For those who are ready to Brexit from Brexit being mentioned in every conversation, the good news is that the vote is today.

The US session was hit by the Opinium and TNS Brexit polls showing “Leave” in the lead. However, another two polls have just been released showing “Remain” in the lead, which saw the pound rally 0.5% to its highest point this year.

Markets seem to have almost entirely priced in a “Remain” vote win, meaning that the market moves and volatility around the vote may be far less than many had expected.

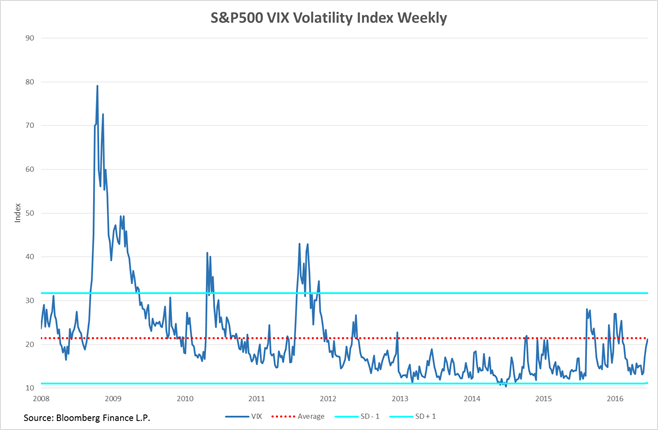

Nonetheless, markets are still incredibly nervous, and some sharp market moves are likely over the next 24 hours. The VIX volatility index spiked 14.6% to 21.2 – its highest level in four months.

The Brexit referendum results will start to trickle in from 12:00 am GMT (10:00 am AEST), and experts are confident that by 3:30 am GMT (1:30 pm AEST) they should be able to project the outcome of the election based on the 200 areas that will have reported by then. But YouGov will also poll on the day and release their results at 10:00 pm GMT (8:00 am AEST), and this could be a very volatile release.

Oil took a dive overnight, with WTI oil losing 1.7% as the EIA inventories showed a much smaller decline than the API inventories figure. EIA inventories declined by 0.92 million barrels compared to the 5.2 million barrel decline in the API figures. Oil also saw selling in the wake of the two Brexit polls showing “Leave” in the lead.

US government bond yields also declined for the first time in five days, showing some nervousness ahead of the vote. The DXY US dollar index similarly lost 0.3%. The Aussie dollar gained 0.7%, breaking above the US$0.7500 handle, benefitting from the US dollar weakness and speculation that “Remain” would win.

Copper and iron ore also had strong performances overnight, gaining 0.8% and 2.8%, respectively. This was the best performance for iron ore in two weeks, and this should help the big iron ore miners in the ASX today.

The most recent two polls showing the “Leave” camp ahead have noticeably pushed Asian markets higher ahead of the open. All Asian markets are now set to open higher, despite all pointing to a negative open straight after the US market close.