- The euro is declining against the US dollar as the ECB and Fed's policies diverge

- ECB President Lagarde's recent comments on falling inflation hint at potential rate cuts, echoed by other ECB officials.

- Focus now turns to key US data releases before the Fed meeting, which could fuel EUR/USD's downtrend.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

- ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a lot of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services, not to mention those we plan to add in the near future.

The euro has continued its downward spiral against the US dollar as the rhetoric between the European Central Bank (ECB) and the Federal Reserve (Fed) continues to diverge.

This growing disparity is fueling a significant shift in market expectations for interest rate adjustments. While the recent ECB meeting left interest rates unchanged, a clear dovish shift emerged in the officials' comments.

ECB President Lagarde's statement, indicating inflation is falling and disinflation is underway, signaled a potential openness to future rate cuts. Adding fuel to the fire, other ECB officials echoed dovish sentiments early in the week.

Francois Villeroy de Galhau suggested potential rate cuts as early as June, while Mario Centeno hinted at the possibility of more aggressive cuts, potentially totaling 100 basis points (four moves), surpassing prior expectations of 75 basis points (three moves).

Shifting Rate Cut Expectations Fuel Euro Decline

The market now anticipates the Fed's initial rate cut to arrive in September, a significant delay from earlier June projections, as seen in our Fed Rate Monitor Tool below.  Source: Investing.com

Source: Investing.com

Meanwhile, the ECB is surprisingly dovish, with some officials suggesting rate cuts could begin as early as June. This divergence in central bank policy expectations has fueled the euro's decline.

Key US Data Ahead of Fed Meeting Could Impact EUR/USD

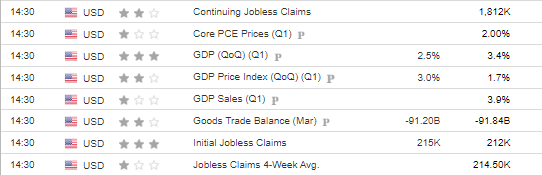

This week's economic calendar features several key releases from the US that could influence the EUR/USD pair before the crucial Fed meeting on May 1st.

The most anticipated data point is the GDP report, which, if forecasts hold, will show a slight decline compared to the previous quarter, but not necessarily signal an impending recession.

Friday will bring crucial data on the Fed's preferred measure of PCE inflation. Barring any major surprises, this data isn't expected to show slowing disinflation.

If these readings indeed confirm the trend of disinflation slowing down, it will provide EUR/USD with yet another compelling reason for further declines.

Focus on Fed Meeting: Will EURUSD Breach $1.05 Support?

Despite this week's data releases, the primary focus remains on the upcoming Fed meeting.

The decisions made by the Fed will significantly impact the trajectory of the EUR/USD pair. With the euro already testing the critical support level of $1.05, a hawkish stance from the Fed could push the pair even lower.

The EUR/USD pair is currently showing signs of a downtrend slowdown, with a distinct local correction taking shape, resembling a flag formation.

This scenario tilts the favor towards the bears. Confirmation of this trend would come with a dynamic breakout below the lower boundary of the said formation.

Such a move would pave the way for an assault on the robust support zone hovering around 1.05.

***

Want to try the tools that maximize your portfolio? Take advantage HERE AND NOW of the opportunity to get the InvestingPro annual plan for less than $10 per month.

For readers of this article, now with the code: INWESTUJPRO1 as much as a 10% discount on annual and two-year InvestingPro subscriptions.

Act fast and join the investment revolution - get your OFFER HERE!

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.