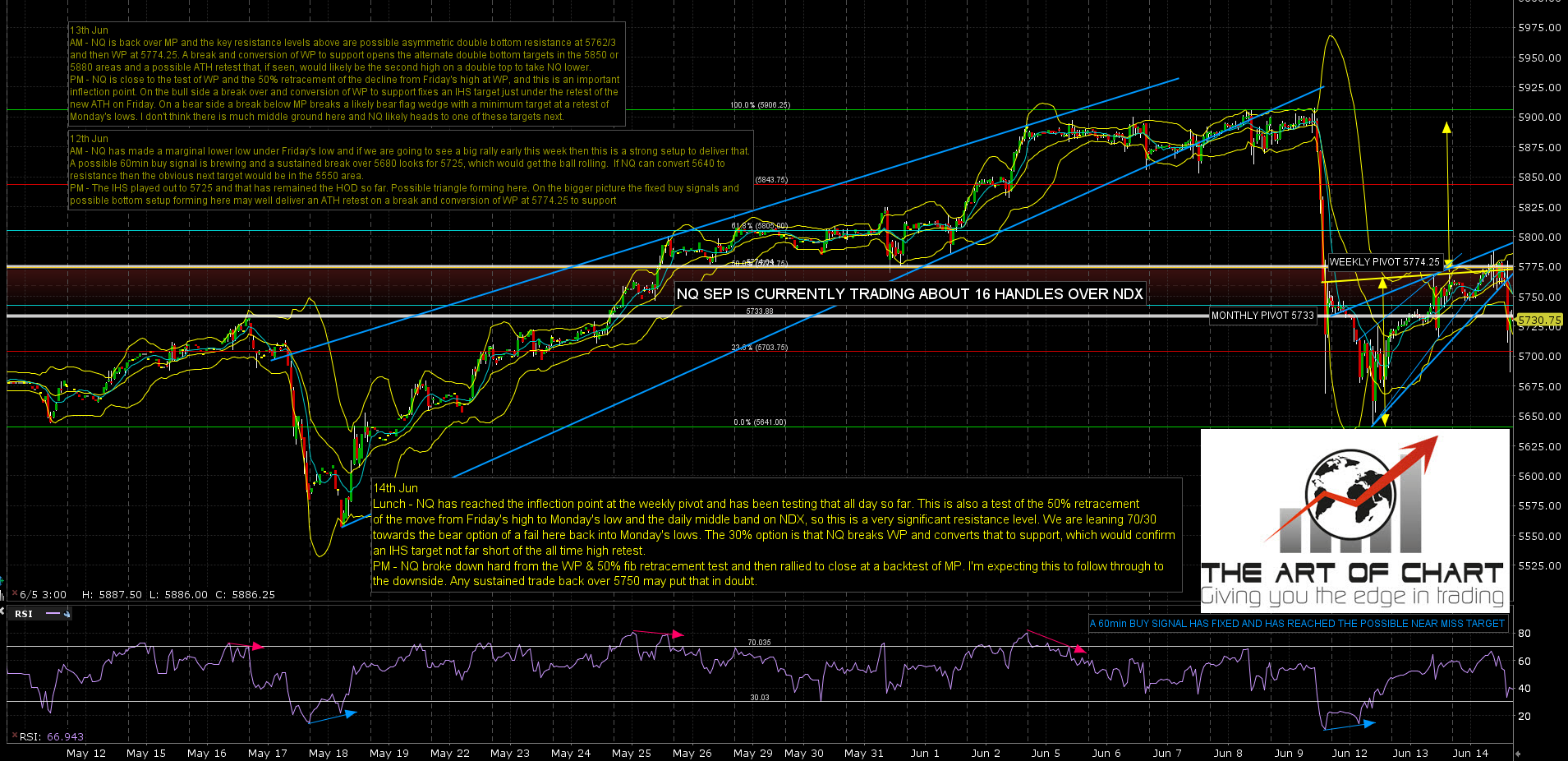

I was saying on my twitter at lunchtime that the 70% option was a fail at weekly pivot resistance and the 50% retracement level on the NQ chart. The duly delivered after a slightly nonplussed pause after the FOMC rate rise at 2pm as the market tried to work out whether such a heavily trailed announcement qualified as news and, if it did, whether such expected news could really be a credible reason for markets to react to it. Honestly I have no idea what the answers to those questions might be myself, but the setup favored the bears regardless and duly delivered the reversal at obvious resistance.

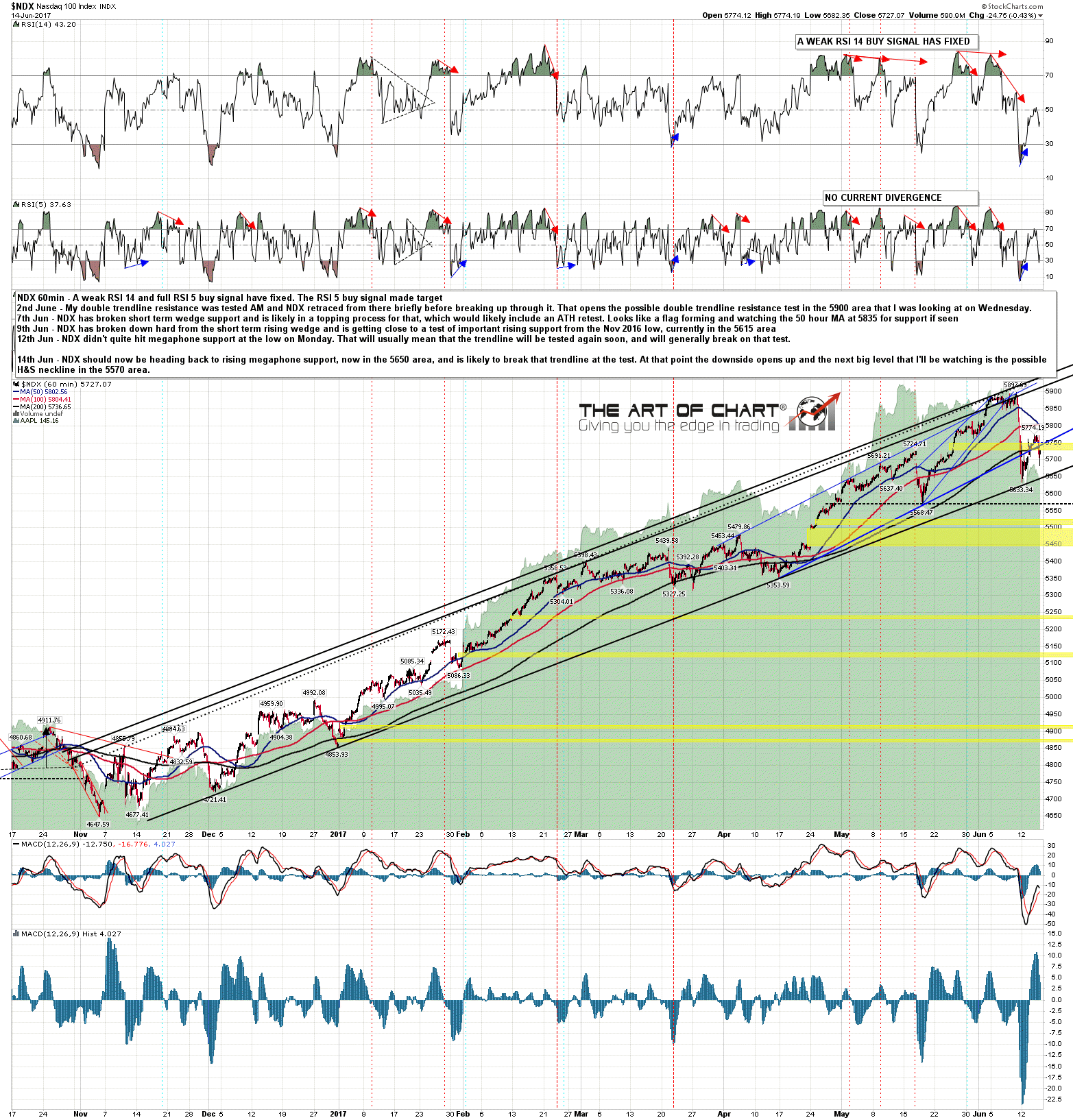

Key trendline support on the Nasdaq 100 charts is megaphone support currently in the 5650 area, and the near miss at the last test is suggesting strongly that will break on the next test. NDX 60min chart:

The ES and NASDAQ futures charts below were after the RTH close for Daily Video Service subscribers at theartofchart.net.

On NQ the rally rising wedge broke down and as this is a likely bear flag on the bigger picture this should deliver a minimum target back at the retest of Monday’s low, though if reached we will be looking for a likely move to the next big support level and possible H&S neckline in the 5550 area. NQ Sep 60min chart:

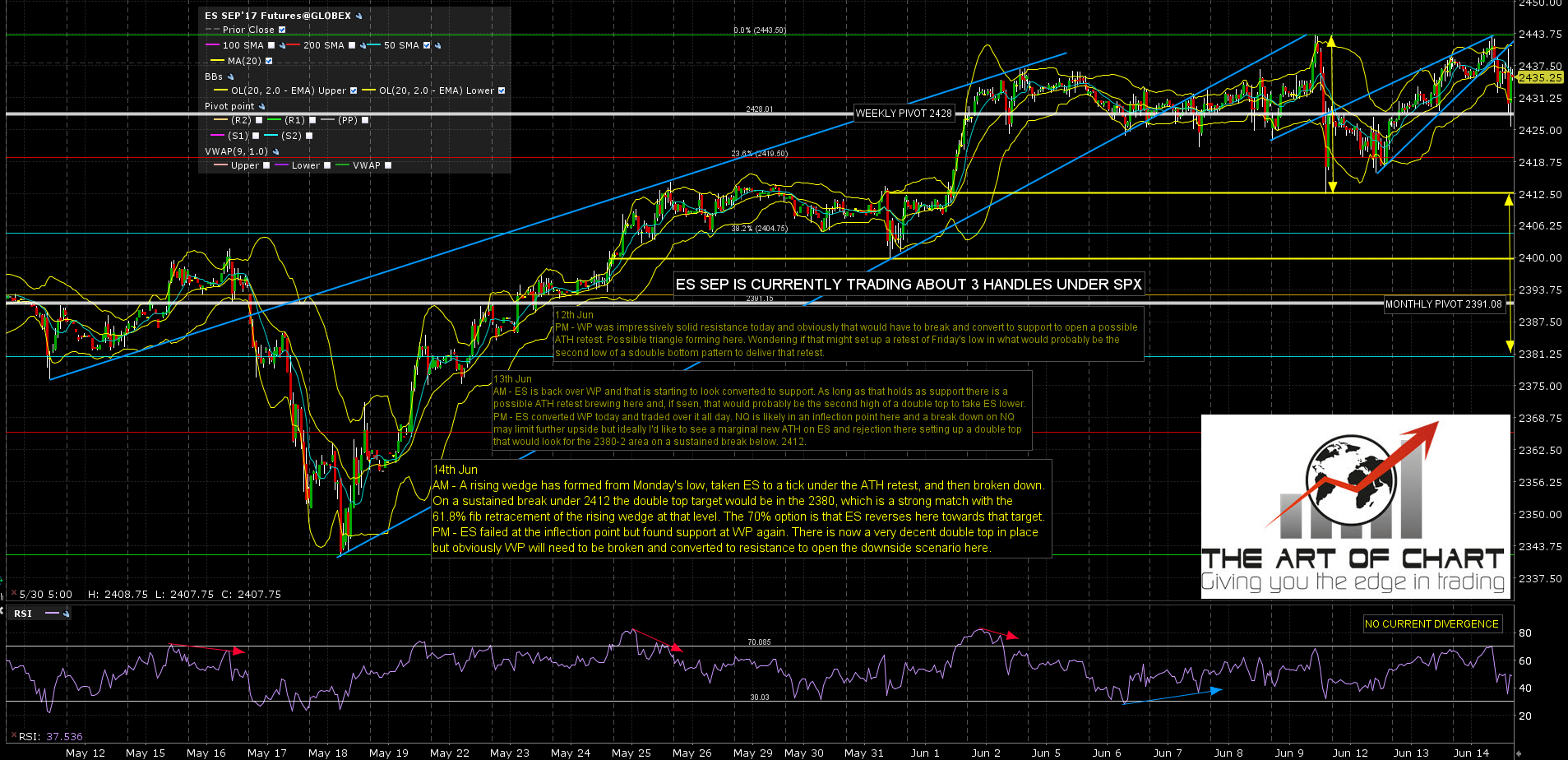

Are there any obvious weeds in this bearish rose garden? Yes, as the ES weekly pivot was tested at the intraday low and in globex since then, and this important support level on ES is holding so far. Until that breaks any declines are necessarily going to be modest. ES Sep 60min chart:

TF broke down from the rising wedge today which boosts the bear case here. TF Sep 60min chart:

In effect equities are currently stuck in a range between the weekly pivot on NQ on the upside and the weekly pivot on ES on the downside (weekly and monthly pivot levels always clearly marked on my futures charts).

One of those needs to be broken and converted to resistance or support to open lower (70% odds) or higher (30% odds) targets. Not expecting to wait too long to see that break and that should be a downward break on this setup, unless bulls can rally through it. We aren’t assuming that they can’t do that, but until we see that we are favoring the downside.