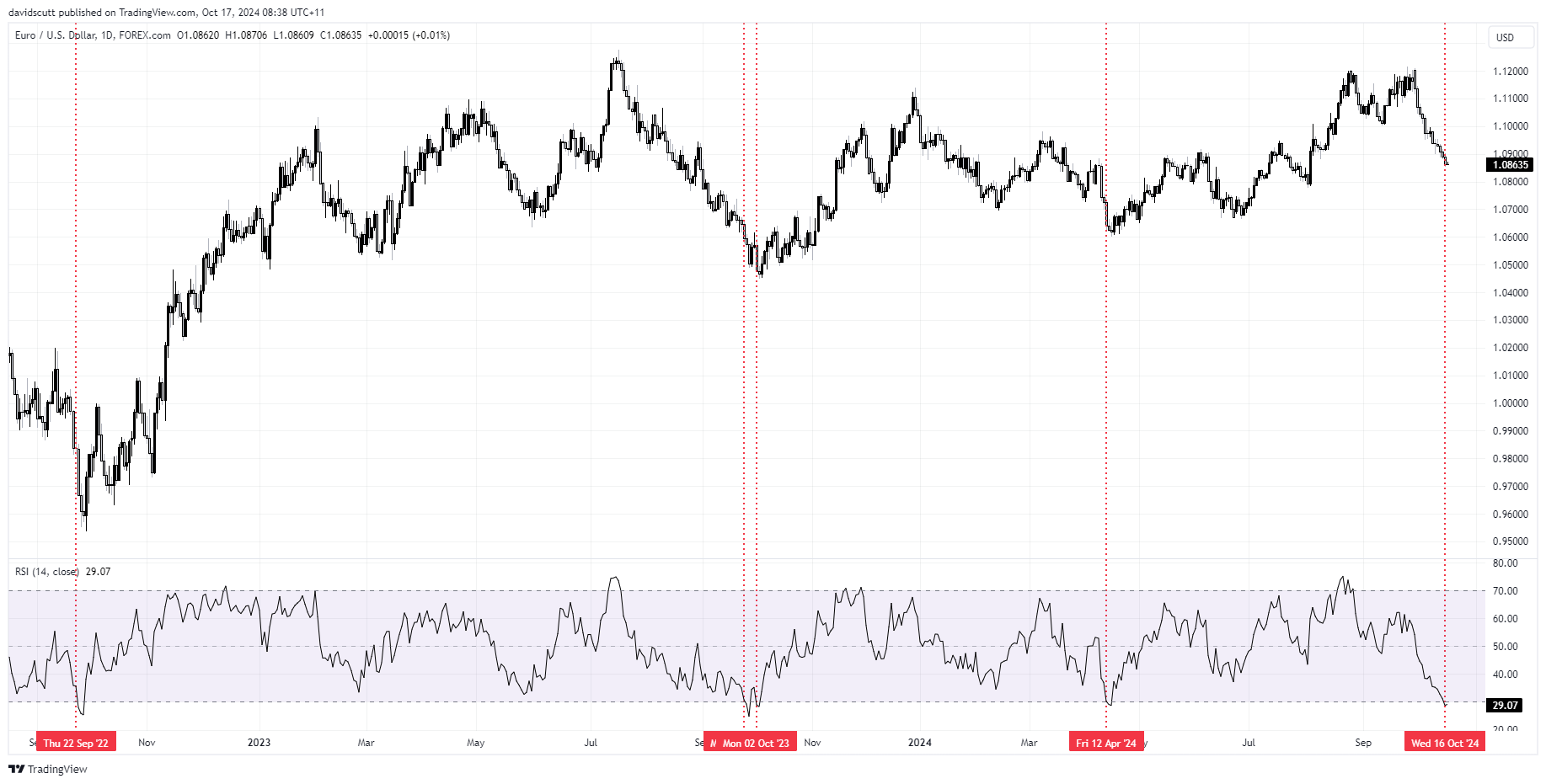

- EUR/USD is oversold for only the fifth time in the past two years

- Prior oversold episodes often occurred before bullish reversals

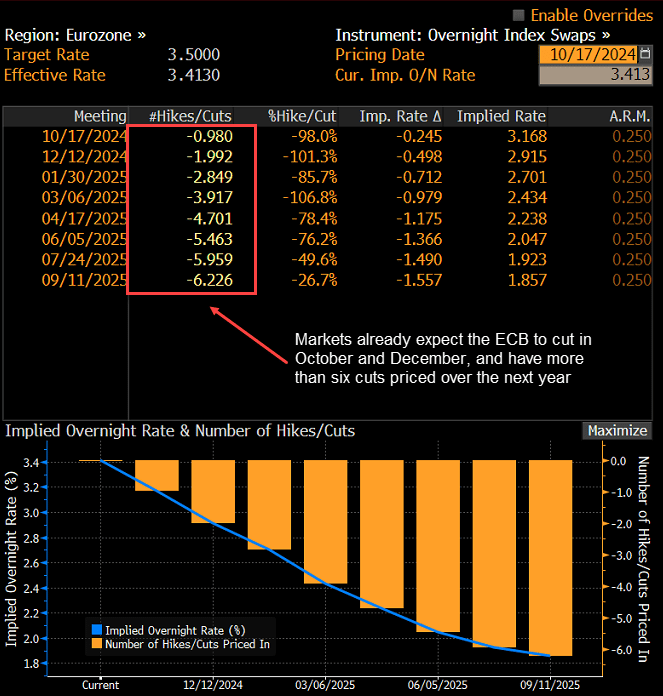

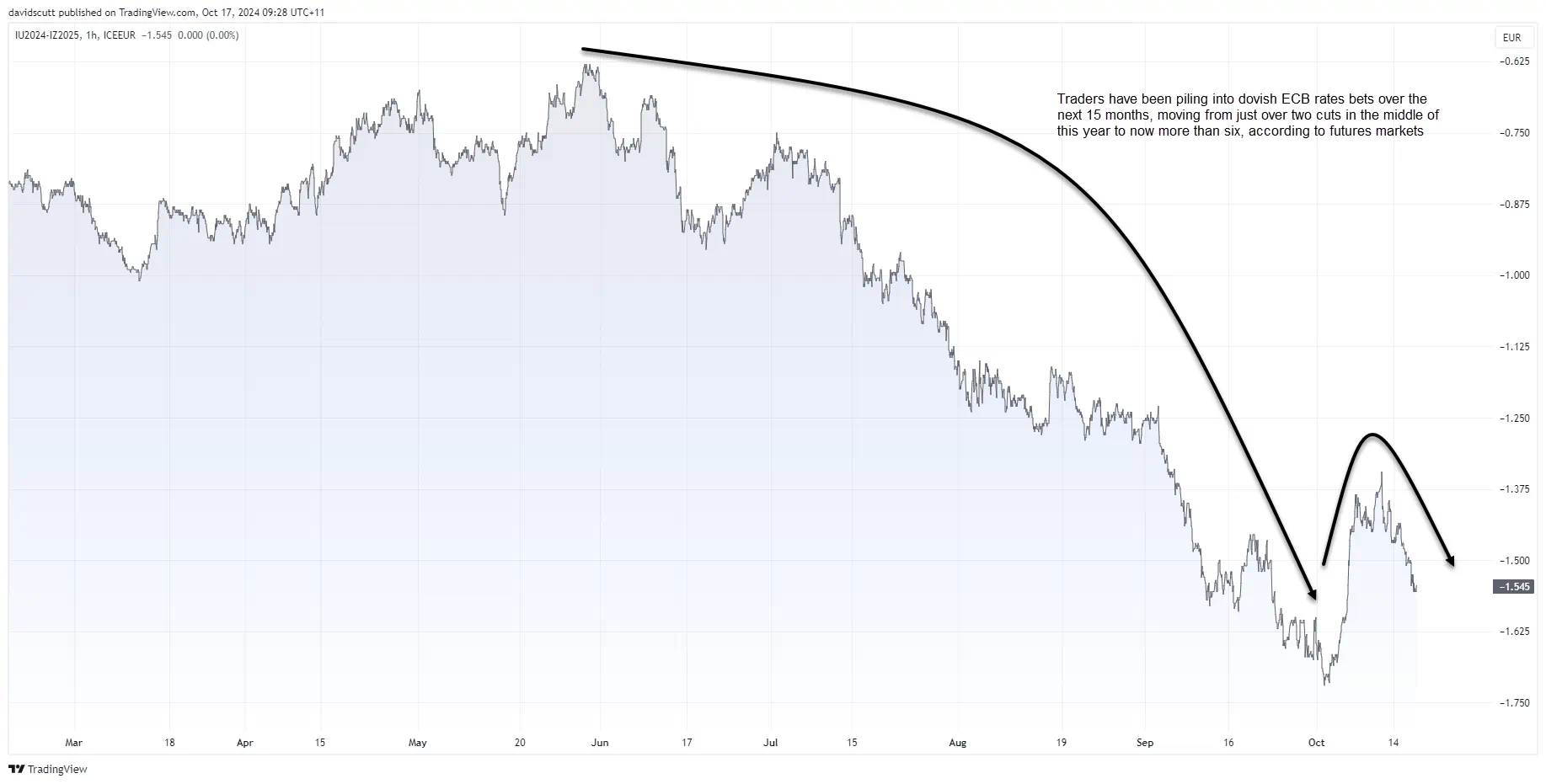

- Markets fully priced for back-to-back ECB rate cuts to close out 2024

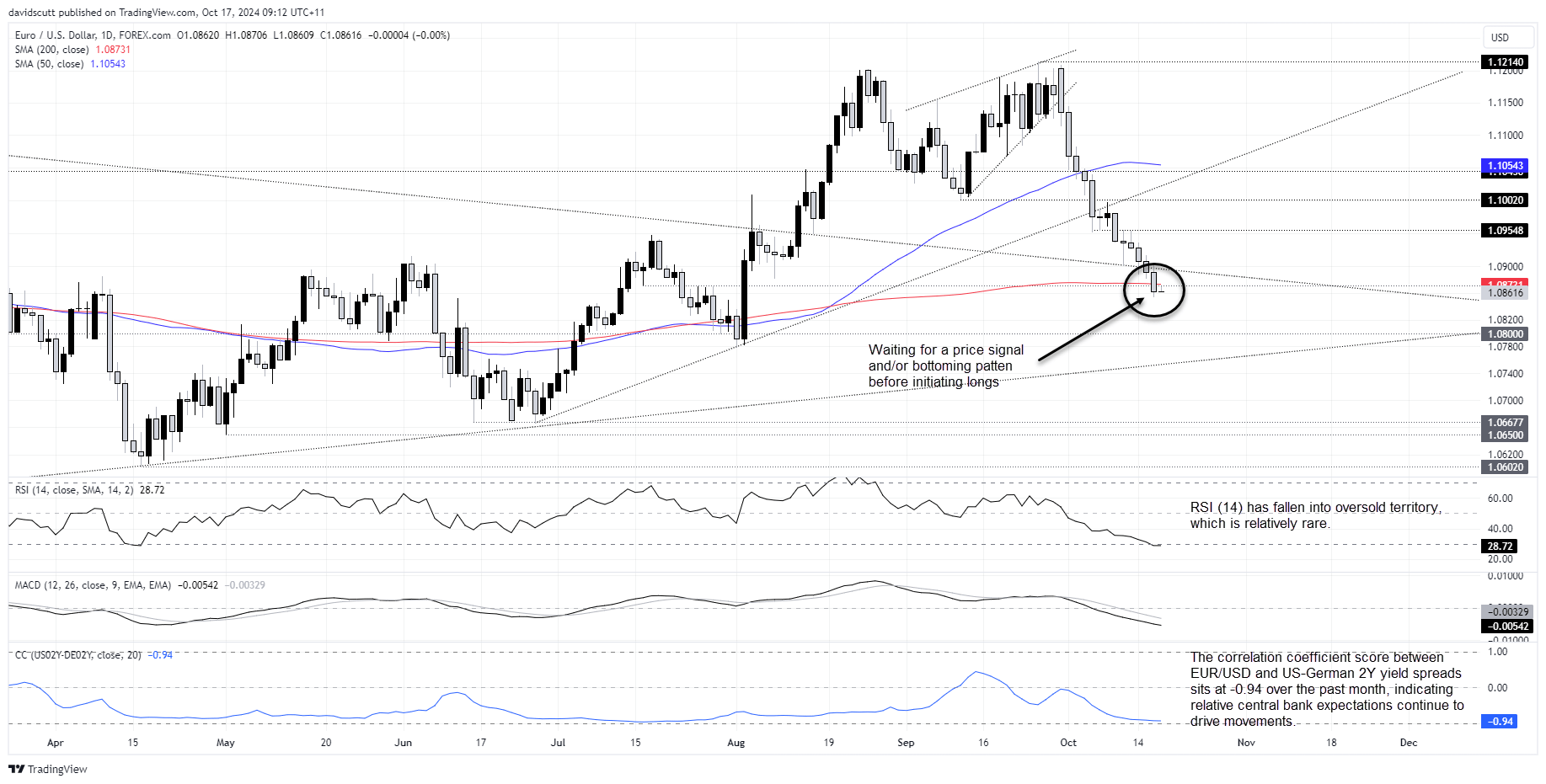

- EUR/USD breaks below 200DMA, but beware squeeze risks

Overview

EUR/USD has rarely found itself in oversold territory on RSI (14) over the past two years, yet that’s where it finds itself heading into the ECB October monetary policy decision later Thursday. A quick look at historic trends suggests some form or bullish reversal is on the cards near-term, and with two full rate cuts priced into the EUR overnight index swap (OIS) curve by the end of the year, traders should be alert to the risk of a ‘sell the rumor, buy the fact’ outcome.

Timing Off But Thinking Remains the Same

I put out a research note earlier this week warning about potential squeeze risk after what was already a sizeable decline, pointing to the risk of disappointing US economic data sending US yields and US dollar lower.

Unfortunately, my timing was off on the setup, but I still believe reversal risk is elevated. I just need to be more patient and wait for the price signal.

RSI (14) is one indicator that’s pointing to the possibility for a countertrend rally, falling into oversold territory only the fifth time in the past two years. I’ve annotated past episodes of oversold conditions to demonstrate that it often occurs around market bottoms, even if not immediately on some occasions.

Another contrarian signal is the rapid increase in dovish rates pricing heading into the ECB interest rate decision later today with markets fully priced for a 25-point cut and another in December, with more than six expected over the next year.

When the US Federal Reserve cut rates last month, many thought it was the start of a broad dollar weakening episode. Clearly, that view's been flipped on its head. Sure, it may be a very different outcome for the Euro, but it’s now up to European data to continue disappointing even after expectations have been lowered dramatically.

Everyone seems to want to dunk on the euro and gobble up the dollar, mimicking the exact opposite behavior seen before the Fed’s September meeting.

EUR/USD Oversold Beneath 200DMA

Accompanying RSI (14) sliding into oversold territory, EUR/USD sliced through and closed below the 200-day moving average and horizontal support around 1.0873 on Wednesday, providing a decent short setup for those who want to focus on price signals solely.

It may well continue to sink, but given how far it’s already fallen and how dire sentiment already is, anything that questions that outlook could spark a potent squeeze.

I’m waiting for a bottoming signal or price pattern before positioning for such an outcome, allowing for a stop to be placed beneath the cycle low for protection. A close above the 200-day moving average would also provide a suitable setup.

Above, the downtrend that has acted as both support and resistance previously is located around 1.0895, making that an initial level to watch. For the long trades to stack up from a risk-reversal perspective, you’d need to see a pushback to 1.0955 or even 1.1000.

The ECB decision arrives at 1:15 PM CET, followed by the press conference at 2:45 PM CET.