- EUR/USD continues to move in the opposite direction to US interest rates

- Economic sentiment towards the US and Europe is diverging quickly, which in an early contrarian warning signal

- Flash PMI reports the highlight of the data calendar on Thursday

- EUR/USD remains a sell-on-rallies play, but watch for near-term squeeze risk

Overview

EUR/USD remains inversely tied to US interest rates, with rising US bond yields pushing the pair lower. Strong US data and weak European performance have widened yield spreads, further pressuring EUR/USD. Despite being oversold, that doesn’t mean the trend may continue. Key support is at 1.0760, and traders should wait for clear setups before acting.

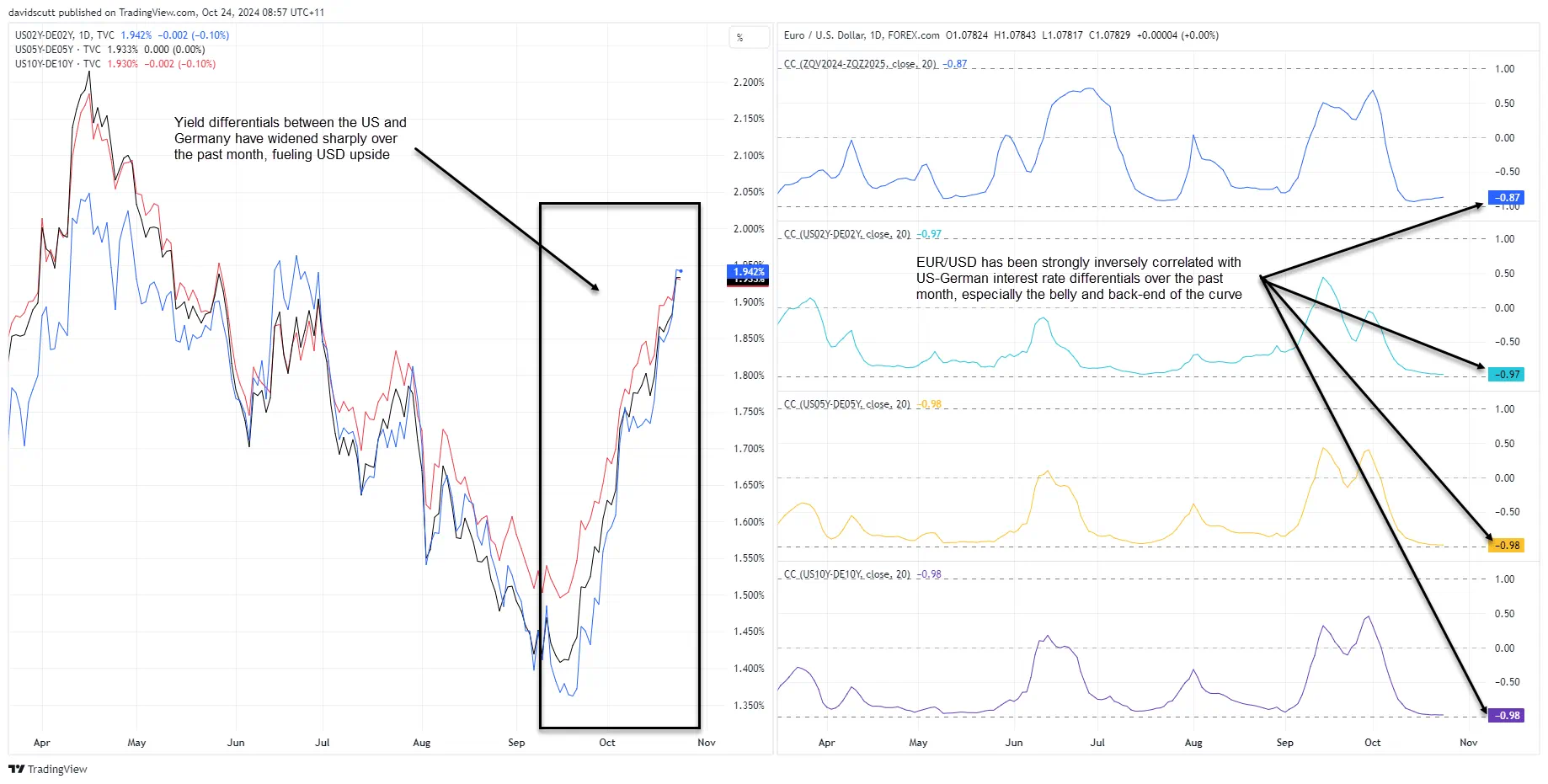

Where USD Yields Move, EUR/USD Does the Opposite

EUR/USD remains an inverse play on the direction of US interest rates, especially the belly and back-end of the US Treasury curve.

The chart on the left-hand side below looks at the change in US-German yield spreads for 2-year, 5-year and 10-year bonds over the past six months. When we say yields spreads, it refers to the differential between what US Treasuries offer relative to German bunds for similar maturity dates.

Source: TradingView

We’ve seen the US yield advantage over German bonds increase rapidly over the past month, encouraging capital to flow towards the higher-yielding US dollar. As shown in the right-hand chart, that’s been incredibly influential on movements in EUR/USD with the rolling 20-day correlation with US -German yield spreads sitting at incredibly strong levels.

As a reminder, correlation coefficients measure the strength and direction of the relationship between two variables, ranging from -1 to 1. A score of 1 means they move perfectly together, -1 means they move in opposite directions, and 0 means no relationship. The closer the score is to 1 or -1, the stronger the relationship.

Based on the scores, the strength of the relationship suggests that where US-German yield spreads have moved, EUR/USD has almost always done the opposite. As yield spreads have soared in favour of the United States, EUR/USD has sunk.

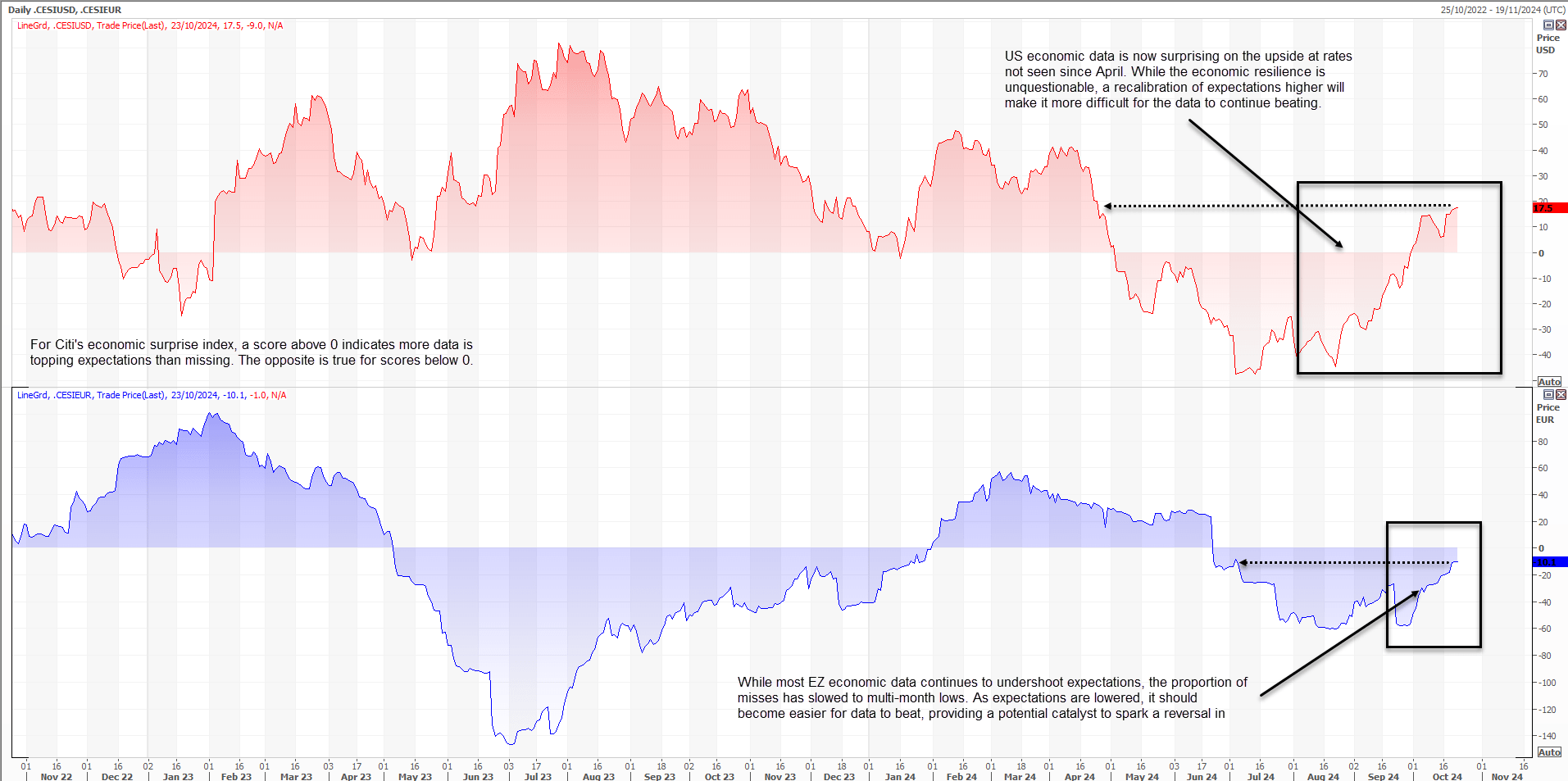

Economic Sentiment Diverges Rapidly

Explaining why US bond yields have increased so dramatically relative to those in Europe, US economic data continues to impress as seen in Citi’s economic surprise indices for the US and euro area.

The proportion of US data beating forecasts has risen to the highest level since April, contributing to a reduction in the amount of rate cuts the Fed is expected to deliver over the current easing cycle.

At the same time, most data in the euro area continues to undershoot, although the proportion has fallen to the lowest level in several months. That’s seen expectations for rate cuts from the ECB ramp up, helping to widen interest rate differentials with shorter-dated US Treasuries.

Source: Refinitiv

Beyond the short-end of the curve, the upcoming US Presidential election is clearly impacting longer-dated US Treasury yields, especially speculation about what a red wave through Congress with Donald Trump as President could mean for the size of US Federal deficits, along with the inflation and growth outlook.

Longer-dated US Treasury yields have risen faster than shorter-dated US yields recently. This “bear steepening” of the US Treasury curve is indicative of an environment where growth, inflation and potentially risks are anticipated to be greater in the future.

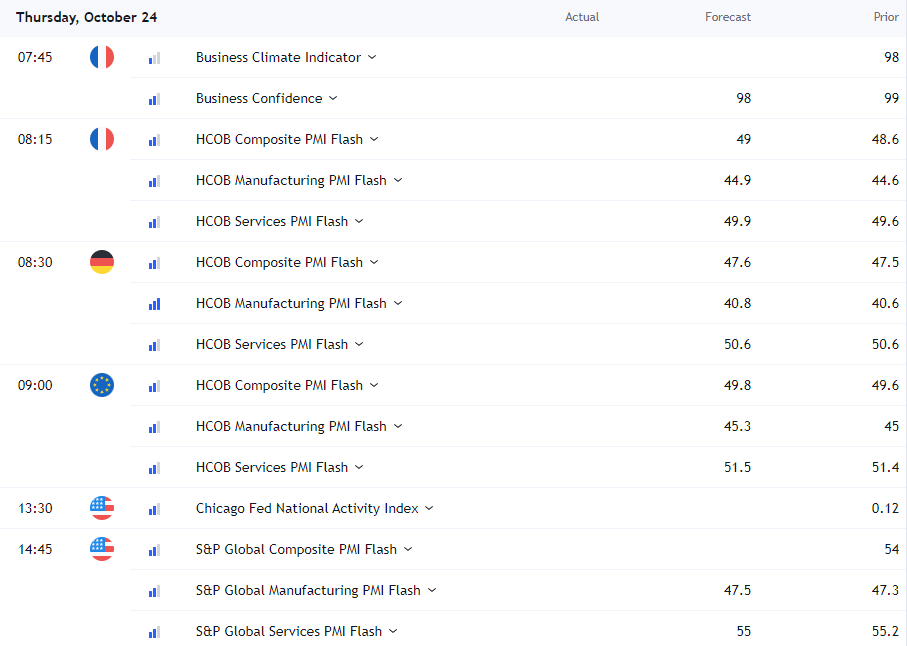

PMIs Provide Limited Event Risk

In what’s been an incredibly quiet economic data week across the developed world, the upcoming session provide some events that could potentially generate movement in EUR/USD for traders.

Source: TradingView

Expectations for the latest batch of manufacturing and services purchasing managers’ indices (PMIs) provide an excellent example of how sentiment towards the US and European economies has diverged recently, especially for the key services sectors

Views towards Europe are incredibly low, making it easier for the data to impress, especially as PMIs measure change from one month to the next. The opposite is true for the US series given expectations are so elevated.

Markets rarely react to the US series as they tend to favor the ISM PMIs released at the start of each month, but they do for the European numbers. That means the focal point for EUR/USD traders on Thursday should be around the European open.

There may also be some interest in the weekly US jobless claims data released later in the session, although it may be overlooked on this occasion due to several one-off factors.

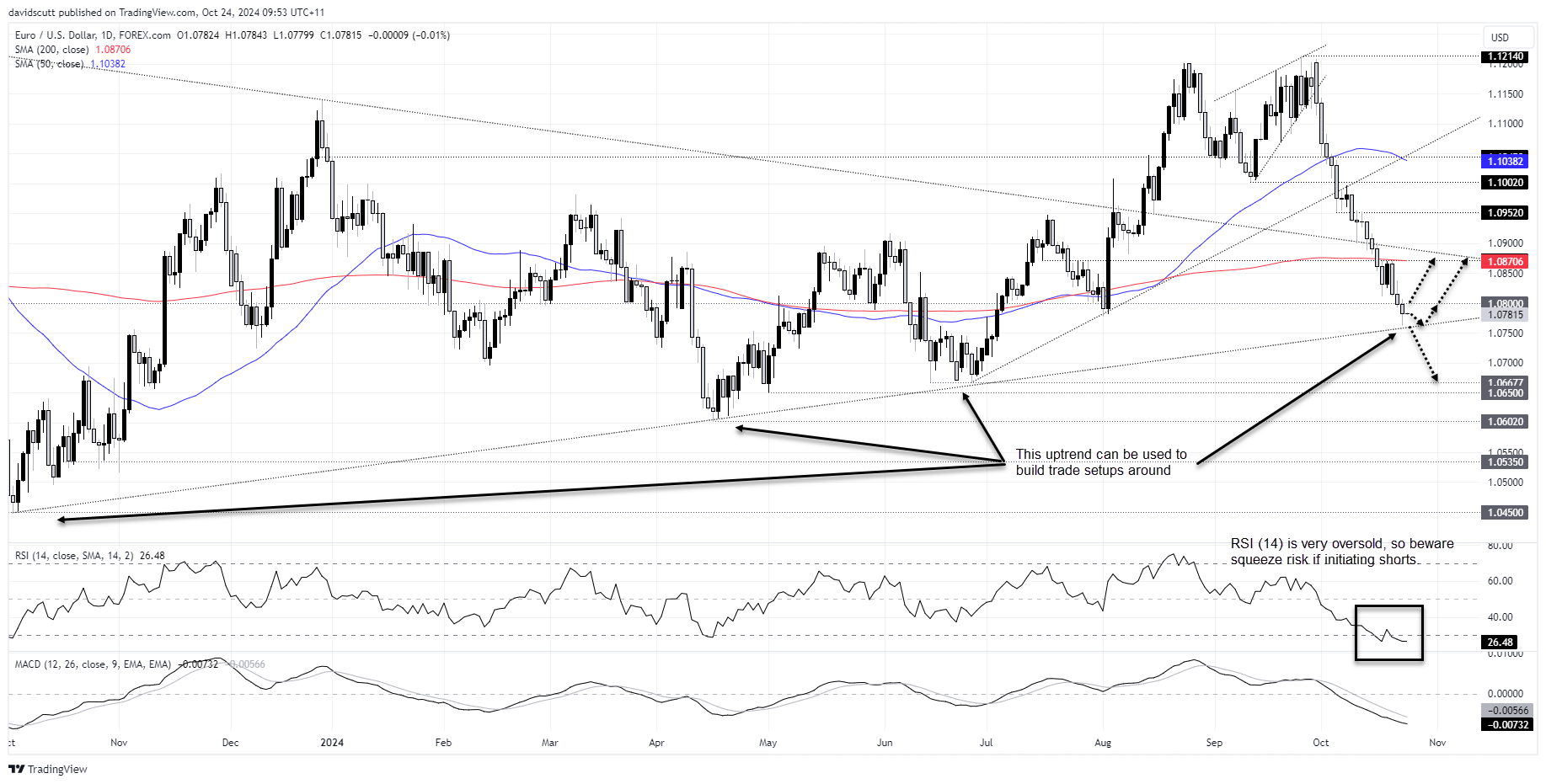

EUR/USD: Two-way Directional Risks After Chunky Move

I caught the EUR/USD move early but have been too impatient ever since, looking for potential turning points rather than simply concentrating on letting the trade run. Yes, it’s oversold on RSI (14). Yes, it’s been nothing but one-way traffic since the start of the month, but neither mean the trend can’t continue.

As discussed earlier, EUR/USD remains an inverse play on US interest rate expectations and the technical picture for short and longer-dated Treasury futures looks just as ugly as EUR/USD.

Let the price action and setups come to you.

Source: TradingView

The price came within a whisker on Wednesday of testing long-running uptrend support dating back to this period a year ago. It comes across as an important technical level, so that’s the first downside level of note. It’s located today around 1.0760.

If the price were to break below and hold there, you could sell with a tight stop above for protection. There’s not a lot of visible support below until 1.06677, where it attracted buying earlier in the year. That's a potential target.

Even though selling rallies and breaks remains the preferred strategy, given how oversold EUR/USD is on RSI (14), there’s no need to pre-empt the downside break. If it happens, act. If not, look for another setup.

Speaking of which, if the price were to test the uptrend and hold there, you could initiate longs with a stop beneath for protection.

The price has done a lot of work either side of 1.0800 this year, making that an initial target. If the price were able to break above 1.0800, you could buy with a stop below looking for a push towards the 200-day moving average located at 1.0870.