It’s my firm belief that most Americans are living in a fantasy world where a superhero named President Trump is going to negotiate fabulous “America-first” trade deals with cowering governments around the world… and Americans will then magically relive the 1950s with massive GDP growth, even while QE to infinity becomes as American as apple pie.

The reality of the situation is almost the exact opposite of this fantasy world; de-dollarization is relentless and American government size and debt growth is totally out of control.

China is an economic bullet train carrying 1.4 billion gold-focused passengers. It’s blasting through a melting block of American fiat-focused butter, and India’s citizens are poised to take everything China’s citizens are doing to even greater gold-oriented heights.

The rise of the Chindian gold-oriented economic empire and the decline of the American empire are both unstoppable processes.

There’s no question that Trump will negotiate numerous trade deals with more favorable terms for America than his presidential predecessors ever did, but the tariff taxes involved mean these deals create less global growth rather than more.

These taxes are also inflationary.

A “big” trade deal between China and American is unlikely, but even if it happens it would probably add only about half a point to the current pathetic level of US GDP growth in the short term, and it wouldn’t stop the business cycle from peaking.

The cycle is peaking. Recession is coming.

A breakout above $1362 targets $1450.

Simply put, the peak in the business cycle is when sane investors buy gold and silly children try to relieve the 1950s by price-chasing the US stock market.

I’m long the stock market, but I’m not buying new and bigger core positions. I consider that an act of financial madness.

There is no asset class that does as well as gold does as the business cycle peaks, and this cycle peak might include the interesting arrival of… inflation.

Note the similarity of the current action in the inverse H&S bull continuation pattern to the price action in late 2009. Gold is poised for a major upside breakout.

I think the US business cycle peak will force Trump to change tactics from trying to extend the cycle with tariff taxes and he’ll focus on devaluing the dollar. If he loses the election, the democrats are also likely to pursue dollar devaluation. It’s win-win for gold.

I expect this US business cycle peak will be followed by a substantial period of growing stagflation.

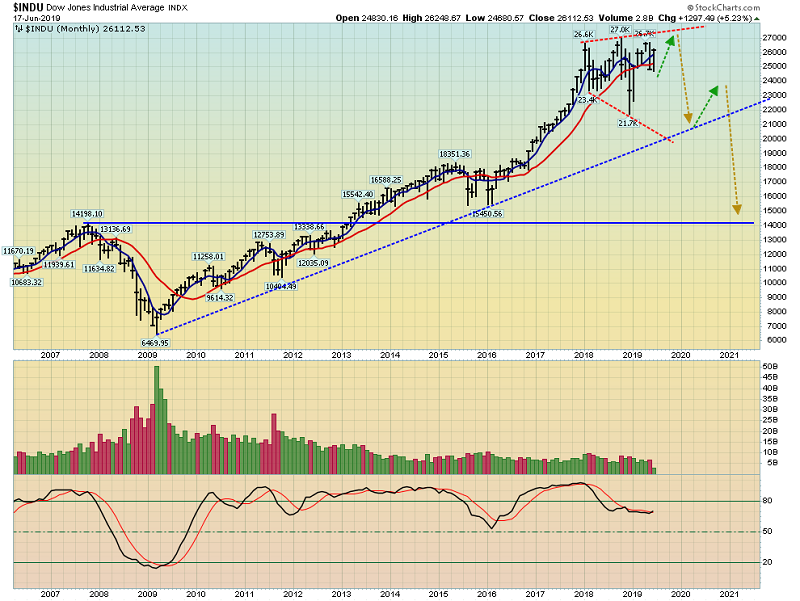

That means the Dow could gyrate between about 15,000 and 30,000 for years in a stagflationary quagmire, much like it gyrated between 500 and 1000 in the 1970s as stagflation lorded over all markets.

“Right now, they’ll just give a very dovish message that leans toward a July rate cut. The market is worried enough about weakness in China, inflation undershooting and the possibility that tariffs disrupt the global supply chain that it’s hard for me not to think the Fed won’t be moving faster than people thought.” - Joe LaVorgna, chief economist for the Americas, Natixis, June 14, 2019.

Mike Grapen is chief economist at Barclays (LON:BARC) bank, and he’s predicting a half-point cut in July! The bottom line is that while the long-term outlook for America is empire-fade and stagflation, the Fed is still a powerful central bank and the main driver of the US stock market.

This is the short-term Nasdaq stock market chart. While big core positions should be reduced as the business cycle matures, short-term trading should be embraced.

At my guswinger.com swing trade site, I’m betting the Fed makes a dovish statement at tomorrow’s key meeting, and that creates short-term buying of the stock market… and gold!

This is the VanEck Vectors Gold Miners ETF (NYSE:GDX) chart. The current Fed meet should be bullish for gold stocks. What about the July meet?

Well, that should be even more bullish! A big rate cut in July may not be enough to save the stock market from the tariff tax quagmire it’s sinking into as the business cycle peaks.

That’s because institutional money managers traditionally begin to sell the stock market as the Fed cuts rates at the peak of the cycle and… they buy gold! Once tomorrow’s Fed meet is out of the way, it will be time for gold stock investors to get bold, reduce hedges, buy all dips, and… enjoy!

Written between 4am-7am. 5-6 issues per week. Emailed at aprox. 9am daily.

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?