Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 6 out of 11 markets closed higher: Shanghai Comp +0.52%, Hang Seng +0.83%, Nikkei -0.22%

- In Europe 10 out of 13 markets closed lower: CAC -0.38%, DAX +0.20%, FTSE -0.07%

- Fair Value: S&P +1.13, NASDAQ +12.40, Dow -28.83

- Total Volume: 1.49 million ESM & 125 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Motor Vehicle Sales, Challenger Job-Cut Report 7:30 AM ET, Jobless Claims 8:30 AM ET, Productivity and Costs 8:30 AM ET, Factory Orders 10:00 AM ET, EIA Natural Gas Report 10:30 AM ET, Fed Balance Sheet & Money Supply 4:30 PM ET.

S&P 500 Futures: Fade The Fed

Chart courtesy of Scott Redler @RedDogT3 – $spx futures +7 as there’s no downside follow thru to yesterday’s bearish reversal. We’ll see if sellers Return, or was yesterday a miss/direction move to throw off bullish sentiment. $spx support pivot at 2923 is key.

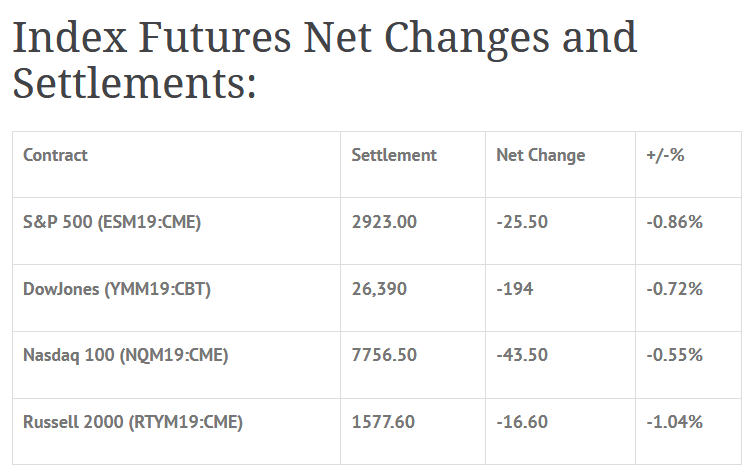

During Tuesday nights Globex session, the S&P 500 futures (ESM19:CME) printed a high of 2961.25, a low of 2952.50, and opened Wednesday’s regular trading hours at 2954.00.

After the 8:30 CT bell, initial weakness knocked the ES down to an early low at 2947.00. From there, the futures firmed up, and by 10:45 had rallied back through the opening range to make a new RTH high at 2956.00.

Once the morning high was in, the ES once again set its sights lower, and with the help of a few sell programs, broke down to a new low at 2943.50 just before noon.

When the fed came out saying they were going to remain patient on interest rates, the futures started trading higher, eventually topping out at 2956.00 again. After that, another headline hit the tape from fed chairman Powell about economic growth, and the ES tumbled.

When the MiM came out showing $901M to sell MOC, the ES had dropped more than 20 handles from its RTH high, and it continued dropping going into the close. On the 3:00 cash close the futures printed 2924.75, and continued even lower to print 2923.00 on the 3:15 futures close.

In the end, the overall tone of the ES was weak. In terms of the days overall trade, total volume was higher, with 1.5 million futures contracts traded.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.