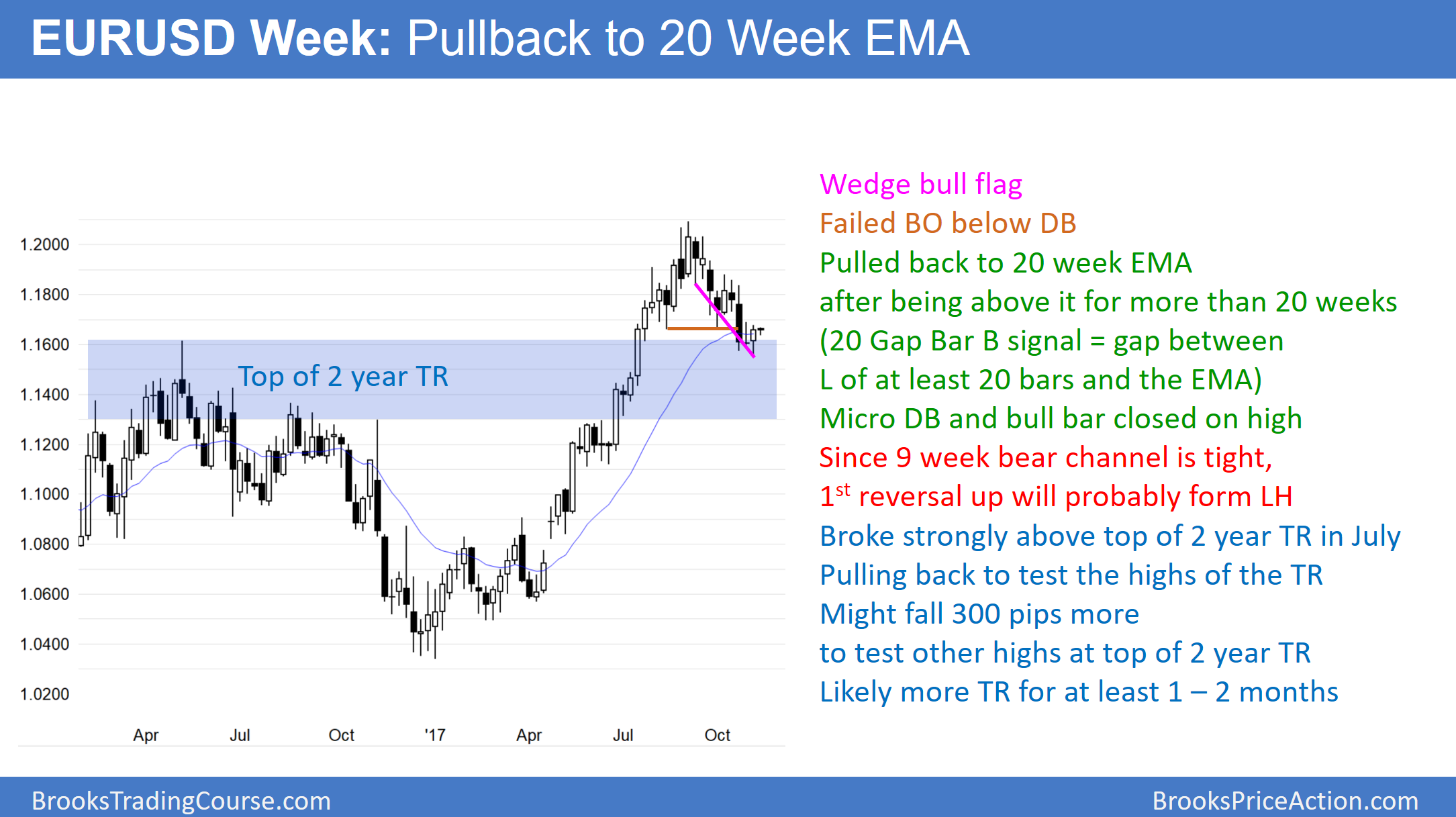

The weekly EUR/USD chart had a bull reversal bar last week at the 20-week exponential moving average (EMA) and the top of the 2-year trading range. The 9-week pullback is a wedge bull flag. Furthermore, the 3-week micro double bottom and bull trend bar make it likely that the bear break below the double bottom will fail.

The selloff from the September high was likely to be minor because the 6-month rally was in a tight bull channel. Similarly, the current attempt to reverse up will likely be minor because the 9 week bear channel has been tight. As a result, the odds favor a trading range that will last at least another 1 – 2 months.

The daily chart (not shown) of the EUR/USD Forex market has a head and shoulders top. But, most tops fail. The weekly chart has a buy signal at the 20-week EMA and the top of a 2-year trading range. Yet, the 9-week selloff has been in a tight bear channel.

Is This The 1st Of 2 Legs Sideways To Down?

Since the 6-month rally was climactic, the odds favor a pullback that has a couple of legs down. The current 9-week selloff has 3 legs. However, it is in a tight bear channel, and 9 weeks is probably not enough of a correction after a rally that has lasted about 11 months. Consequently, the 9-week selloff will probably be the 1st of a larger 2 legged correction.

Hence, a rally over the next few weeks will probably form a lower high. Then, the EUR/USD chart will likely have a 2nd leg sideways to down. If that leg is down, it will probably not fall much below the 1.1300 support zone (blue box in the chart) at the top of the 2-year trading range.

Overnight EUR/USD Trading

Last week was a buy signal bar at support on the weekly chart. Therefore, this week will probably trade above last week’s high. The market needs to find out if there are more buyers or sellers there. Will the 9-week selloff begin to reverse up or continue down? Since the EUR/USD market has been sideways for 4 months, the odds are that it will continue sideways. Since trading ranges disappoint bulls and bears, the bulls should trigger the buy this week, but be disappointed by a lack of a strong reversal up. The bears have been disappointed by the lack of follow-through selling after the breakout below the 4-month head-and-shoulders top.

A rally above last week’s high triggers a weekly buy signal. That high is only 3 pips above today’s high. Today or sometime this week, the bulls should trigger the buy. There is therefore a 30% chance of a very strong rally this week. More likely, there will not be a strong breakout and the 3-week trading range will continue.