“Hard choices, easy life. Easy choices, hard life.” Jerzy Gregorek

A bit of strength the past couple of days but after such a heavy volume crack lower Tuesday, more consolidation is needed.

Cash is a great place to be with the odd long or short but we need some time to setup the charts again before I’ll be heavy.

We did fade into the close which is what I’d expect at the moment and the early strength was on amoebic volume which doesn’t help the bull case for the short-term.

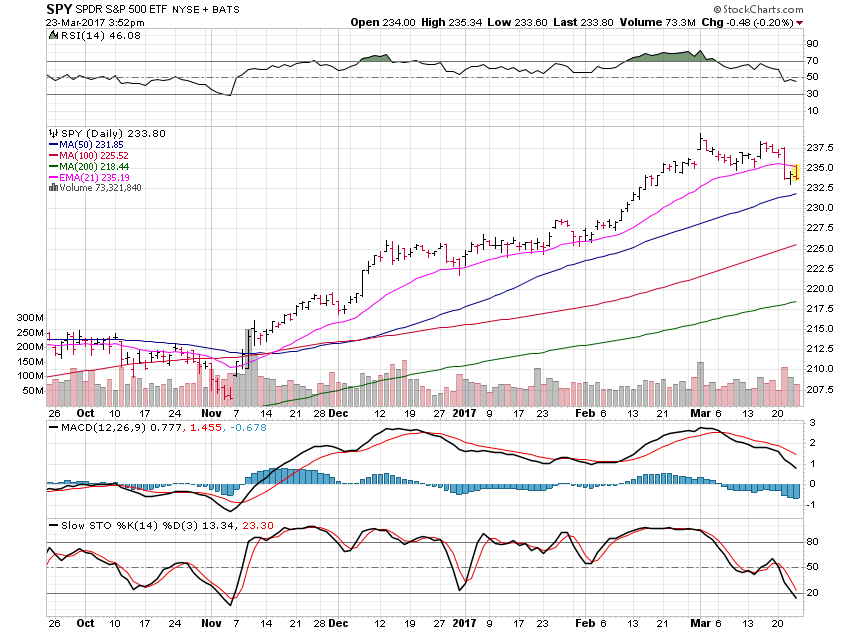

SPDR S&P 500 (NYSE:SPY) does not look strong here.

I’d expect at least a test of the 50 day average at 231.85 or so and maybe a move to the 227.50 area.

That said, if we can move back above the 21 day average at 235.20 that would tell me a low is most likely in.

Time will tell but my guess remains 6 to 8 weeks of consolidation before we see the next trending move higher.

There will be swing trades as we wait.