The chart above looks at the NASDAQ 100 and the NASDAQ Fear Index (VXN) over the past 15-months. Since last fall, the NDX 100 has continued to create a series of lower highs.

Falling resistance was hit at (1) of late, at the top of a small bearish rising wedge and support has been taken out. At the same time, the NASDAQ Fear index was near lows of the past 15-months.

Over the past two weeks the VXN has pushed above a 90-day resistance line at (2).

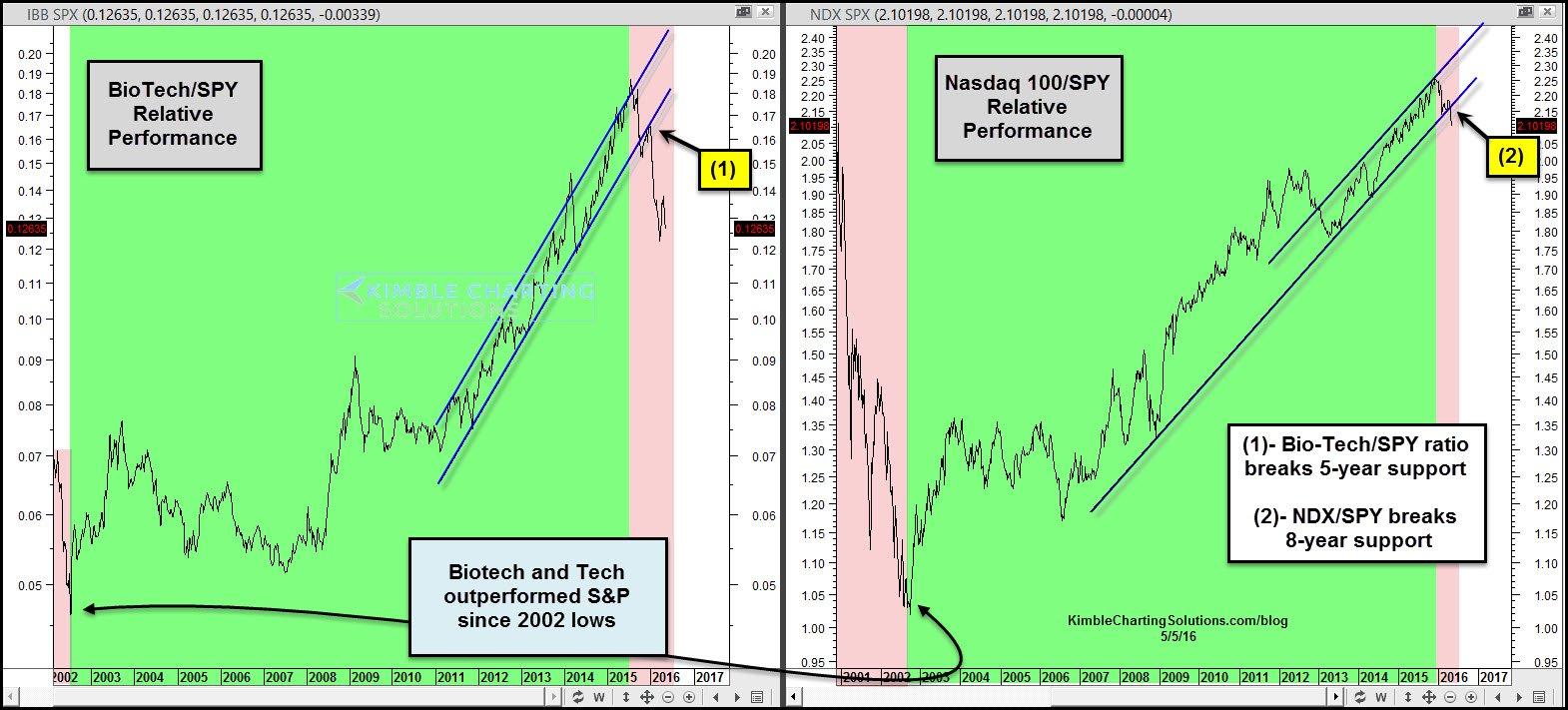

Biotech and Tech stocks have been upside leaders since the 2009 lows, outpacing the broad market by a large percentage. The above chart reflects that both have broken multi-year support lines, which suggests that these upside leaders could turn into downside leaders.

For the broad markets to push to all-time highs, bulls want/need Tech and Bio-Tech to act stronger.

Full Disclosure: Short the NDX with a tight stop.