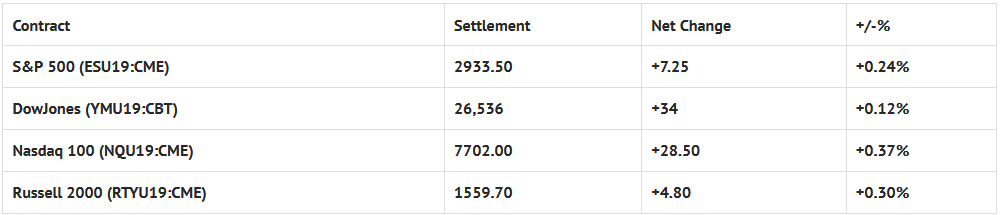

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 9 out of 11 markets closed higher: Shanghai Comp +2.38%, Hang Seng +1.23%, Nikkei +0.60%

- In Europe 11 out of 13 markets are trading higher: CAC +0.70%, DAX +0.85%, FTSE +0.69%

- Fair Value: S&P +4.73, NASDAQ +28.95, Dow +11.46

- Total Volume: 1.66 million ESU & 2.6k SPU traded in the pit

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes the 52-Week Bill Settlement, Jobless Claims 8:30 AM ET, Philadelphia Fed Business Outlook Survey 8:30 AM ET, Current Account 8:30 AM ET, Leading Indicators 10:00 AM ET, EIA Natural Gas Report 10:30 AM ET, Fed Balance Sheet & Money Supply 4:30 PM ET.

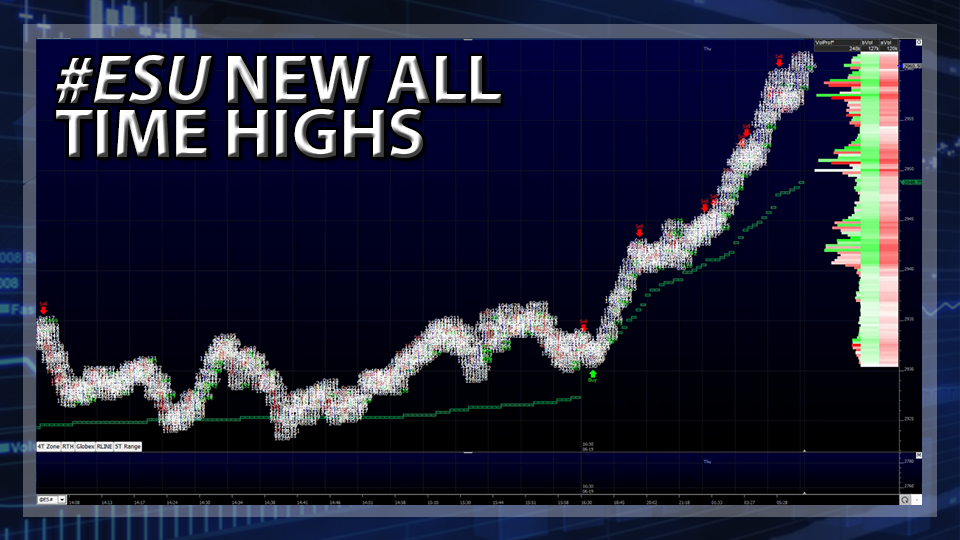

S&P 500 Futures:Fed Day; ‘Back and Fill, Then Rally’

Chart courtesy of Scott Redler @RedDogT3 – $spx futures +25 as we attempt to get and stay above 2954 key All time high pivot. There were many spots to adjust with a plan.

During Tuesday nights Globex session, the S&P 500 futures (ESU19:CME) were held to just a 8.75 handle range, and the lack of volatility rolled over into Wednesday’s regular trading hours. After the 8:30 CT bell, the ES printed the RTH session high at 2927.50, then proceeded to trade sideways in an 8 handle range until the fed announcement at 1:00.

The news headline algo’s were ready and waiting, and the initial knee jerk reaction to the FED’s decision to curb interest rate hikes until 2020 took the ESU down through the Globex low at 2921.75, to a new low at 2915.25. The futures recovered immediately, and popped back up through the opening range, to a new high at 2935.25, in a matter of seconds.

After a little back-and-fill down to the 2923.25, stock markets continued to trade higher for the rest of the session, and when the MiM reveal came out showing $364 million to buy, the futures were trading at 2932.75. The ES would then go on to print 2930.75 on the 3:00 cash close, and 2933.25 on the 3:15 futures close, up 7 handles on the day.