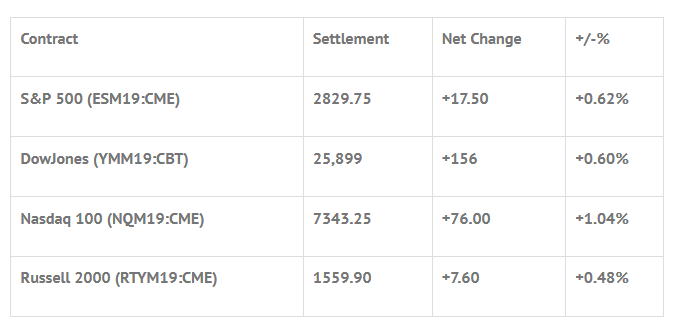

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 10 out of 11 markets closed higher: Shanghai Comp +2.47%, Hang Seng +1.37%, Nikkei +0.62%

- In Europe 10 out of 13 markets are trading higher: CAC +0.02%, DAX -0.15%, FTSE +0.60%

- Fair Value: S&P +5.17, NASDAQ +28.33, Dow +30.39

- Total Volume: 1.37mil ESM & 644k SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Housing Market Index at 10:00 AM ET.

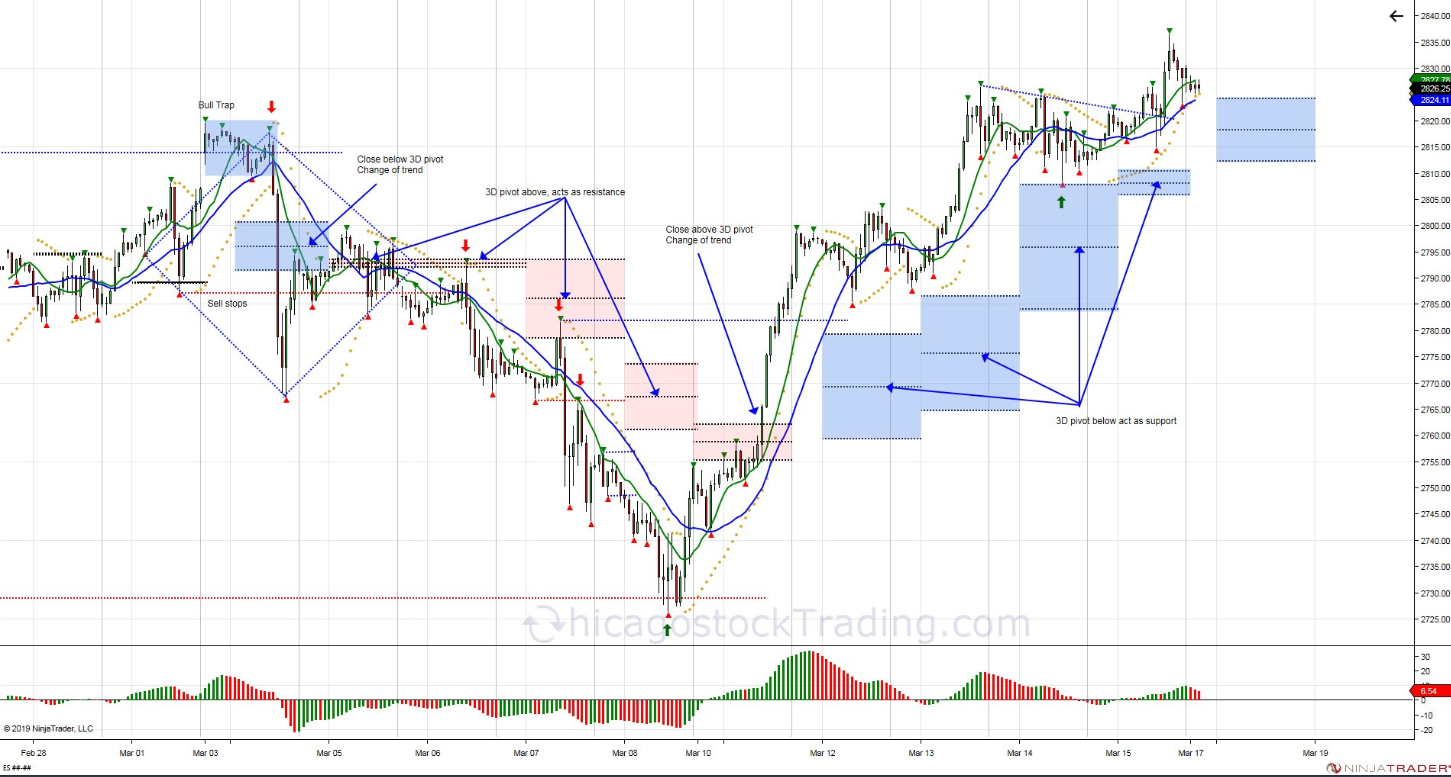

S&P 500 Futures: The March Quad Witch RIP

Chart courtesy of Stewart Solaka @Chicagostock – $ES_F Last Monday, SP500 closed above its 3D pivot to reverse its ST negative trend into a bull. For remainder of the week pivots below acted as support, creating upside pressure. Monday’s 3D pivot range

During Thursday nights Globex session, the S&P 500 futures (ESH19:CME) traded up to a high of 2826.50, a low of 2812.50, and printed 2819.00 on Friday mornings 8:30 CT open. After the bell, the ES down ticked to 2817.75, and then rallied up to 2824.75. After that first push higher, the futures sold off down to 2817.25, before rallying up to a lower high at 2823.00. The next move was back down 2817.75 at 9:43 CT, and then a big buy program triggered, helping to push the ES into the stops zone above 2828.00 and up to 2831.25 at 10:50, up +19 handles on the day.

After a small drop back down to 2828.00, the futures then traded up to a new high at 2836.50, then pulled back as volume started to taper off going into 12:00 CT. The weakness continued into the close, even when the MiM revealed $2.3 billion to buy, and a heavy volume drop took the ES down to 2826.50. You can blame that on the Quad Witch.

The selling flush did straighten out though, and after the 3:00 cash close the futures turned around and rallied up to 2830.75.

In the end, the overall tone of the ES was much stronger than I anticipated. In terms of the days overall trade, total volume was lower high for a quad witching, with 1.37 million futures contracts traded.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.