Market sentiment improved yesterday and today in Asia, with European shares rebounding after ECB’s Lane said that they don’ see inflation above 2% in the medium term.

Later in the day, Fed Chair Powell hinted that they were not rushing to reduce their balance sheet, which encouraged some more stock buying. Today, market attention is likely to fall on the US CPI for December.

Stocks Rebounds, Dollar Slides After Powell’s Testimony

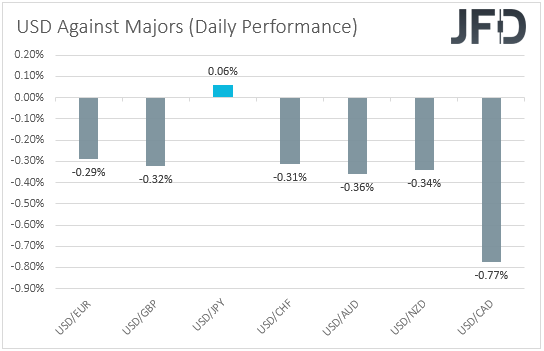

The US dollar traded lower against all but one of the other major currencies on Tuesday and during the Asian session Wednesday. It gained fractionally against JPY, while it lost the most ground versus CAD, AUD, and NZD, in that order.

The weakening of the US dollar and the Japanese yen, combined with the strengthening of the risk-linked Loonie, Aussie and Kiwi, suggests that market sentiment turned positive yesterday.

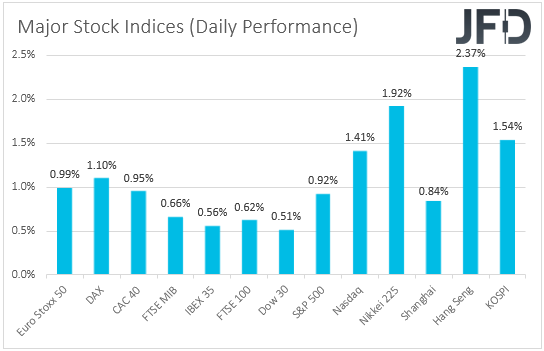

Indeed, looking at the performance of the equity world, we see that central EU and US indices traded in the green, with the improved appetite rolling into the Asian session today.

European shares may have rebounded after ECB Chief Economist Philip Lane said that the ECB does not see Eurozone inflation above 2% in the medium term, despite rising to 5% in December, which means that they are sticking to their view of no hikes this year. Later in the day, Fed Chair Powell testified before the Senate Banking Committee, and his remarks may have improved further investors’ appetite.

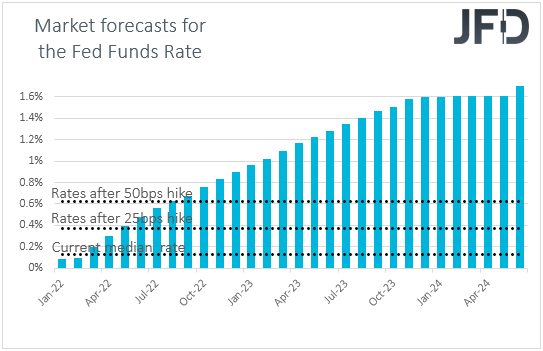

The Fed chief said that the US economy is ready for higher interest rates and a balance sheet reduction to combat inflation. However, he said that the Committee is still debating approaches regarding reducing its balance sheet and that this could take two, three, or four meetings before finding consensus.

Although market participants did not alter their bets regarding rate hikes, the market reaction suggests that Powell’s comments were not as hawkish as many may have sought to continue selling stocks and buying dollars.

It seems that he confirmed the market’s view on interest rate liftoffs, while his no-rush approach on the balance-sheet policy allowed for some increase in risk exposures. After all, he appeared less aggressive than some of his colleagues on the matter.

Remember that on Monday, Atlanta Fed President Raphael Bostic said that high inflation and a robust economic recovery warrant a rapid rundown of Fed asset holdings.

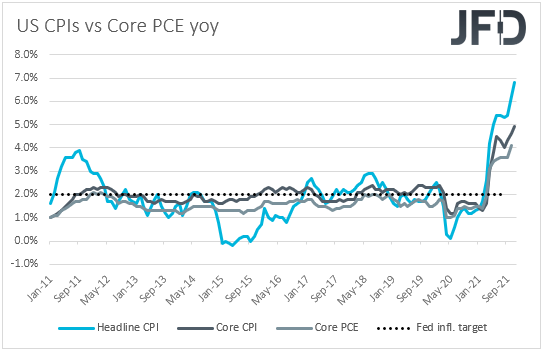

Now, attention turns to the US CPIs for December, where expectations increase acceleration. The headline rate is forecast to hit 7.0% for the first time since 1982, and the core one is to rise to 5.4%.

However, with equities rebounding strongly even with those forecasts being publicly known, we believe that inflation may need to surprise the upside for investors to start pricing in a more aggressive strategy by the Fed.

Anything else may allow participants to continue buying stocks and other risk-linked assets and perhaps keep selling US dollars for a bit more, at least until Brainard’s testimony, which is scheduled for tomorrow.

To be honest, though, Brainard was considered a policy dove before her appointment. We see very few chances for her appearing more hawkish than Powell did yesterday.

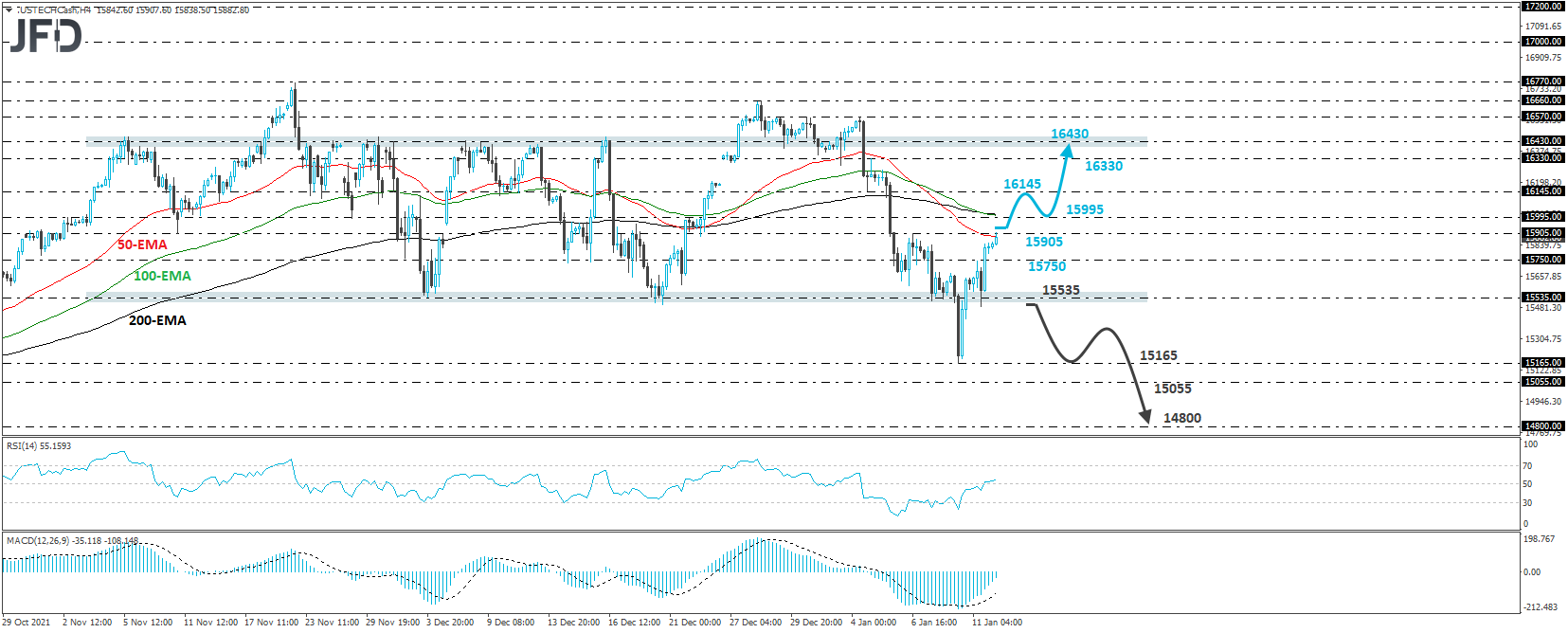

NASDAQ 100 – Technical Outlook

The NASDAQ cash index traded sharply higher yesterday, returning within the sideways range that has been containing most of the price action since Oct. 26. The boundaries of that range are 15535 and 16430. With that in mind, we will abandon our latest negative view and switch back to neutral for now. However, we do see some chances for further recovery within that range.

A clear break above the high of Jan. 6, at 15905, could initially target the 159965 zone, the break of which could carry larger advances, perhaps towards the inside swing low of Jan. 4, at around 16145. If participants are unwilling to stop there, we could see them climbing towards the 16330 zone, or even the upper bound of the current range, at around 16430.

To start examining decent declines again, we would like to see a drop back below 15535. This could result in another round of selling towards Monday’s low of 15165. Slightly lower lies the 15055 barrier, marked by the low of Oct. 18, the break of which could see scope for extensions towards the inside swing high of Oct. 12, at 14800.

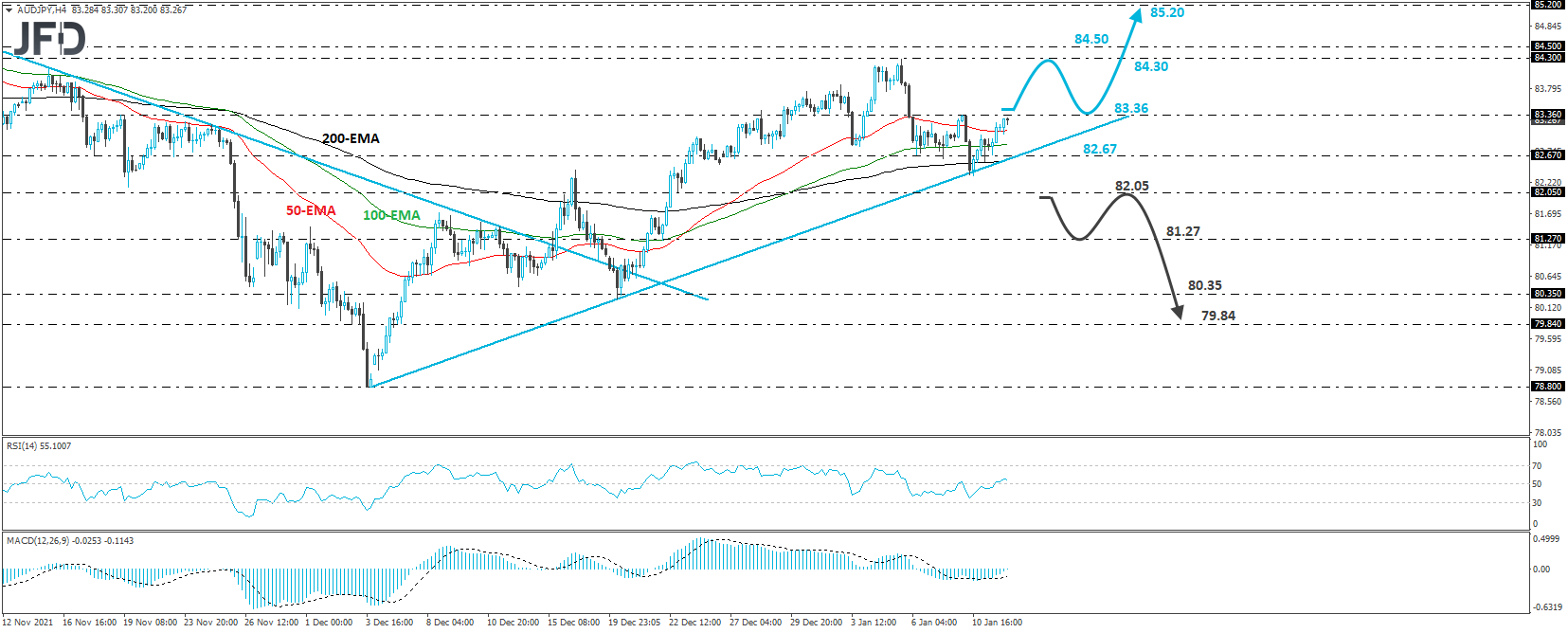

AUD/JPY – Technical Outlook

Since Monday, AUD/JPY has been in recovery mode when it hit support at the upside line drawn from the low of Dec. 3. As long as the rate stays above that line, we will consider the short-term outlook to be positive and confident on further advances. We would like to see a break above Monday’s high, at 83.36.

Such a move would confirm a forthcoming higher high on the 4-hour chart and may initially target the peak of Jan. 5, at 84.30, or the inside swing low of Nov. 2, at 84.50. If the bulls are unwilling to stop there, then a break higher could see scope for advances towards the high of Nov. 4, at 85.20.

On the downside, we would like to see an apparent dip below 82.05 before we start evaluating a possible bearish reversal. The rate will already be below the aforementioned upside line and may slide towards the low of Dec. 22, at 81.27. If the bears don’t stop there, we could see them pushing towards the low of Dec. 20, at 80.35.

As for the Rest of Today’s Events

During the European session, we got Eurozone’s industrial production for November, with the figure coming in at 2.3%. While later in the day, we have the EIA report on crude oil inventories for the preceding week.

We also have four speakers on the agenda, and those are BoE MPC member Jon Cunliffe, ECB Supervisory Board Chair Andrea Enria, Minneapolis Fed President Neel Kashkari, and most importantly, Fed Board Governor Lael Brainard. We may get an idea of what she thinks regarding monetary policy before her testimony tomorrow.