- Following the ECB's decision to maintain interest rates, attention shifts to the Federal Reserve's upcoming decision.

- The Fed Rate Monitor Tool indicates a strong consensus for the Fed to keep rates steady, with a likelihood of 94.5%.

- The focus will be on Jerome Powell's speech, but expectations are for conventional statements without major revelations.

Following the European Central Bank (ECB)'s decision to conclude its string of consecutive interest rate hikes and maintain its rates at the current level, the financial world's attention has shifted to the Federal Reserve.

In alignment with the ECB's recent stance, the Federal Reserve is widely anticipated to keep its rates steady in the upcoming decision.

This expectation is substantiated by the strong consensus reflected in the Fed Rate Monitor Tool, which now indicates an overwhelming likelihood of 94.5%, marking a slight decrease from the previous week's 97.8% reading.

However, what holds the most significance in this scenario is not just the prospect of a second consecutive pause but also the content of Jerome Powell's forthcoming speech. So, what should we anticipate from his address?

Realistically, I don't foresee any groundbreaking revelations, and I regret to disappoint those who may be hoping for any dramatic or abrupt changes.

We can generally anticipate a conventional Powell, where he reiterates the following key points:

- The Federal Reserve's primary objective is to steer inflation back towards its 2 percent target.

- Policy decisions will continue to be made on a meeting-by-meeting basis, taking into account the most current data and economic conditions.

- The present state of the economy remains resilient, with ongoing adjustments in the labor market.

- The potential consequences of monetary policy on the economy are a significant consideration.

Beyond these points, there is unlikely to be any substantial deviation from the usual rhetoric.

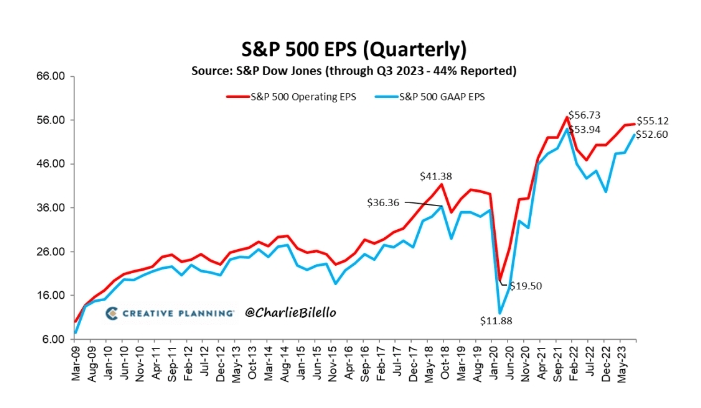

S&P 500 EPS Trend Remains Positive

Meanwhile, around 44% of the companies listed on the S&P 500 have released their earnings reports.

It appears that the trend is affirming a positive direction and that the preceding quarter marked the low point, indicating that, thus far, U.S. companies are maintaining their resilience effectively.

Source: Charlie Bilello

As for Treasury yields, after reaching new highs, they appear to be retracing, with the 10-year yield well below 5 percent and the 2-year yield slightly above, but only marginally so.

All eyes will remain on Powell's words, making today an intriguing day for the markets.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of assets, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor."