Bonds are often the first choice for minimizing tail-risk in investment portfolios, and for good reason. But this is a partial solution at best, and one that dispenses a wide range of “effective” results through time.

Nonetheless, fixed-income allocations are prized for offering ballast to equities. Most of the time this works out fine. Return correlation between stocks and bonds tends to be low, or even negative, depending on the rolling window and choice of fixed-income securities. As a result, bonds tend to deliver timely diversification benefits at times of maximum stress for stocks. But nothing’s perfect on planet Earth and the limitation extends to bond allocations as a tool for managing equity risk.

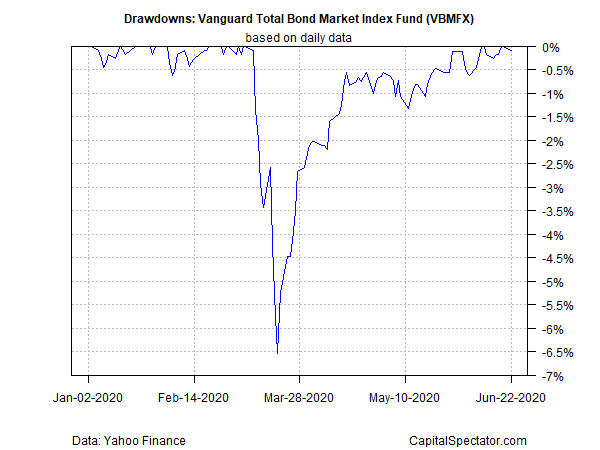

The recent coronavirus correction offers a telling real-world example. Consider how a core-bond investment fared during the selling wave in March. As a proxy, we’ll use Vanguard Total Bond Market Index Fund Investor Shares (VBMFX), which holds a mix of investment-grade securities – mostly Treasuries and high-grade corporate debt.

As a general rule, VBMFX has played a valuable diversification role relative to equities. But in the shockwave that struck markets in March, the normally defensive nature of VBMFX was subjective to severe pressure. The fund’s drawdown history this year tells the story.

In a matter of days, VBMFX went from a position of trading at a record high (March 6) to a steep drawdown of nearly 7% (March 19). For investors holding the fund and expecting a broadly diversified portfolio of “low-risk” bonds to provide a safe harbor during a financial and economic hurricane, results delivered a rude reality check.

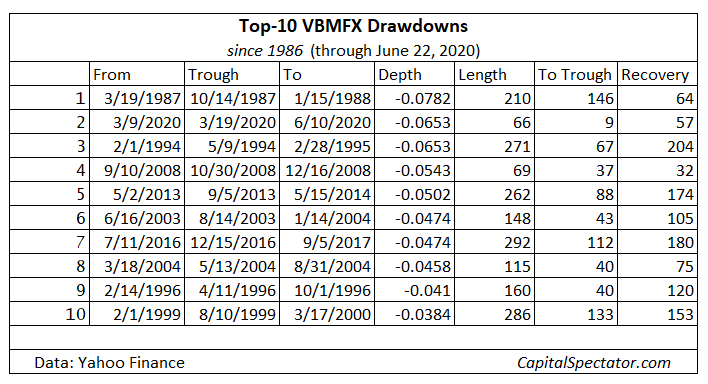

Surprising? Not if you knew of VBMFX’s history. The fund, which launched in 1986, is no stranger to sharp drawdowns. The only aspect of the fund’s recent slide that’s unusual is the speed of the decline. Otherwise, as the table below reminds, drawdowns of roughly 4% to 8% aren’t unprecedented, based on the top-10 peak-to-trough declines for VBMFX.

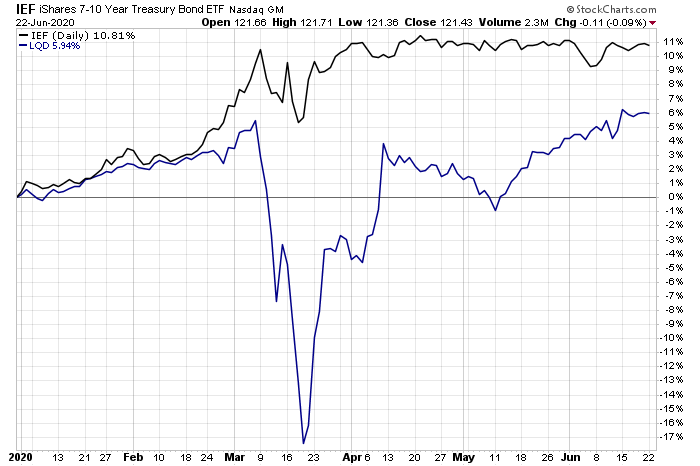

What accounts for VBMFX’s drawdowns? In this year’s swoon, much of the weakness was due to the tumble in corporate bonds. As the next chart shows, the performance difference between Treasuries (NASDAQ:IEF) and investment-grade corporates (NYSE:LQD) was dramatic in the extreme during the March correction, based on a pair of exchange-traded-fund proxies.

One lesson that investors learned this year is that so-called core bond strategies can suffer deep cuts. True, VBMFX’s drawdown was relatively mild compared with the roughly 34% haircut for US stocks (S&P 500 Index) in March.

As for bonds, taking recent history as a guide suggests that shifting to a Treasuries-only portfolio would go a long way in reducing tail-risk relative to a traditional core fixed-income strategy.

Maybe, although it’s worth pointing out that IEF (the Treasuries ETF) isn’t immune to sharp drawdowns, even if this year’s results suggest otherwise. In the 2008-2009 financial crisis, for instance, IEF suffered a 10% drawdown.

Shortening maturity can help, which is to say that nothing offers stability like cash and cash-equivalents.

The main takeaway is that bonds aren’t immune from tail risk. The incidence of fat tails (unusually extreme returns) is less intense compared with stocks, but it’s not zero either. Bond returns aren’t normally distributed and so severe results can be surprisingly frequent for “safe” bond strategies.

The good news is that an intelligently design stock-bond portfolio still offers a degree of valuable risk management that balances tail-risk reduction without cutting too deeply into expected return for a diversified strategy overall. Refining this foundation with additional asset classes and more granular slices of the financial markets can, in theory at least, further boost risk-adjusted results.

But there are limits to risk management capabilities from traditional asset classes in a passive or semi-passive long-only context. Bonds can help, but confusing the assets with a silver bullet is a recipe for disappointment.

Keep in mind, too, that for much of the past four decades inflation has been a non-issue for bonds, which has created an ideal environment for fixed-income strategies. If and when inflation ceases to be a low-risk factor, the limitation of bonds as a risk-management tool will likely suffer a further fall from grace, relative to naïve expectations.