You know that things are starting to turn around for the bears, because people are starting to ship me alcohol. Back in the good old days of 2008, my mailbox was always stuffed with wine and chocolates. That dried up for years – – yes, years – – but recently fine liquors have started arriving. Indeed, I’m sipping on a superb bourbon at this very moment. Slopers are a fine lot.

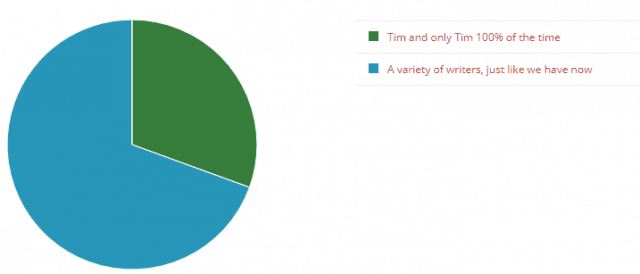

I asked in the prior post whether people liked the variety of writers we have or whether it should be just me. Well, a large quantity of you responded, and the winner is………the status quo!

Times like these are extraordinarily difficult to handle. One the one hand, 7 of the past 8 trading days constituting this new quarter have been profitable (today, obscenely so). And yet the question always looms: Do I stay or do I go? If I stay there will be trouble. And if I go there will be double.

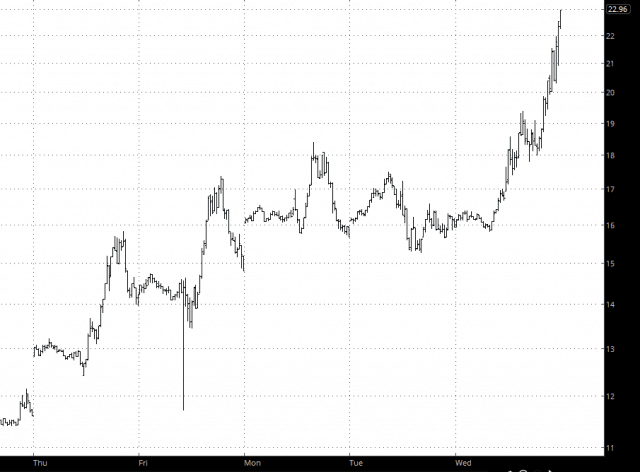

I mean, volatility has MORE THAN DOUBLED in just a few trading days. Ohmygard!

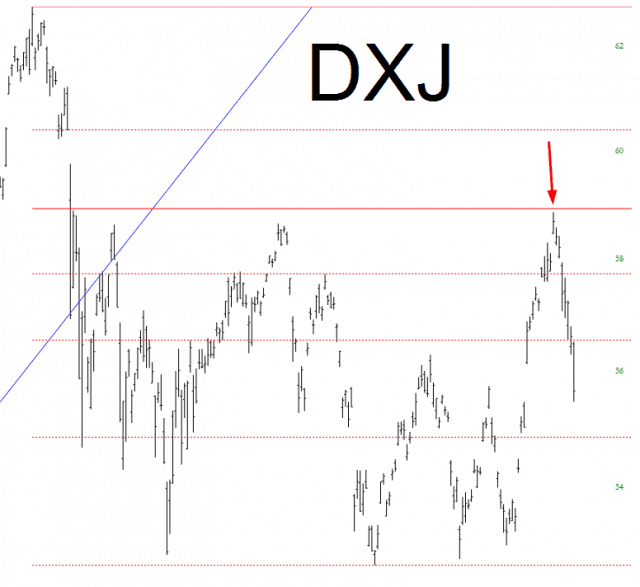

I must say, the supremely awesome SlopeCharts has been an essential guide during this journey. For example, I was experimenting with the Fibonacci Retracements feature. Based on this, I entered short positions against Japan…….

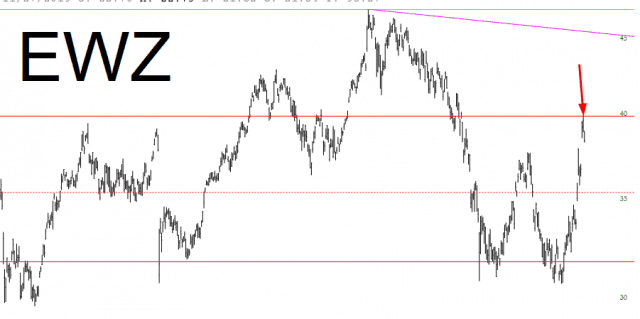

….as well as Brazil……..

You can see what a superb job these “Fibonacci-friendly” ETFs did with respect to their retracement levels.

So it’s all well and good that charting has been working out well. I have 84 positions, and all 84 are in the green. That’s a good feeling. But Trump is already getting nervous, and he’s already slinging shit at Jerome Powell, so that should be a persistent worry-point for the bearish set.

Can we look to earlier this year for any guide? After all ,that was the last time we had some serious thrills, only to have it snatched away from us. Well, let’s see. Here is what we’ve seen recently:

and this is the tumble from late January and early February.

I don’t find this comparison particularly instructive, but I will remind you of this fact: the big scary fall earlier this year all transpired over the course of ONLY FIVE TRADING DAYS. And the “meat” of the fall was during just TWO trading days (you can see those big bars above, sticking out plainly). It all ended, sadly, with that hammer on February 9th, and it was off to LIFETIME HIGH HELL in no time flat.

Almost every time I get nervous and decide to cover, whatever stock it is I covered just keeps falling. I try very hard to pick good patterns, and given even a partially cooperative environment, these patterns do, in fact, WORK. So I need to have a bit more faith in myself.

Thus, I will keep my stops up-to-date. What this assures me of is that I will NOT maximize my profits, because the day will come along that the market rips higher and I get stopped out level and right. What I think it helps me do, however, is at exactly PROTECT the vast majority of my profit and keep my sanity, since instead of trying to make one macro decision, I can let the individual positions take care of themselves.

One decision I did not have to wrangle with, however, was whether I should be more aggressive, because I ran out of buying power long ago. I couldn’t get into any more positions even if I wanted to do so!

Anyway, October is already fantastic, and we’re only one-third of the way into it. Depressogenic character that I am, I already am mourning going back to a market I don’t like, since magnificent days like these only come along once in a blue moon. I wish it could last forever. Or at least until the Dow was at zero.