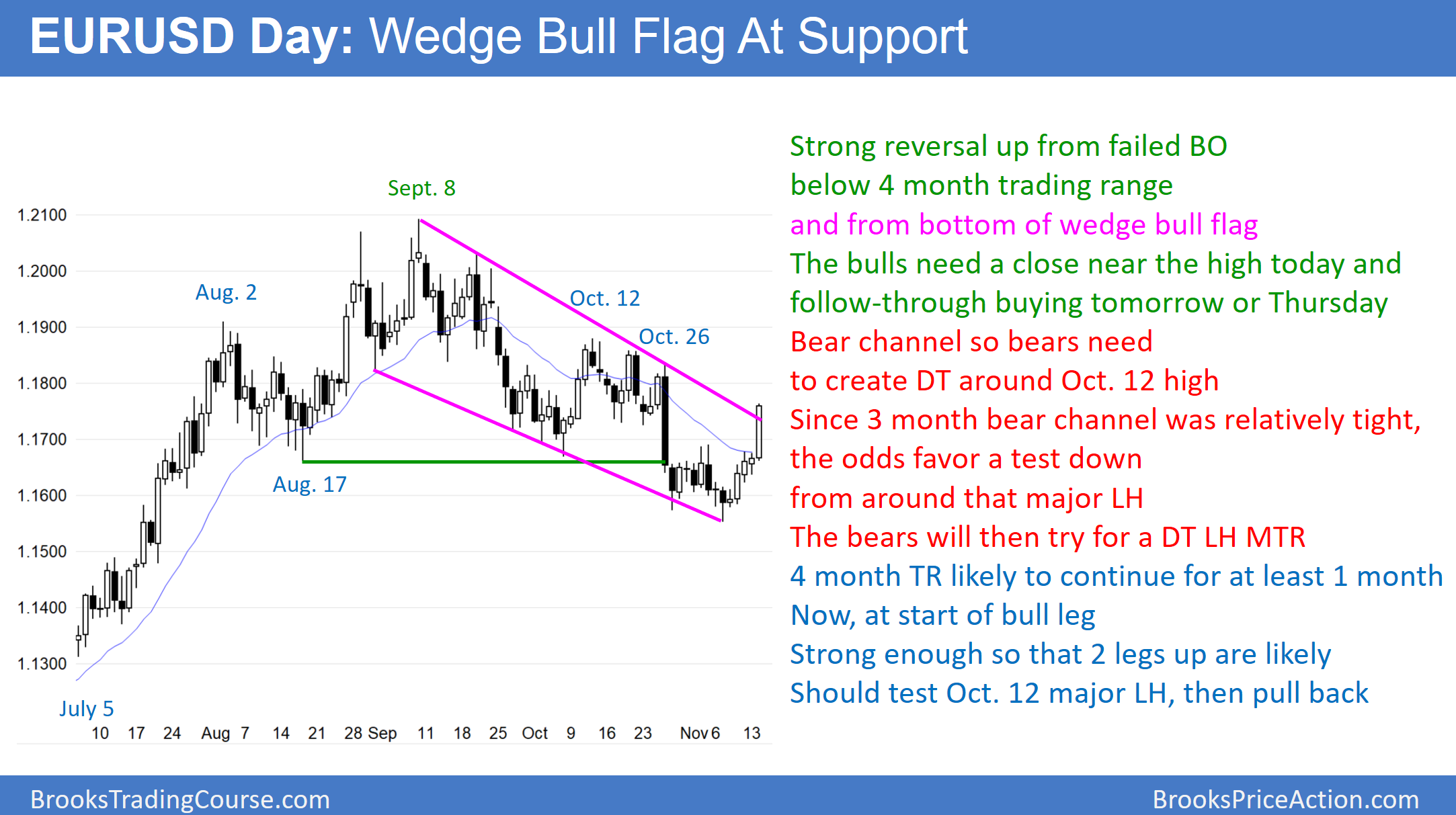

The EUR/USD daily chart reversed back up strongly overnight from a failed breakout below a 4-month trading range. The 3-month selloff was a wedge bull flag.

The EUR/USD weekly chart (see yesterday) is reversing up from a wedge bull flag at the 20-week exponential moving average. Since the 3-month selloff was in a tight bear channel, the odds are that the rally will form a lower high. The bulls will probably need a test back down 5 – 10 bars (weeks) from now. Consequently, this rally will probably be a minor reversal in a 4-month trading range rather than a resumption of the bull trend.

Yet, the bull trend on the weekly chart was very strong. The reversal comes at the support of the 20-week EMA and a test of the breakout above a year trading range. Therefore, the bull trend remained in effect during the 3 month pullback. Hence, if today closes near its high and tomorrow has a bull body on the daily chart, then there will be a 50% chance that the rally will go above the September high before there is a selloff to below last week’s low.

Overnight EUR/USD Forex Trading

The EUR/USD 5-minute Forex chart rallied 80 pips in a tight bull channel. By going above last week’s high, it triggered a buy signal on the weekly chart. The overnight bull channel was tight. Therefore, the odds are against a bear trend today.

However, there was a big bull bar that broke above the tight bull channel at 4:35 a.m. PST today. That is a buy climax. Hence, the rally might convert into a trading range for a few hours. Yet, the rally is strong enough so that the odds are that the 1st reversal down will be minor. That means that a bull flag or a trading range today is more likely than a reversal into a bear trend. Consequently, traders will look to buy pullbacks for swing trades and scalps.

Most bears will wait to short until there is a clear trading range or a series of 3 or more strong bear bars. Even then, without at least an hour of sideways trading, it will be difficult for the bears to make more than a small scalp.