Thomson Reuters provided some useful earnings data on the S&P 500’s Technology sector, and this is an update to my post of two days ago.

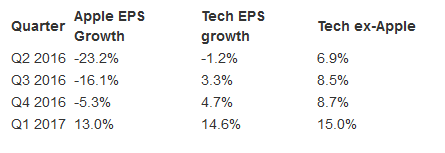

Here is an updated table showing Technology sector’s expected EPS growth, with and without Apple (NASDAQ:AAPL).

Source: ThomsonReuters data dated 8/16/16

From an investment or portfolio manager standpoint, the Technology sectors earnings growth should outperform the SP 500’s expected earnings growth, and Tech, Ex-Apple, should outperform both the S&P 500 and Apple as an individual company.

In addition, Apple’s fiscal ’17 and ’18 EPS and revenue revisions have turned positive – an important sign for relative strength.

For new readers, scan www.fundamentalis.com for Tech and Apple related posts the last 4 weeks.

The end-game for those bearish and expecting a correction in the next 4 – 6 weeks, Technology should offer some relative strength and a sector to hide.

For those with a longer-time horizon, as I have for clients, looking through year-end and into the Q1 ’17, which will then lap the very weak Q1 ’16, Technology should offer the potential for out-performance.

These are just opinions, so invest based on your own comfort level and estimates do change daily.

(Long Apple, and overweight Technology as a sector)