- The Fed left interest rates unchanged as expected, but the median FOMC member now expects two more rate hikes (50bps of tightening) this year.

- Fed Chairman Powell reiterated that hawkish message in his press conference.

- The S&P 500 is holding up relatively well in the face of forecasts for higher interest rates this year – all eyes on 4325.

As I noted in my FOMC meeting preview report yesterday, the as-expected US CPI report essentially eliminated any chance of a surprise rate hike at this meeting, so it was no shock that the Fed “stuck to the script” and left interest rates unchanged in the 5.00-5.25% range.

Despite the lack of a headline surprise though, the central bank’s monetary policy statement, Summary of Economic Projections (SEP), and Chairman Powell’s ongoing press conference delivered some important takeaways for traders.

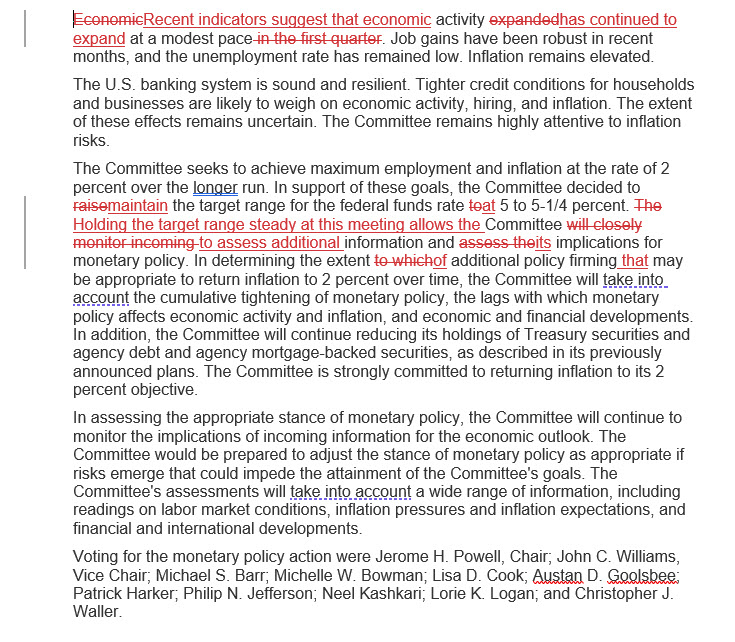

The FOMC Monetary Policy Statement

Compared to June’s monetary policy statement, there were surprisingly few changes to the monetary policy statement itself. First, the FOMC updated a reference to say that the economy has “continued to expand” at a modest pace, though that is unlikely to be a major market mover.

The only other tweak was to highlight that holding interest rates steady “allows the Committee to assess additional information” on the economy, underscoring that, for now, it views today’s decision as more of a “skip” in an ongoing rate hike cycle than an extended pause.

Source: Federal Reserve

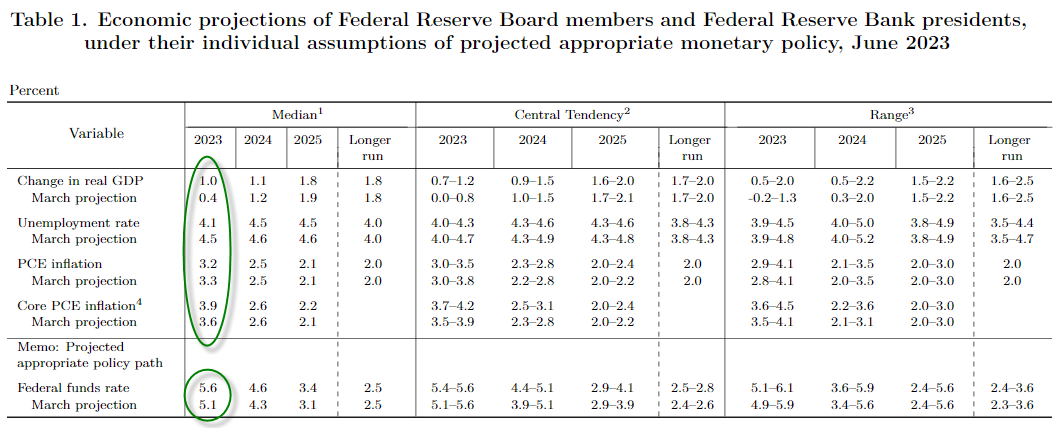

The Fed’s Summary of Economic Projections and Dot Plot

The central bank’s economic projections are where the first big surprise of the day emerged. Specifically, in the Fed’s infamous “dot plot” of interest rate expectations, the median FOMC member revised his/her estimate for year-end interest rates up 50bps to the 5.50-5.75% range, implying that the majority of US central bankers expect at least two more 25bps interest rate increases this year:

Source: Federal Reserve

Beyond that (or more accurately, in support of that) upgrade to interest rate forecasts, the FOMC also revised up its forecast for 2023 GDP growth to 1.0% (from 0.4% in March) and its estimate of Core PCE to 3.9% (from 3.6%), while revising down its forecast for year-end unemployment to 4.1% (from 4.5%). Put simply, Jerome Powell and Company believe the full-year outlook for the US economy has improved dramatically and therefore expect to raise interest rates by more than anticipated.

Chairman Powell’s Press Conference

Fed Chairman Powell is still speaking as we go to press, but on balance, his comments thus far are not undermining the “hawkish hold” delivered through the SEP:

- WE ARE STRONGLY COMMITTED TO 2% INFLATION.

- WITHOUT PRICE STABILTY, WILL NOT ACHIEVE SUSTAINED STRONG LABOR MARKET.

- FULL EFFECTS OF TIGHTENING HAS NOT YET BEEN FELT.

- NEARLY ALL POLICYMAKERS VIEW SOME FURTHER RATE HIKES THIS YEAR APPROPRIATE.

- LABOR MARKET REMAINS VERY TIGHT.

- SOME SIGNS SUPPLY AND DEMAND IN LABOR MARKET COMING INTO BETTER BALANCE.

- LABOR DEMAND STILL SUBSTANTIALLY EXCEEDS SUPPLY OF WORKERS.

- GETTING INFLATION BACK TO 2% HAS A LONG WAY TO GO.

- AT THIS MEETING, CONSIDERING HOW FAR AND FAST WE HAVE MOVED, JUDGED IT PRUDENT TO HOLD RATES STEADY.

- FED PROJECTIONS ARE NOT A PLAN OR DECISION.

- REDUCING INFLATION IS LIKELY TO REQUIRE BELOW-TREND GROWTH, SOME SOFTENING OF LABOR CONDITIONS.

- WE WILL CONTINUE TO MAKE DECISIONS MEETING BY MEETING.

- EXPECT JULY WILL BE A "LIVE MEETING"

- DATA SINCE THE LAST MEETING CAME IN ON THE HIGH SIDE OF EXPECTATIONS.

- WE WILL LOOK AT ALL THE DATA AND THE EVOLVING OUTLOOK AND WILL MAKE THE DECISION IN JULY.

- THE LABOR MARKET HAS SURPRISED WITH EXTRAORDINARY RESILIENCE.

S&P 500 technical analysis – SPX Daily chart

So far, markets are seeing a roughly as-expected, if relatively subdued, reaction to estimates of higher year-end interest rates. The US dollar is recovering from its daily lows (though still down on the day), nudging down the prices of commodities like gold and oil, and major US stock indices are falling from their intraday highs.

Keying in on the S&P 500, prices are still holding this week’s breakout above key previous resistance in the 4325 area, keeping bullish hopes alive. If the index can hold above that level for the rest of the week, it could pave the way for continued gains into next week as equities shrug off yet another risk. Meanwhile, a drop-through 4325 support would hint at a potential retracement down to previous-resistance-turned-support and the 50-day EMA near 4200 next.