- Dollar hits 20-year high ahead of the NFPs

- Strong report could justify aggressive Fed hikes

- Yen, euro lose the most; loonie takes the first place

Dollar climbs higher as data support forceful Fed

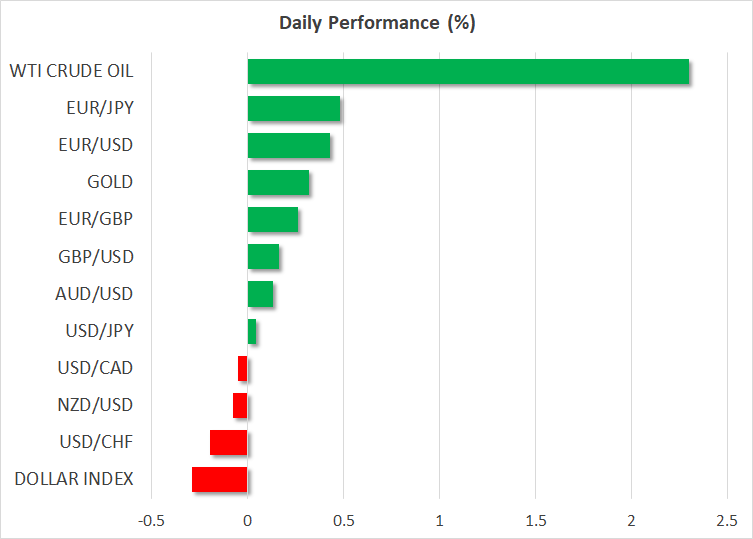

The US dollar continued flexing its muscles against all but one of the other major currencies on Thursday and during the Asian trading session Friday, with the dollar index hitting a 20-year high. Dollar traders kept adding to bets for another triple hike by the Fed at its Sep 21 gathering after incoming data supported the notion just a day prior to the official US employment report for August.

Initial jobless claims for last week fell more than expected, layoffs dropped in August, and the Institute for Supply Management (ISM) revealed that manufacturing grew steadily during the month, with the details of the report pointing to a rebound in employment and new orders. All this is consistent with a tight labor market and an economy showing some signs of improvement.

Maybe that’s why the Dow Jones and the S&P 500 rebounded, even with increasing hike bets adding extra pressure to the more rate-sensitive Nasdaq. Or, maybe some investors decided to cover short positions ahead of the NFPs and as the S&P 500 reached a key support zone, marked by the inside swing high of July 8.

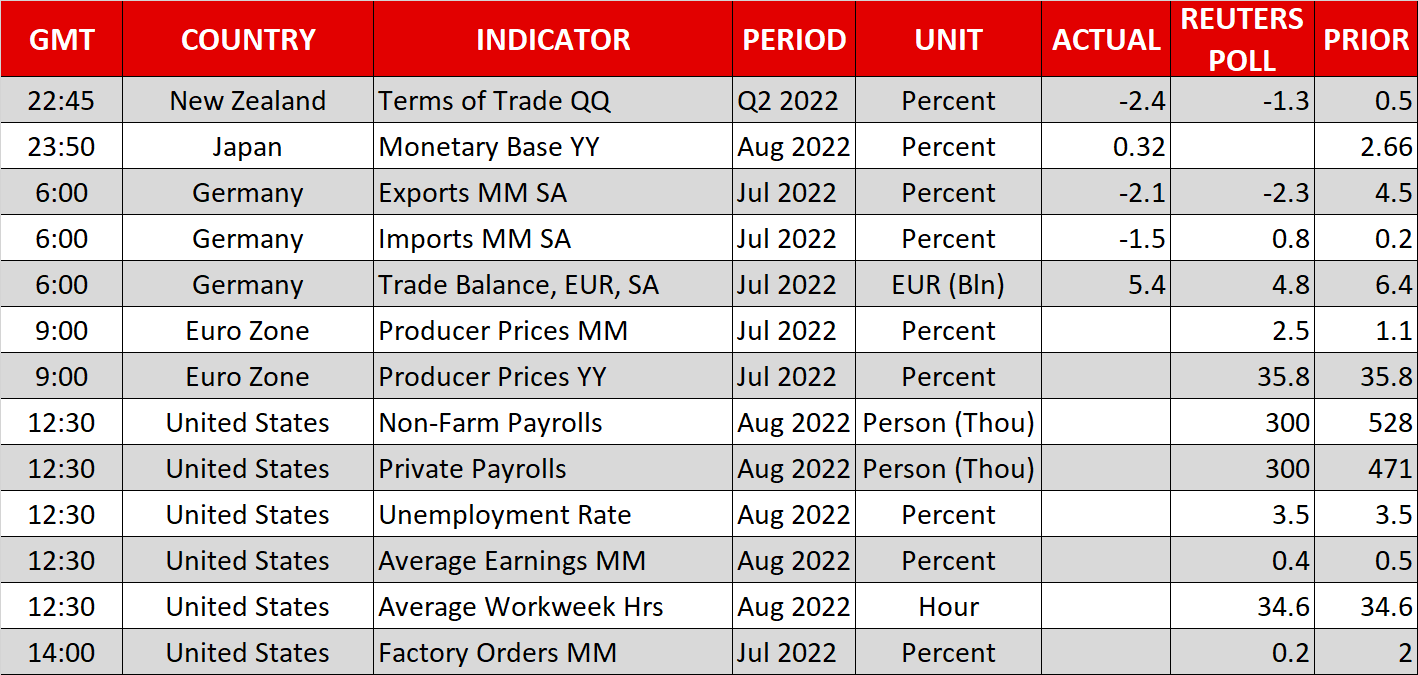

US jobs data enter the limelight

With the Fed denying that the US economy is in recession due to a very strong labor market, the financial world is likely to lock its gaze on the official US jobs data, coming out later today. Nonfarm payrolls are forecast to have increased by another 300k, a slowdown from July’s 528k, but still a solid number consistent with further employment strength. The unemployment rate is expected to have remained untouched at its 50-year low of 3.5%, while average hourly earnings are anticipated to have accelerated somewhat in yearly terms.

Another round of strong employment numbers could add to the already-high probability of another 75bps hike by the Fed. However, with the dollar staying very strong heading into the release, there is the risk of profit taking if the numbers just meet their forecasts. For the dollar to keep flapping its wings, the result may have to be better than expected.

Now, in case of a disappointment, the greenback may pull back, but it is unlikely to reverse its uptrend. One month's worth of data is unlikely to terrify the Fed. After all, some officials, including Chair Powell at Jackson Hole, have already expressed strong determination to bring down inflation, even if that results in a slower economy and a softer labor market. Those are the “unfortunate costs of reducing inflation,” the Fed chief clearly said at Jackson Hole.

Yen and euro finish last, loonie the frontrunner

Due to the widening rate differentials between Japan and the US, the yen was hurt the most, with dollar/yen breaking and sustaining a close above 140.00. The euro was the second loser in line, with euro/dollar slipping back below parity, even as the probability for the ECB to also deliver a 75bps hike has increased. This confirms the narrative that euro traders are more concerned that the ECB’s actions will assist in pushing the Euro area into recession, rather than trusting it to tame inflation.

The only currency that stood its ground against the greenback was the Canadian dollar. The Loonie came under strong buying interest, with its traders taking the probability of a 75bps rate increase by the BoC at next week’s gathering to 85%, despite the latest GDP data showing that the Canadian economy grew by less than expected in Q2.

Yet, its hard to imagine the risk-linked loonie continuing to outperform the safe-haven dollar in a risk-averse environment, even as both the Fed and the BoC appear overly hawkish. However, with the Canadian economy performing better than some others, the Canadian dollar may add to gains against the already wounded yen, euro, and pound. After all, year to date, the loonie has been the second-best performing currency among the majors, behind the king US dollar.