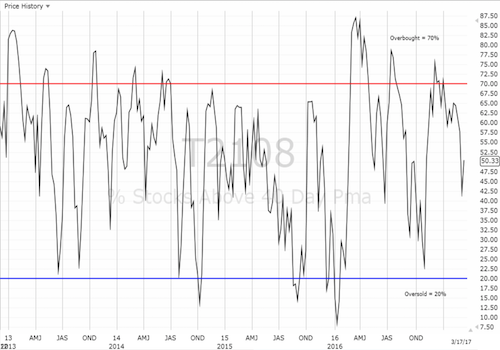

For 2017, the S&P 500 (SPY) has experienced just THREE periods of multi-day pullbacks. Two of those three have occurred this month. The other period was the longest of the year: a shallow 4-day pullback that brought an end to the last over-bought period. Instead of licking my chops in preparation for a long overdue confirmation of the deterioration of the underlying technicals of the stock market, I was taken aback by AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs). AT40 bounced off its intraday low to end the day with a marginal gain; the rebound was quite a surprise given the weakness in financials. This (very) mild bullish divergence gives me pause, so I will now look to see whether the S&P 500 follows-through next week from its (very) mild post-Fed swoon.

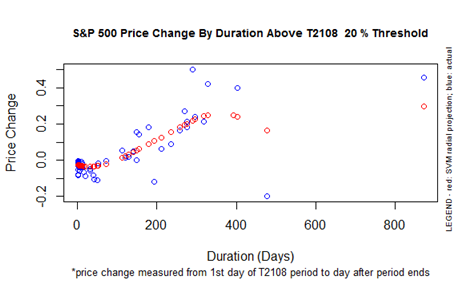

AT40 has now traded for 271 straight days above oversold conditions (AT40 above 20%). My favorite technical indicator just missed oversold conditions ahead of the U.S. Presidential election, but its bounce from there helped form the basis of my post-Trump bullishness. The S&P 500 has gained 27.5% since ending oversold conditions on February 12, 2016 as part of the “J.P. Morgan Chase bottom.” This performance is a few percentage points above what I would expect if the “20% overperiod” ended here.

The chart below shows the history of the 20% overperiod. Note that the duration of the current 20% overperiod is in VERY rare territory. Yet, the duration could extend for more than another 100 trading days before I would call a market top just based on the duration alone. In the meantime, I am noting that the chart below suggests that a sell-off back to oversold conditions would not cause a particularly large percentage drop in the S&P 500. Some of that behavior was on display when AT40 dropped as low as 36.5% on March 14th while the S&P 500 continued its reluctant swoon. The index ended that day just 1.3% off its all-time high. Note well that these data do not indicate how much additional selling might occur during an oversold period.

S&P 500 historical performance during the T2108 20% overperiod.

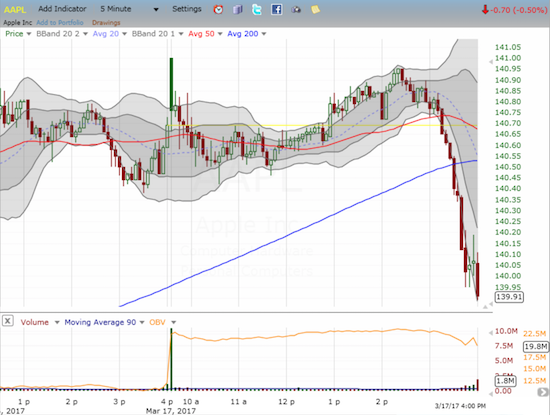

I am now 1-1 for my return to the weekly Apple (NASDAQ:AAPL) trade. AAPL kept its price close to the vest until the post-Fed celebration. I decided to hold onto my position for one more day in the hopes the stock would follow-through. AAPL barely gained a penny, so I locked in slightly lower profits before the close. I decided to wait until Monday to reinitiate the trade. My decision may have caused me a good entry point for the next trade: AAPL strangely collapsed intraday into the close. The 90-minute sell-off accelerated in the last hour.

I will have my eyes on AAPL right from Monday’s open. I assume the rush to sell into the close was somehow related to quadruple witching – the simultaneous expiration of stock and index options. If so, AAPL should experience a nice bounce-back at least Monday morning.

Apple (AAPL) has churned for the entire month of March.

This 5-minute chart of AAPL reveals the surprising rush to sell into the last close.

The monthly expiration of options is my time to review trades that went wrong. The most notable gaffes were Intel (NASDAQ:INTC) and Freeport-McMoran (NYSE:FCX). I stubbornly reinitiated my INTC “between earnings” trade as I think the sell-off on the Mobileye (NYSE:MBLY) acquisition was overdone. FCX is struggling with support at its 200DMA. I am content to wait for resolution of this battle before deciding my next move.

Intel (INTC) traded below its 200DMA for the first time since June, 2016. The selling momentum seems to have ended quickly.

Freeport-McMoRan Inc. (FCX) is struggling to hold onto 200DMA support even as commodities in general regained buying interest last week.

Is the bullish divergence a hint of a change in market tone?

Black line: AT40 (T2108) (% measured on the right)

Red line: Overbought threshold (70%); Blue line: Oversold threshold (20%)

Be careful out there!

Full disclosure: long INTC call options