- XOM has surged with inflation and Russia-Ukraine tensions

- Dividend yield is 4.4%, but its growth rate is low

- Wall Street consensus outlook is mixed

- The market-implied outlook (calculated from options prices) is predominantly neutral

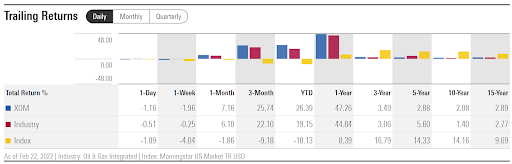

Energy supermajor, Exxon Mobil (NYSE:XOM) is one of the big winners from rising inflation and heightened geopolitical tensions. The shares in the oil and natural gas supplier have returned a total of 47% over the past 12 months and 25.7% in the past three months.

Somewhat surprisingly, given the recent invasion of Ukraine, the shares are 6% below the 52-week closing price high of $82.39, set on Feb. 7.

Source: Investing.com

Even with the recent price surge, XOM yields 4.4%. The dividend growth rate has slowed in recent years, however. The trailing 3-, 5- and 10-year dividend growth rates are 2.2%, 3.1%, and 6.4%, respectively. The current payout ratio is quite high, at 65%, albeit in line with Chevron (NYSE:CVX), which is also 65%.

Source: Morningstar

While the large gains in XOM and of other energy majors are impressive, the longer term total returns strike a note of caution. The trailing 3-, 5-, 10- and 15-year annualized total returns are below 3.5% per year. The meager returns from XOM over the past 15 years reflect the prevailing low inflation over this period, of course.

XOM’s earnings have followed an encouraging trajectory following the COVID-driven collapse and have beaten the consensus EPS in each of the past six quarters. However, the outlook suggests that growth will be somewhat temporary as the consensus outlook for EPS growth over the next 3-5 years is -1% per year.

Source: E-Trade

I assigned a bullish rating to XOM when I wrote about it on Sept. 1, 2021. The shares were trading at $55.55 at that time. The main factors driving the bullish view were:

- Expectations of rising interest rates and inflation

- Strongly bullish Wall Street consensus outlooks

- A neutral to slightly bullish outlook implied by options trading on XOM

While most readers are familiar with Wall Street analysts’ consensus outlook, many will not have encountered the idea that options prices can be used to calculate an outlook. A brief explanation will suffice, but more references are available here. For those with a strong quantitative bent, the CFA Institute has a great monograph on this topic.

Here are the basic ideas. The price of an option on a stock reflects the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate a probable price forecast that reconciles the options prices. This is called the market-implied outlook. It represents the consensus view among buyers and sellers of options.

In the almost six months since my Sept. 1 post, XOM has returned 47% (including dividends), as compared with -4.7% for the S&P 500.

It was clear in September, as it is today, that XOM’s performance is being driven largely by current events rather than long-term fundamentals and related considerations. With almost six months since my last analysis, I have updated the market-implied outlooks and compared these with the Wall Street consensus outlooks.

Wall Street Consensus Outlook For XOM

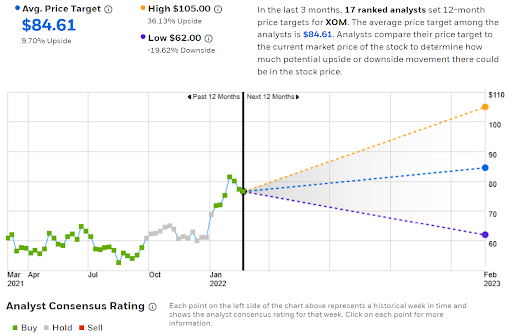

E-Trade calculates the Wall Street consensus outlook by combining the views of 17 ranked analysts who have published ratings and 12-month price targets over the past 90 days. The consensus rating is bullish and the consensus price target is $84.61, or 9.7% above the current share price. At the start of September, E-Trade’s consensus 12-month price target was $69.50, which was 25.2% above the share price at that time.

Source: E-Trade

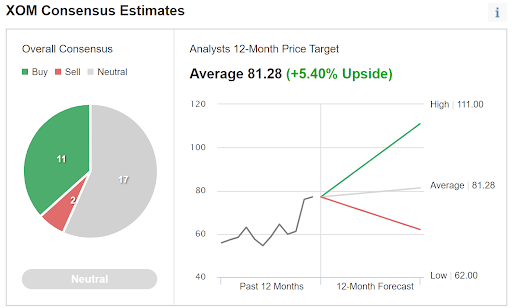

Investing.com builds the Wall Street consensus outlook using ratings and price targets from 30 analysts. The consensus rating for XOM is neutral/hold and the consensus 12-month price target is 5.4% above the current share price. These are materially different from E-Trade’s calculation of the consensus.

Source: Investing.com

A major reason why I look at more than one version of the Wall Street consensus is to identify cases in which the consensus results appear sensitive to the details of calculation. There is considerable dispersion between the individual analyst ratings and price targets, so it is not terribly surprising to see such different consensus results. The spreads between the highest and lowest individual price targets provide a measure of the disagreement between analysts. This spread is quite high for XOM. The high level of dispersion among individual analyst numbers, as well as the differences between these two calculations for the consensus, suggest some caution in putting too much weight on the consensus results.

With the two consensus 12-month price targets implying returns of +9.7% and +5.4%, the expected total returns (adding the dividend yield) are 14.1% and 9.8%.

Market-Implied Outlooks For XOM

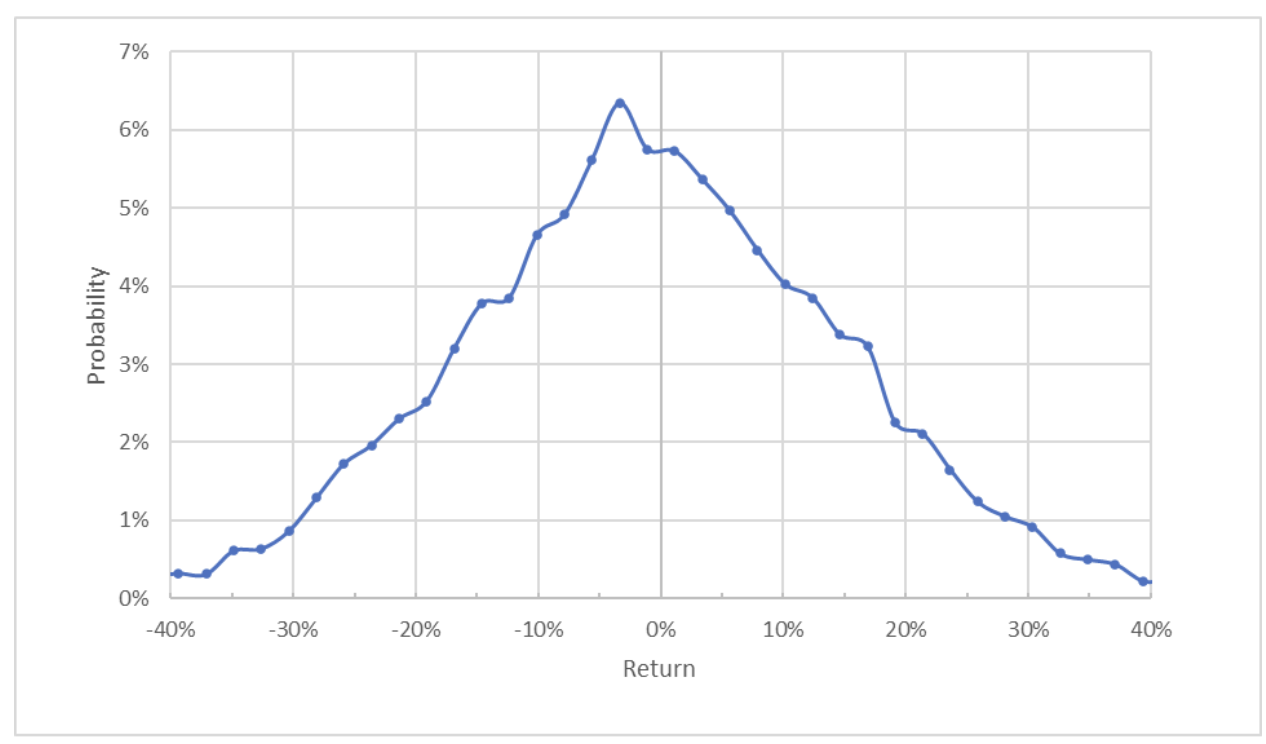

I have calculated the market-implied outlook for the 3.7-month period from now until June 17 and for the 10.8-month period from now until Jan. 20, 2023, using options that expire on these two dates. I selected these two option expiration dates to provide a view to roughly the middle of 2022 and through the full year. The options trading on XOM is heavy, adding confidence in the meaningfulness of the market-implied outlook.

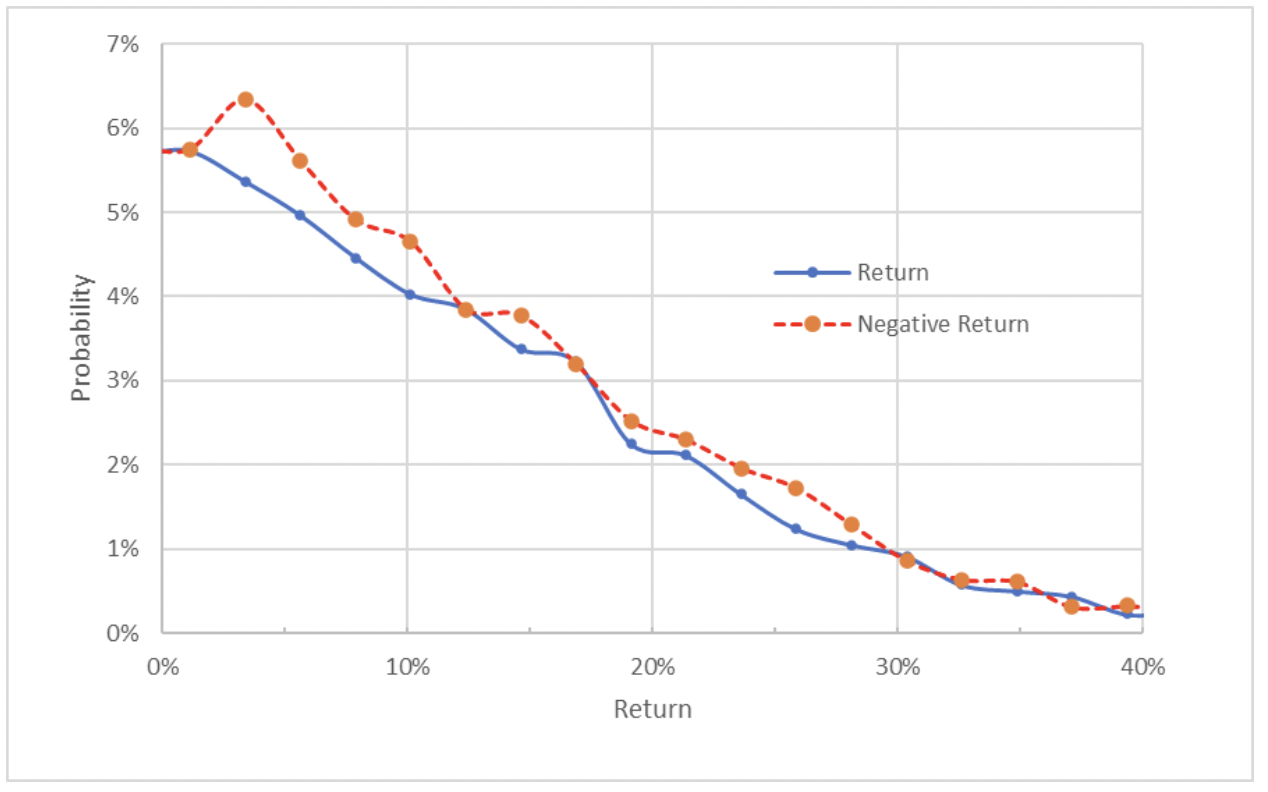

The standard presentation of the market-implied outlook is in the form of a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Source: Author’s calculations using options quotes from E-Trade

The market-implied outlook for XOM for the next 3.7 months is generally symmetric, with comparable probabilities of positive and negative returns of the same magnitude, but the maximum probabilities are slightly tilted to favor negative price returns over this period. The peak probability corresponds to a price return of -3.4%. The annualized volatility calculated from this distribution is 33%.

To make it easier to directly compare the probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Source: Author’s calculations using options quotes from E-Trade

The probabilities of negative returns are consistently higher than the probabilities of positive returns of the same magnitudes (the dashed red line is slightly above the solid blue line across almost the entire range of the chart above).

Theory suggests that the market-implied outlook is expected to be negatively biased because investors, in aggregate, tend to be risk-averse and, thus, will overpay for downside protection (put options). This, in turn, means that the market-implied outlook will tend to appear more bearish than investors’ actual beliefs. While there is no truly robust way to determine whether this bias is present, the potential for this bias suggests that this market-implied outlook is generally neutral and may even be slightly bullish. It is notable that the probabilities of large negative returns closely match those for positive returns of the same magnitude (the solid blue line and the dashed red line are very close on the right quarter of the chart above). This means that the market is not pricing in elevated odds of large declines.

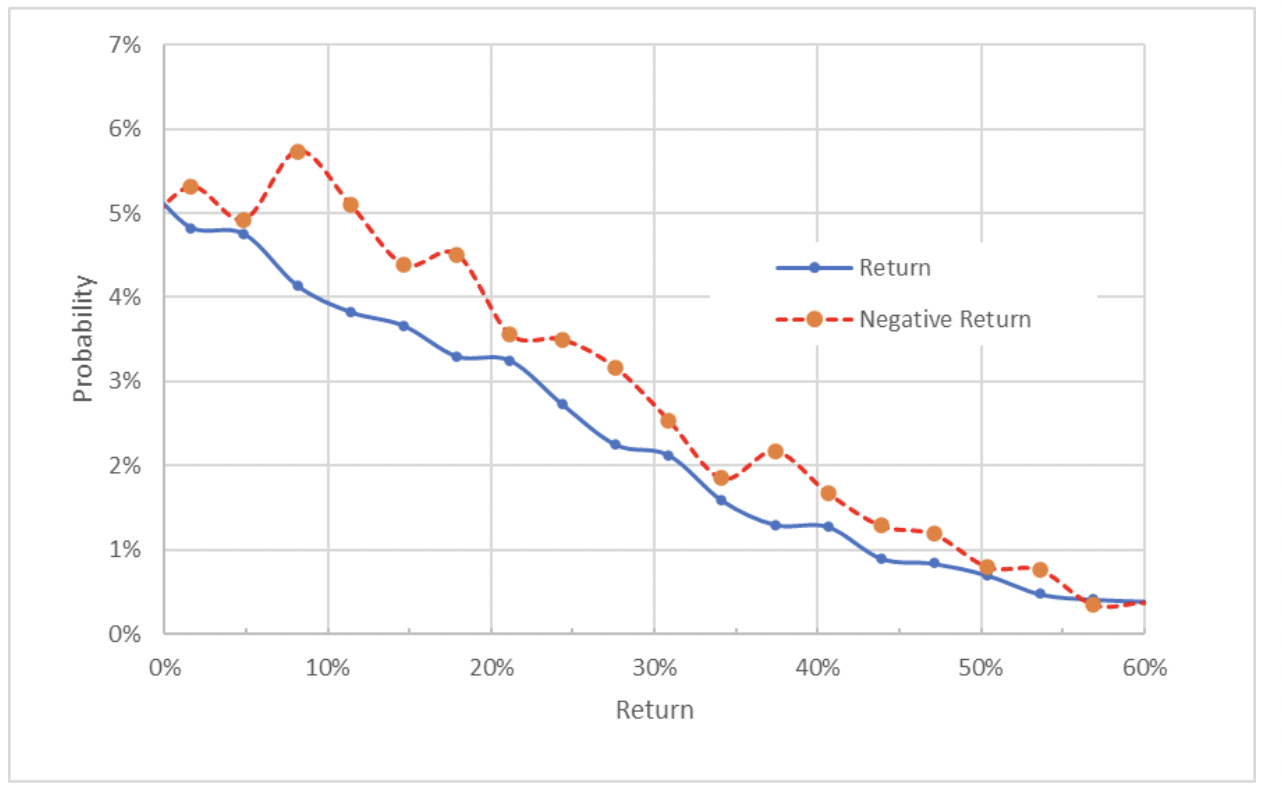

Looking out 10.8 months, to Jan. 20, 2023, the market-implied outlook is similar but it exhibits a more bearish tilt. The probabilities of negative returns are more elevated relative to those for positive returns (the dashed red line is further above the solid blue line). The peak probability corresponds to a price return of -8.1%. The annualized volatility calculated from this outlook is 31%. Acknowledging the subjectivity in the interpretation of the market-implied outlook, I view this as a neutral-to-slightly-bearish outlook.

Source: Author’s calculations using options quotes from E-Trade

The updated market-implied outlooks are somewhat similar to the results from the start of September. The shorter term outlook is predominantly neutral with a slight bullish tilt and the longer term outlook is neutral with a slight bearish tilt. The expected volatility, at around 30%, is right in line with the previously calculated value.

Summary

Exxon Mobil has rallied substantially in the past year, along with oil and gas prices, and the invasion of Ukraine by Russia has provided an additional tailwind.

However, the massive gains for XOM effectively price in future earnings growth, of course.

The Wall Street consensus outlook suggests substantially reduced upside potential over the next year, with expected total return in the range of 10% to 14%. As a rule of thumb for a buy rating, I want to see an expected total 12-month return that is at least half the expected volatility.

Using the Wall Street consensus outlook for the expected return and the market-implied outlook for the expected volatility (30%), XOM falls slightly short. The market-implied outlook to the middle of 2022 is predominantly neutral with a slightly bullish tilt and the view to early 2023 is neutral with a slight bearish tilt.

The enormous uncertainties around inflation, as well as the Ukraine conflict, are positive for XOM, but the strong performance of shares in the energy behemoth over the past year has reduced the potential for futures gains.

Considering the fundamentals, the Wall Street consensus outlook, and the market-implied outlooks, I am changing my rating on XOM to neutral/hold.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.