While this weekend’s headlines are dominated by who got exposed to and infected by coronavirus from the President on down I want to make sure other key news items are not lost in the shuffle, specifically those that expose a system that has self corrupted itself and is desperately trying to keep the balls in the air while causing ever more long lasting damage to our global economy.

Let’s face it: This week’s market action was dominated by dozens of stimulus headlines. Stimulus progress and markets rip higher, stimulus disagreements and markets dropped lower exposing markets again to be a toy thing of the liquidity game.

Will they or won’t they is the question on everyone’s mind and many bets are placed that they will, for likely they must as the jobs growth picture is slowing dramatically from the summer sugar recovery high and keeping markets and consumer confidence high into the election is a political imperative.

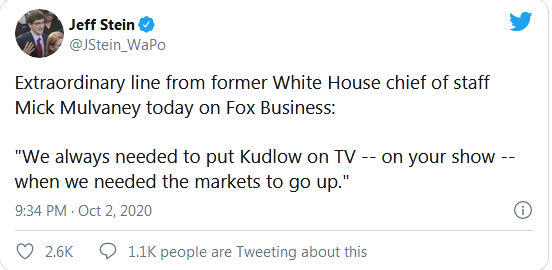

And don’t think for a second that they are not political imperatives. Market levels are as much a national security imperative as is having a strong military. For the last few years Larry Kudlow’s curiously timed TV appearances have become a fodder of Twitter jokes and yours truly has been at the forefront on Twitter of mocking the ever so obvious attempts to manipulate markets higher at every corner and opportunity.

Oh you’re just a conspiracist. No, I just try to cut to the truth and reality of markets.

And sometimes that truth slips out:

“When we needed markets to go up”.

And there it is. Markets going up exposed as a necessity for political purposes.

And cue the drum roll:

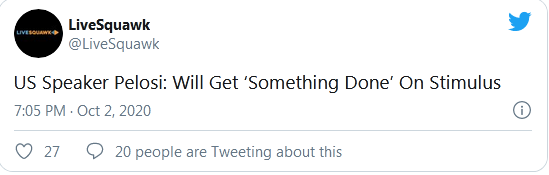

And don’t think it’s just the current administration that is playing these games.

What? You think it’s an accident that on Friday when futures were down hard that Nancy Pelosi came out with this headline 5 minutes after market open immediately putting a floor under the market:

Sometimes it’s hard to avoid getting the impression that the 2 parties are not in fact one in the same putting on a show of choice. They both are living off a market structure they can’t ill afford to lose in trajectory. As George Carlin once opined: “You don’t have a choice. You have owners. It’s a big club”.

Do you really think it’s an accident that the only people placed in charge of the country’s monetary policies are doves? People of the perma intervention kind. It is after all the same Congress comprised of these very two parties that approves all the nominations. Bernanke was a dove, Yellen was a dove, Powell now the perma-dove with interest rates at zero forever and ever amen.

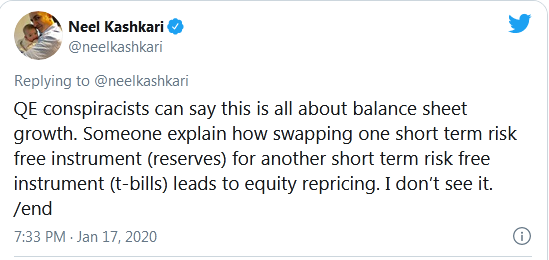

There is no diversity of opinion, there’s no diversity of thinking, and critical viewpoints are either not considered or outright dismissed and mocked.

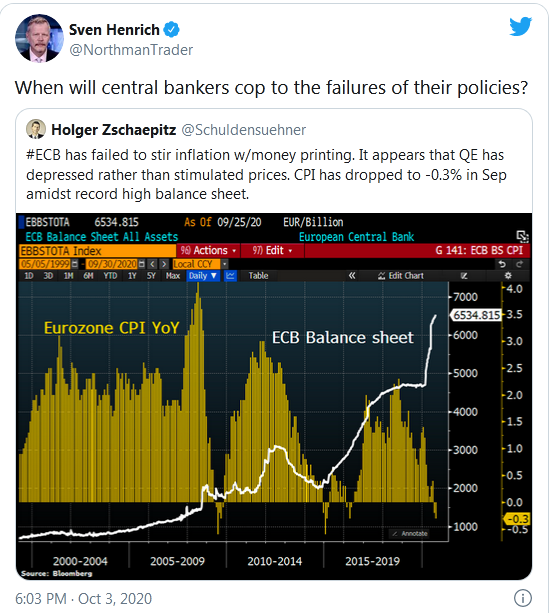

Indeed central bank career path day appears structured on the notion one must show positive effects of QE on growth whether it’s true or not. Critics don’t get considered for promotion in the ranks apparently:

“A new academic paper casts fresh doubt over the case for QE. Lubos Pastor, an economist at the University of Chicago, and three colleagues have parsed about 50 studies looking at the effect of asset purchases on growth and inflation. They found that researchers working in central banks tend to find a larger impact than academics and conclude that central bankers have incentives (such as possible promotions) to be too kind toward QE. Papers written entirely by central bankers found an impact on growth at the peak of QE that was more than 0.7 percentage points higher than the effect estimated in papers written entirely by academics. The authors then investigate the reason for these discrepancies. They suggest that career concerns may have played a role and provide some evidence that central bank researchers who found the largest impact of QE had a better chance of receiving a promotion.”

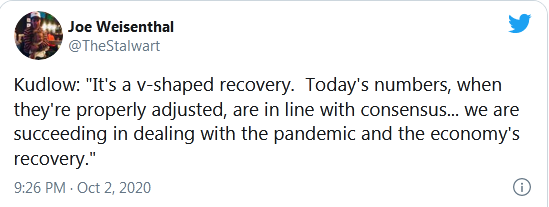

You can’t make this stuff up. And it is this very institutional group stink that leads to statements of self delusion such as this:

This from the President of the Minneapolis Fed who, while denying QE’s impact on asset prices, proceeded to dismiss yours truly as a QE conspiracist and “swashbuckling pirate”:

It’s all fun and giggles while markets go up but the dismissive conspiracist voices fell notably silent during the 35% market crash in Q1 2020. Since then we again see the original criticism confirmed as markets rallied to new all time highs despite the largest economic crisis in our lifetimes. Amazing things can happen when you expand your balance sheet by $3 trillion in just 4 months. It’s called market distortion.

And no, that’s not my opinion, it’s a fact confirmed by another nugget of truth that crossed the headlines this week courtesy Dallas Fed president Kaplan:

“My concern about asset purchases is they can distort markets,” Kaplan told the Wall Street Interview in a webcast interview. “It’s a tool that I’d want to be careful with.”

I guess now that we ballooned the balance sheet to a historic $7 trillion and continuing to buy assets at a clip of $120B per month ($1.44 trillion annualized) NOW we want to be careful as it might distort markets.

Give me a break. Markets are already grossly distorted. After all:

There’s little doubt a renewed stimulus package would be beneficial to asset prices again in the short term, no matter the valuations.

The question for all of us is how long the valuation disconnect jig so constantly danced by monetary and government authorities can be maintained in the face of its ever more self evident failure:

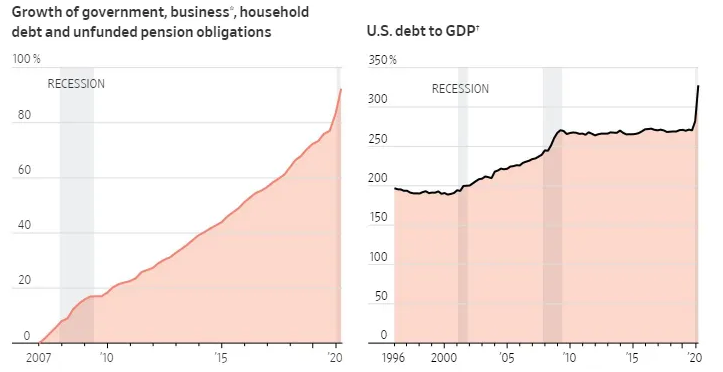

While career focused central bankers are keen on promoting the fantasy that QE promotes growth the ever more frantic interventions from cycle to cycle amid ever slowing growth cycles ever more dependent on expanding debt strongly suggest otherwise.

Indeed this week’s frantic market action chasing every single stimulus headline not only again highlights how utterly dependent markets are on artificial stimulus to maintain lofty valuations, but how fragile the underlying economic construct really is.

For after 11 years of nonstop interventions, the building of a $7 trillion Fed balance sheet (and ever growing larger), zero rates, a US debt now exceeding $27 trillion (a $17 trillion increase since just 2007) and heading toward $30 trillion, it takes ever more to support this market valuation construct:

And still, with all this, over half of Americans may retire poor.

I suggest this is not a record of success but of systemic failure that has left the country poorer, and long term growth prospects weaker as the forces of deflation and demographics will be with us for years to come. Indeed the monetary and government cheerleaders of ever higher asset prices find their narratives confronted with a brutal long term reality:

“If you’re worried about the short-term economic outlook, I have bad news: the long-term outlook is worse. That’s what emerges from the latest long-term budget outlook released by the Congressional Budget Office last week. It contained this sobering number: the agency expects annual economic growth to average just 1.6% over the next three decades—down by about a quarter of a point from its forecast a year ago—and just 1.5% by the 2040s. The U.S. hasn’t had trend growth that low since the 1930s.”

I submit that to approach this structural reality with record indebtedness and the highest market valuations in history is a math equation that does not solve itself with a positive outcome.

But for now the rallying cry is for more stimulus again:

Where is the rallying cry for structural solutions? It doesn’t exist. Instead the rallying cry is to cheerlead markets higher at every opportunity, to convince of policy success when there isn’t any, to maintain confidence at all cost. Wall Street wants more Fed stimulus. The Fed wants more fiscal stimulus. Everybody wants more and more so not to risk the great unwind that is staring us all in the face.

We can’t know when and how the unwind will present itself, but at least we know when Larry Kudlow will go on TV. “When we need markets to go up”.

Looks like we will see Larry on TV a lot more, especially if there’s no stimulus deal. But hey, maybe they’ll get one done after all for without there is nothing but hope for another Fed bailout following the December Fed meeting:

Stimulus. Fed injections. No solutions.