The second-quarter 2016 results of finance stocks reflect a marginal improvement over the prior quarter. While the industry backdrop hasn’t improved significantly with continued global growth concerns and low interest rate environment, rebound in oil prices and positive domestic economic factors alleviated the pressure on the finance business to some extent.

Per the latest Zacks Earnings Preview report, overall earnings for the S&P 500 stocks in the Finance sector are expected to be down 3.1% year over year. This compares with a 6.9% decline in earnings in the previous quarter. However, revenues are expected to decline 0.4% versus a 2.7% increase in the prior quarter.

About 80% of the S&P 500 companies in the finance sector have reported results for the Apr-Jun quarter so far. Total earnings for these companies decreased 4.2% year over year despite a revenue improvement of 1.1%. However, 66.7% companies have surpassed bottom-line expectations and 52.8% beat on top line.

Our quantitative model offers some insights for stocks that are about to report their earnings.

Per the model, in order to be confident of an earnings beat, a stock needs to have the right combination of the two key criteria, a favorable Zacks Rank – Zacks Rank #1 (Strong Buy), #2 (Buy) or #3 (Hold) – and a positive Earnings ESP.

Earnings ESP is our proprietary methodology for identifying stocks that have high chances of surprising in their upcoming earnings announcement. It shows the percentage of difference between the Most Accurate Estimate and the Zacks Consensus Estimate. Our research shows that for stocks with this combination, the chance of a positive earnings surprise is as high as 70%.

Let’s see what’s in store for the following companies that are expected to report results on Aug 2.

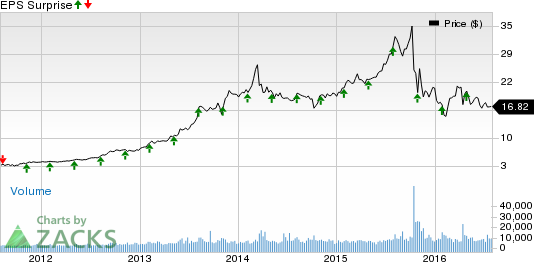

BofI Holding, Inc. (NASDAQ:BOFI) : Estimates have been stable lately, ahead of the release of the company’s fiscal-fourth quarter 2016 (ending Jun 30) results. The Zacks Consensus Estimate of 46 cents for the company reflects a year-over-year increase of 20.1%.

The company has an Earnings ESP of +2.17%, however, carries a Zacks Rank #4 (Sell) making it difficult to conclusively predict an earnings beat this quarter.

The company recorded positive earnings surprise in all the four trailing quarters, with an average earnings beat of 5.9%.

Financial Engines, Inc. (NASDAQ:FNGN) : The Zacks Consensus Estimate of 17 cents reflects a year-over-year growth of 6.3%. Also, we are not confident about an earnings surprise call as the company has a Zacks Rank #4 with an Earnings ESP of +5.88%.

Notably, estimates have been stable lately, prior to the company’s second-quarter 2016 earnings release. The company reported positive earnings surprise in one of the trailing four quarters with an average positive surprise of 0.1%.

Solar Capital Ltd. (NASDAQ:SLRC) : The Zacks Consensus Estimate of 41 cents for the company reflects a year-over-year increase of 8.6%. Notably, the estimates remained unchanged ahead of the company’s second-quarter 2016 results.

The combination of a Zacks Rank #3 with an Earnings ESP of 0.00% makes surprise prediction difficult for this company as well.

Notably, the company reported a nominal average positive surprise in the trailing four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>

BOFI HLDG INC (BOFI): Free Stock Analysis Report

SOLAR CAPITAL (SLRC): Free Stock Analysis Report

FINANCIAL ENGIN (FNGN): Free Stock Analysis Report

Original post