I am spending my weekend in Denver, so I think I’ll just share a few charts as we prepare to enter the “Repealing ObamaCare Was a Dud” market week.

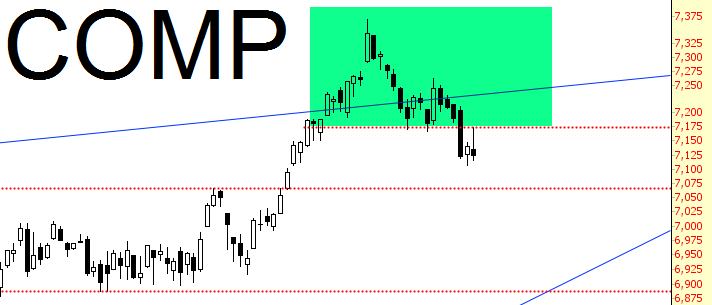

First up is the Dow Composite. I’ve tinted the topping pattern, and we have a nice little shooting star candlestick on Friday.

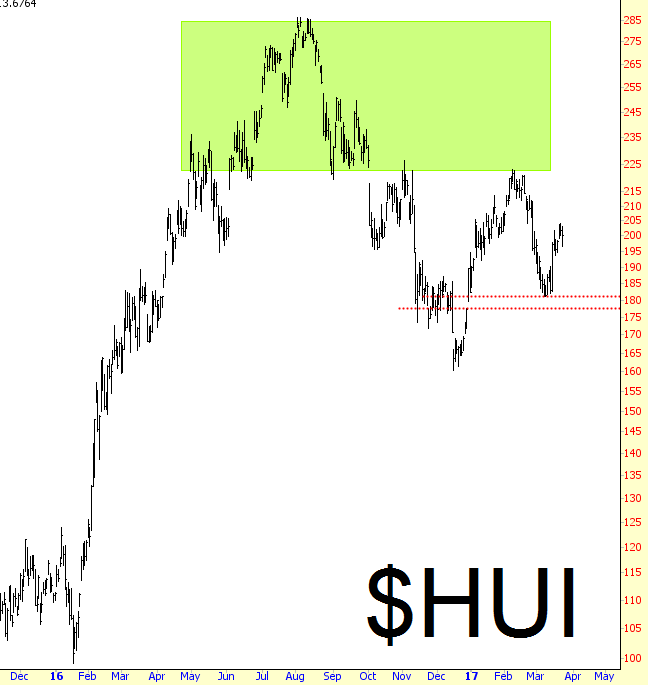

I am, as you might guess, quite short the market, and I also flipped to bearish on precious metals miners last week. It’s still a little “iffy”, but this could turn into a meaningful drop.

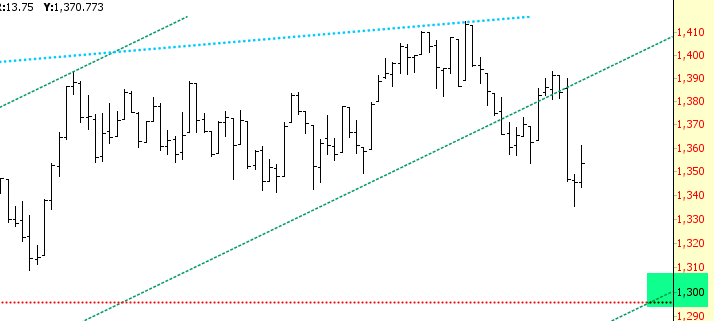

The index I follow most closely each day is the Russell 2000, and I think the path to 1300 is fairly clear. That’s not a monstrous drop (not even 5%), but it’s something.

Aligning with this bearish view is the configuration of the S&P 500, whose delineation between support and resistance in the short-term I’ve illustrated with that red horizontal.

Amongst the Dow indexes, the Transports have been the weakest recently. It has three failed attempts to break out, and now it’s slumping.

As I’ve mentioned, I intend to hold shorts and expand my positions until such time as we get a decent volatility event. In the heavily muted environment we live in these days, a VIX in the high teens would suffice. It looks like we’re already revving the engines.