- Volatility surrounding the possibility of four rate hikes in 2018 has been escalating

- A shift in one Fed member’s forecast from three to four will alter the median outlook

- Recent trade tensions make a change in the outlook unlikely

As markets gear up for the start of the Federal Reserve’s two-day policy meeting which begins today, Tuesday, the longstanding expectation has been that the main outcome will be a 25 basis-point rate increase to a range of 1.75%-2.00%. With odds above 90% for this to happen according to Investing.com’s Fed Rate Monitor Tool, the move itself likely won't fuel any market worries.

However, traders are craving clarification on the broader outlook for monetary policy. And a single shift in the voting pattern of Fed policymakers could trigger renewed volatility and increased market jitters.

The rate decision, scheduled to be announced at 2:00PM ET (18:00GMT) on Wednesday, will be accompanied by not only the statement from the Federal Open Market Committee (FOMC) but also the quarterly update of policymakers’ economic projections, followed by a press conference with Fed chairman Jerome Powell that could provide additional clues to the U.S. central bank’s outlook.

Interest Rate Frequency Bets Stir Volatility

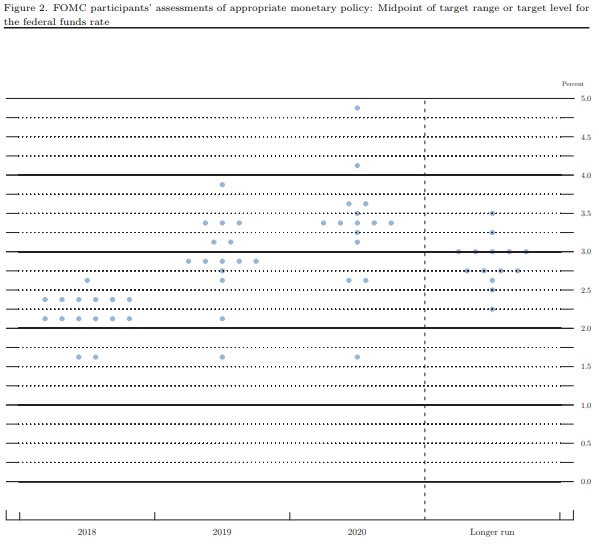

As part of economic projections issued this past March, the so-called “dot plot”—which anonymously provides individual Fed policymakers’ forecasts for interest rates—showed that the median bet was for a total of three hikes in 2018 with an additional three next year, as part of the Fed's plan for “further gradual increases in the Federal funds rate.”

However, incremental increases in inflation readings, on the back of an extremely tight labor market stoked speculation that the Fed could move as many as four times in 2018, including the increase which already occurred in March.

That in turn fueled market turbulence, beginning in February, which ended with the first monthly decline for the S&P 500 (-3.9%) in nearly a year. It also pummeled the Dow’s year-to-date gains, pushing them back down to 1.5% after the blue chip index experienced its best start to the year since 1987.

As well, the murmurs over a more aggressive Fed began to notably rise. Arguably they reached a crescendo at the end of that month when Powell testified to Congress that “some of the headwinds the U.S. economy faced in previous years have turned into tailwinds," citing stimulative fiscal policy and firmer demand for U.S. exports. “In the FOMC’s view, further gradual rate increases in the Federal funds rate will best promote attainment of both of our objectives,” he added.

Market reaction (or overreaction) indicated that traders understood Powell’s comments to be hawkish, confirming the possibility of four hikes this year. The odds continued to strengthen as positive economic data and higher inflation readings cemented the idea that the Fed may add an additional rate hike to the three it had already predicted for 2018.

Flash forward to the end of May however, when markets were shaken by political developments in Italy and fears of a breakup of the eurozone. The threat of a financial crisis that could shake the global economy canceled out bets on a fourth hike in December. The idea of an additional hike that would push interest rates to 2.25%-2.50% took a nosedive.

The above chart clearly shows the oscillations in the probability of interest rate hikes reaching the 2.25%-2.50% range by year’s end, bringing the total to four increases for 2018. As of the time of writing, the odds were at just under 45%, still below the 50% threshold which had been breached earlier this year.

Every Fed Vote Counts

The whipsawing odds of a fourth hike this year reflects market uncertainty regarding just how aggressive the Fed should, or might want to be. Influential New York Fed president William Dudley tried to soothe sentiment at the beginning of March by saying: “If you were to go to four ... rate hikes I think it would still be gradual,” he said at a conference. Dudley explained that such a move would be only half as aggressive as the eight-per-year hikes the Fed executed last decade, which he called the “alternative to gradual.”

Nevertheless, the confusion over three or four hikes lies at the heart of Fed members opinions and their economic points of view. In March, the median call of 2.125% for 2018 implied leaving rates at the 2.00%-2.25% range or a total of three rate hikes this year.

Fed March dot plot showing anonymous individual forecasts for interest rates. Source: Federal Reserve.

However, as can be seen in the Fed’s March dot plot (above), there were an equal number of members calling for three hikes as there were or four. The two more dovish members simply outweighed the single more hawkish member. In a nutshell, if one of the Fed policymakers previously in the three rate hike camp nudges up their forecast this time, the ball game changes, officially shifting the outlook to four increases for 2018.

Will It Matter?

Although market algos could go bonkers and the financial media will undoubtedly hype the shift in sensationalist headlines, it would hardly mark a fundamental policy change. While every vote counts, the shift would actually be miniscule.

Keeping in mind that none of the voters on the FOMC have dissented with a Fed decision so far this year, it seems unlikely that a slight shift in the median outlook will cause an uproar within the inner circle.

While there's no crystal ball showing toward which side the data-dependent Fed is leaning, all signs point to a lack of impetus for a change. During the month of May, Dallas Fed president Robert Kaplan, Philadelphia Fed chief Patrick Harker and Atlanta Fed head Raphael Bostic each specifically indicated that their forecast was for three hikes.

San Francisco Fed president John Williams—who will replace Dudley at the head of the NY Fed on June 17—did say, on May 4, that “the central tendency of the committee (last March) was for three or four rate increases in the year (…) I still think that’s the right way to think about it given the continued improvement in the economy.”

However, much has changed, specifically when it comes to international trade. Since the March 21 rate hike, at least five Fed policymakers have commented on the downside risks to the economy given the ongoing trade tensions between the US and, especially over the weekend, the rest of the G7. Since then that uncertainty has, if anything, increased.

Though the Fed has deemed markets in good shape to move forward with a quarter point hike on Wednesday, it definitely seems like an inauspicious moment for any policymaker to change their vote.