We are in the last stretch of the Q2 earnings season and investors are keeping a tab on companies’ performances. Several companies reported better-than-expected second-quarter 2017 results, despite a challenging operating environment.

Per the latest Earnings Preview, nearly 99% of the S&P 500 companies in the Finance sector have reported results for second-quarter 2017 so far. Total earnings for these companies increased 8.7% year over year on a revenue improvement of 3.6%. Notably, 77.9% companies have surpassed bottom-line expectations and 68.4% beat on the top line.

Performance of the companies so far reflects a significant improvement over the prior-year quarter. The report further states overall earnings for the S&P 500 stocks in the Finance sector are likely to be up 8.6% year over year in the second quarter. This compares favorably with a 5.6% decline in earnings witnessed in the last-year quarter.

Recovery in the energy sector and improving domestic economic factors strengthened the industry backdrop for the sector. Also, an improving labor market with lower unemployment rate, rising interest rates and a recovering housing market supported growth in the industry. Nevertheless, global concerns and political uncertainty adversely affected the performance of the Finance sector during the quarter.

Let’s have a look at how our model offers insights into the expected performance of the companies.

Our quantitative model offers some insights into stocks that are about to report earnings. Per the model, in order to be confident of an earnings beat, a stock needs to have the right combination of the two key ingredients – a positive Earnings ESPand a Zacks Rank #3 (Hold) or better. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Let’s take a look at the finance stocks that are scheduled to release quarterly numbers on Aug 8.

New Mountain Finance Corporation (NYSE:NMFC) is slated to report quarterly results after the market closes. Its Zacks Consensus Estimate of 34 cents reflects year-over-year growth of 5.47%. However, the figure remained unchanged over the past 30 days.

Despite a favorable Zacks Rank #2 (Buy), we cannot predict a likely earnings beat this quarter because the company has an Earnings ESP of 0.00%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Notably, it witnessed an average negative surprise of 1.47% over the trailing four quarters.

Financial Engines, Inc. (NASDAQ:FNGN) is set to announce results after the market closes. The Zacks Consensus Estimate of 25 cents for the company for the upcoming release indicates year-over-year growth of about 30.5%.

Further, Financial Engines’ activities during the quarter were enough to win analysts’ confidence, as is evident from one positive revision in earnings estimates (versus no negative revision) over the last 30 days. Notably, the Zacks Consensus Estimate remained unchanged at 25 cents over the same time frame.

Additionally, our proven quantitative model predicts a likely earnings beat. The company has a Zacks Rank #2, with an Earnings ESP of +4.00%.

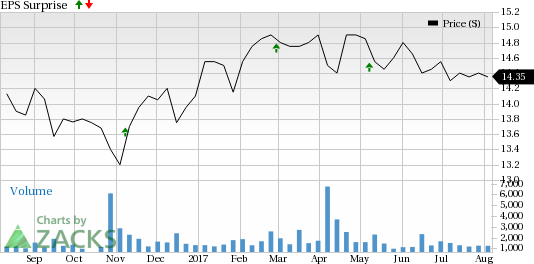

Financial Engines recorded positive earnings surprise in three of the trailing four quarters as shown in the chart below:

The Zacks Consensus Estimate of PRA Group, Inc. (NASDAQ:PRAA) , which is also scheduled to report results after the market closes, remained unchanged over the past 30 days. However, the 48 cents figure reflects a year-over-year plunge of 42.4%.

We cannot conclusively predict a likely earnings beat this quarter because it has an Earnings ESP of 0.00% and a Zacks Rank #4.

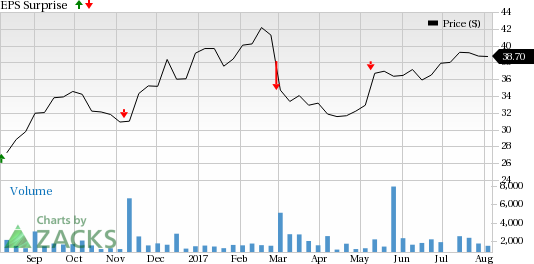

With respect to the surprise trend, PRA Group recorded an average negative surprise of 43.47% over the trailing four quarters as shown in the chart below:

Virtu Financial, Inc. (NASDAQ:VIRT) is slated to announce results before the market opens. The Zacks Consensus Estimate of 23 cents for the company for the upcoming release indicates significant year-over-year growth of about 73.1%.

Further, Virtu Financial’s activities during the quarter were enough to win analysts’ confidence, as is evident from 36.3% increase in the Zacks Consensus Estimate over the last 30 days.

Additionally, our proven quantitative model predicts a likely earnings beat. The company has a Zacks Rank #3, with an Earnings ESP of +21.74%.

Virtu Financial recorded average positive earnings surprise of 0.9% over the trailing four quarters as shown in the chart below:

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

New Mountain Finance Corporation (NMFC): Free Stock Analysis Report

Financial Engines, Inc. (FNGN): Free Stock Analysis Report

Virtu Financial, Inc. (VIRT): Free Stock Analysis Report

PRA Group, Inc. (PRAA): Free Stock Analysis Report

Original post

Zacks Investment Research