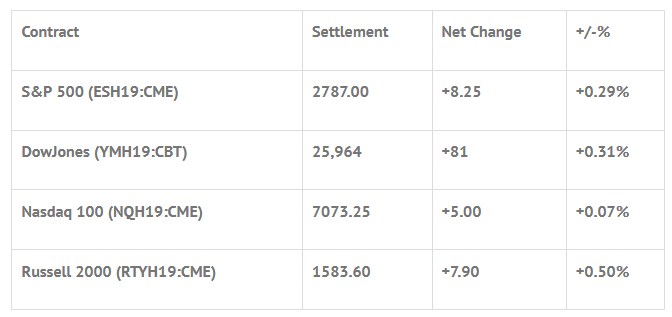

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed higher: Shanghai Comp -0.34%, Hang Seng +0.41%, Nikkei +0.15%

- In Europe 10 out of 13 markets are trading lower: CAC -0.10%, DAX +0.07%, FTSE -0.96%

- Fair Value: S&P -0.18, NASDAQ +5.51, Dow -10.37

- Total Volume: 1.28mil ESH & 197 SPH traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Raphael Bostic Speaks 7:50 AM ET, Durable Goods Orders 8:30 AM ET, Jobless Claims 8:30 AM ET, Philadelphia Fed Business Outlook Survey 8:30 AM ET, PMI Composite FLASH 9:45 AM ET, Existing Home Sales 10:00 AM ET, Leading Indicators 10:00 AM ET, EIA Natural Gas Report 10:30 AM ET, EIA Petroleum Status Report 11:00 AM ET, Fed Balance Sheet and Money Supply 4:30 PM ET.

S&P 500 Futures: Vix Drops / S&P Pops

I learned a long time ago that shortened holiday weeks can be torturous, and so far so good. Tuesday’s slow grind and yesterday’s fed minutes have helped that case. Despite the fed minutes showing a split over whether officials believed any interest-rate increases would be necessary this year, the fed said the central bank could stop shrinking its $4 trillion asset portfolio later this year, and believed it should be sooner than later. As I have always said, we live in an ever changing world that nothing stays the same for very long, and clearly the fed has been changing its interest rate hike approach.

During Tuesday nights Globex session, the S&P 500 futures (ESH19:CME) printed a high of 2782.25, a low of 2773.25, and opened Wednesday’s regular trading hours at 2779.50. The morning low print was 2777.75, and the morning high came in at 2786.75. The S&P’s traded 2783.25 on the 10:30 European close, and 2777.75 going into the noon hour.

The early afternoon saw a low of 2773.75, a high of 2790.75 and a print of 2785.75 going into the final hour of the day. The futures went on to trade 2786.25 on the 2:45 cash imbalance reveal, then printed 2786.00 on the 3:00 cash close, and settled the day at 2787.00 on the 3:15 futures close, up 8.25 handles, or +0.29%.

In the end, the overall tone of the ES was firm. In terms of the days overall trade, total volume was on the low side, with 1.3 million futures contracts traded.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.