- All eyes are on the Fed ahead of a key interest rate decision

- Markets are expecting a pause from the Central Bank

- As November's outlook remains uncertain, investors ponder the arrival of the highly-awaited pivot point

Last week, I wrote about a noteworthy divergence in inflation data, with the headline CPI on the rise while Core CPI was declining. This divergence occurred alongside a 25 basis point hike by the ECB.

However, the focal point of this week will undoubtedly be the Federal Reserve, as they are set to make a crucial rate decision today.

Market expectations now strongly lean towards a pause in rate hikes, with our Fed Monitor Tool indicating a probability of nearly 100% (up from 92% the previous week).

Source: Investing.com

The outlook for the November decision, however, looks more complicated, with the market currently pricing in a 32% chance of a final rate hike by then.

Source: Investing.com

With growing uncertainty on the horizon, many investors now ponder whether to adjust their strategies for the rest of the year. However, history has consistently shown that making predictions based on day-to-day events and basing investments on them can be a grave error.

Theoretically, the long-awaited pivot point should have already occurred between February and March, yet here we are, still highly uncertain.

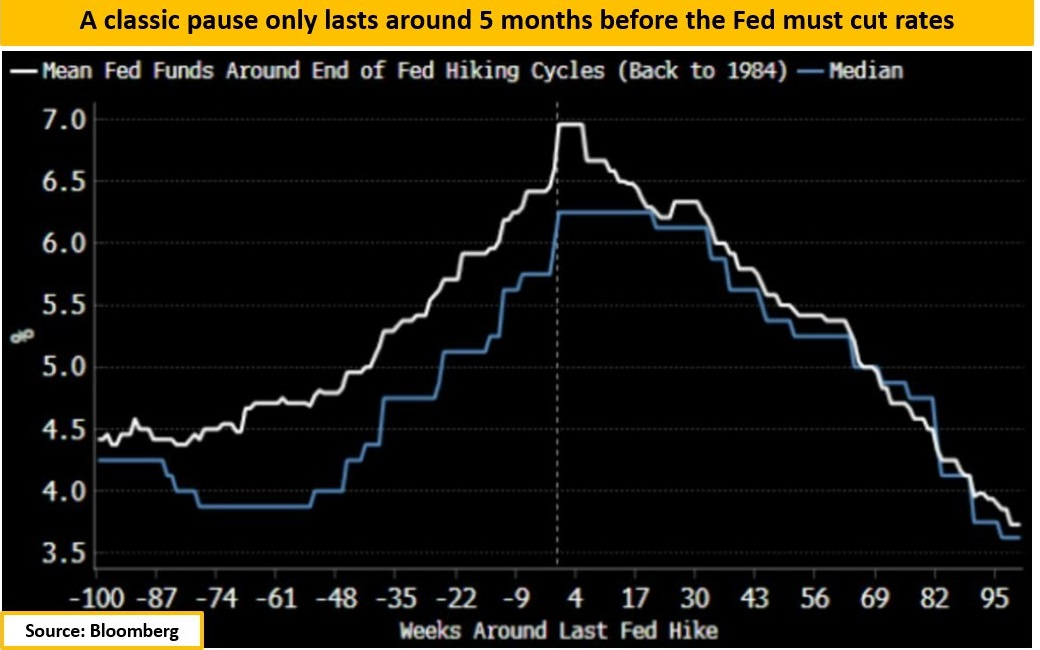

So, when will it finally arrive? Source: Bloomberg

Source: Bloomberg

Historically, the pause between the end of a rate hike cycle and the beginning of a rate cut has lasted, on average, about 5 months.

This suggests that if inflation shows signs of slowing and the Fed is no longer compelled to raise rates, we might begin to witness some easing in the first quarter of 2024, with the caveat that this is a conditional scenario.

Meanwhile, the U.S. economy, especially the labor market, remains resilient and strong, providing the Fed with more flexibility than its European counterparts, who are beginning to see signs of economic distress in their data.

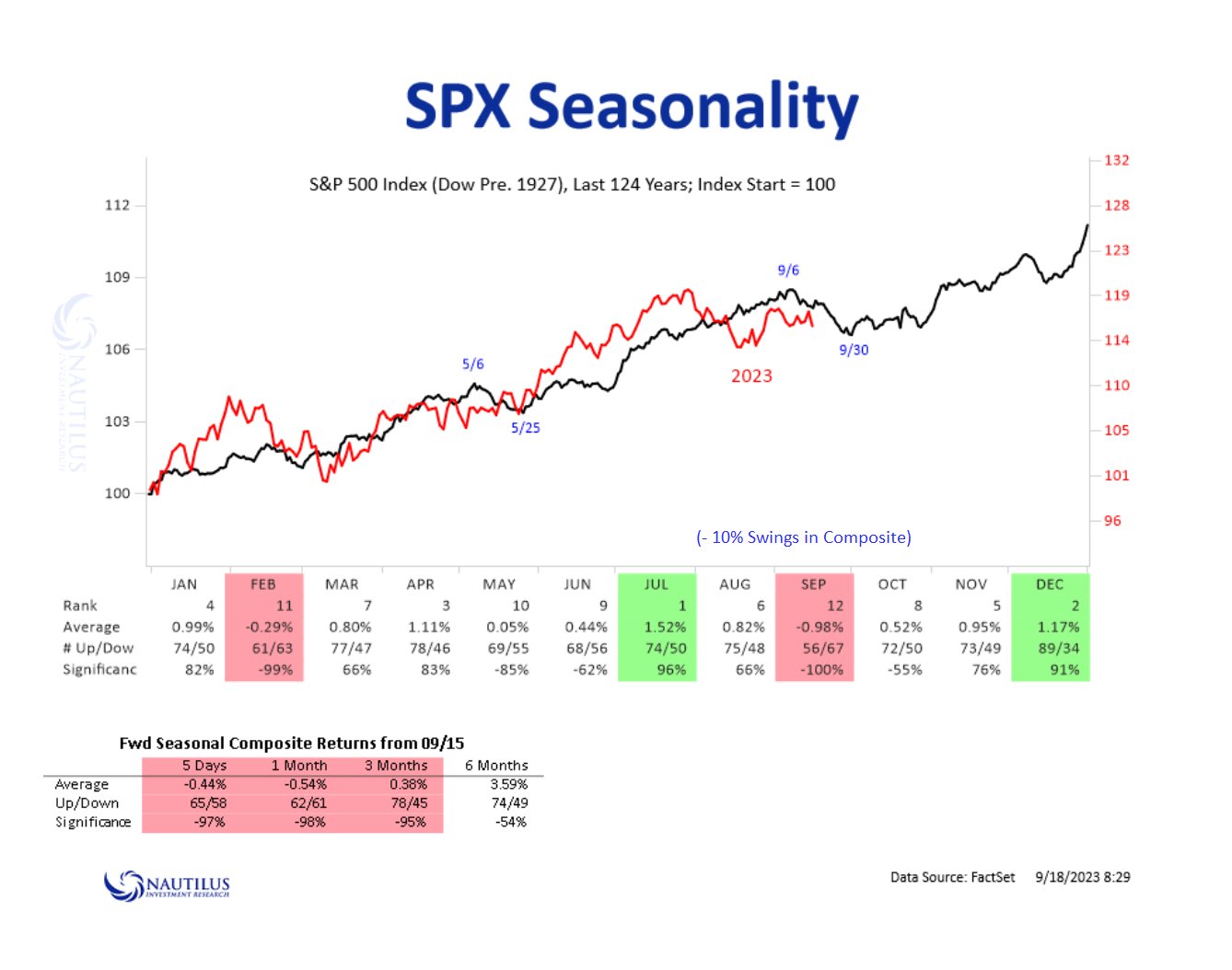

Source: Nautilus

History suggests September has proven to be a challenging month for the S&P 500, perhaps the most challenging in terms of seasonality, with more negative periods than positive ones (67 to 56).

However, if there's one thing we've learned in this year and a half, it's that the Fed doesn't seem to care much about the markets, and I don't believe the Fed will ever let us know when it truly intends to stop hiking rates.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of assets, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor. The author does not own the stocks mentioned in the analysis."