Stocks

Key stock indices maintain a positive bias, although the growth momentum has dried up without new impulses after the China A50 index has updated annual highs, and the S&P 500 raised to 2870 – the highest level since October 2018. The growth impulse after strong Chinese data was supported by statistics from the United States in the areas of production activity and construction costs, which surpassed expectations. Today on the agenda in the US publication of data on orders for durable goods and car sales. Cars and high-priced products are a reliable indicator of prospects.

Bonds

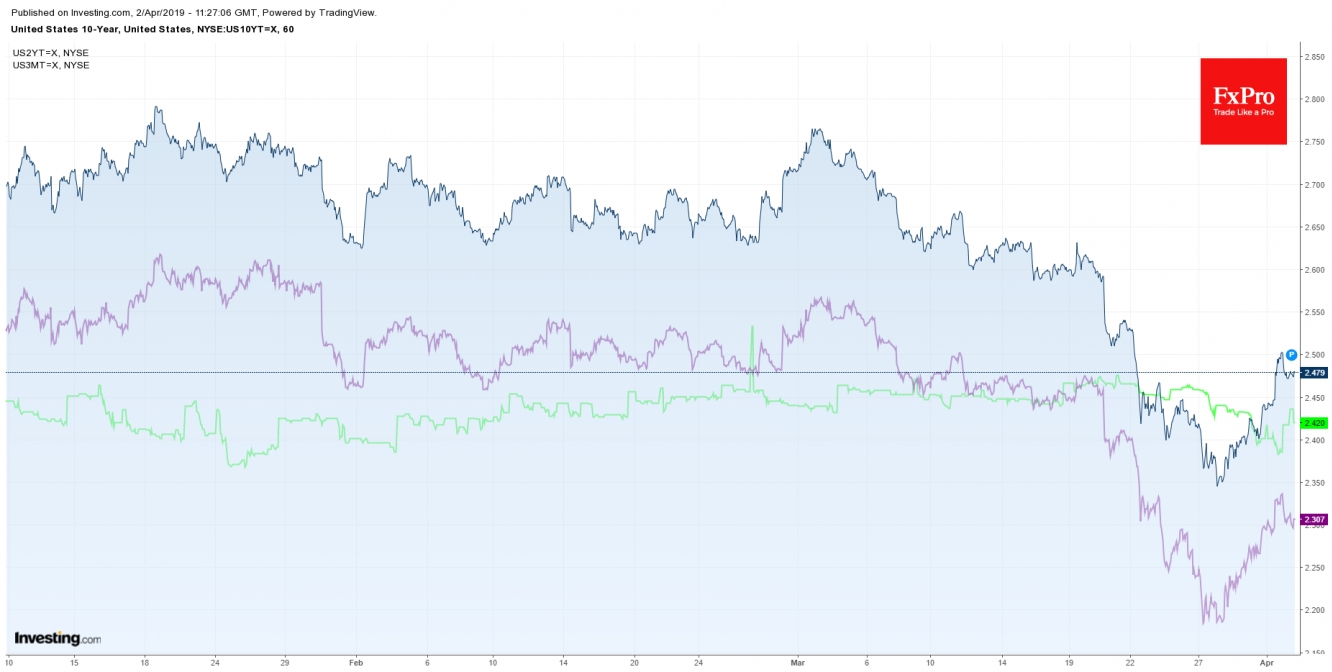

The yield on 10-year US government bond remains higher than the yield on 3-month securities, but there is a slight decrease from the level of 2.5%. A further slide below 2.4% (the current yield of 3-month securities) can return a sense of fear of the impending recession to the markets.

EUR/USD, a key pair of the currency market, as expected, came under pressure in the evening, touching on the 1.1200. On Tuesday morning, the pair to a greater extent, by inertia, dropped to 1.1190. Eurozone inflation once again disappointed. PPI in the region was worse than expected, although year by year the index accelerated to 3.0%. In early March, EUR/USD received support near 1.1200, so market participants are in no hurry to pass these levels without significant drivers. At best, data from the United States can be a similar driver. But, most likely, to determine the medium-term trend based on the data, you will have to wait for tomorrow’s PMI or Employment Change.

The British pound is trading near 1.3050, dropping from 1.3120 at the very beginning of the day in response to British lawmakers reject of all alternative ways to exit from the EU. This outcome increases Brexit’s odds without a deal on April 12. Officials from Germany and France warn that now the only way out is exit without a deal, although the British government is now choosing between this option, as well as a new referendum and new elections, to break the legislative deadlock.

For the first time since November, without any particular reason, the Bitcoin price spiked by almost 20% in a matter of hours to $ 5,000, and even crossed this mark, according to data from some exchanges. It is worth paying attention to further subsequent levels. MA (200) exceedance, now passing through $5200, can be an important indicator that the market is ready for further cryptocurrency purchases.

The Brent crude surged more than 2.5% since the beginning of the week, trading above $69 a barrel on the news of possible new US sanctions against Iran and Venezuela. Further growth is attracting attention, as black gold prices are within reach of an important level of the 200-day moving average. Growth above this level can inspire further purchases of oil.

Alexander Kuptsikevich, the FxPro analyst