- Markets have pared Fed rate cut pricing overt the past month

- Higher US interest rates has fuelled USD strength, including against EUR

- EUR/USD finds buying at key technical level

Overview

Everyone has been dunking on the euro and buying US dollars recently, explaining why EUR/USD has continued to sink. But with sentiment towards the common currency so dire, it won’t take much to spark a short squeeze. With major risk events approaching, the temptation to square up short trades may prove too appealing for some.

US Economic Exceptionalism Returns?

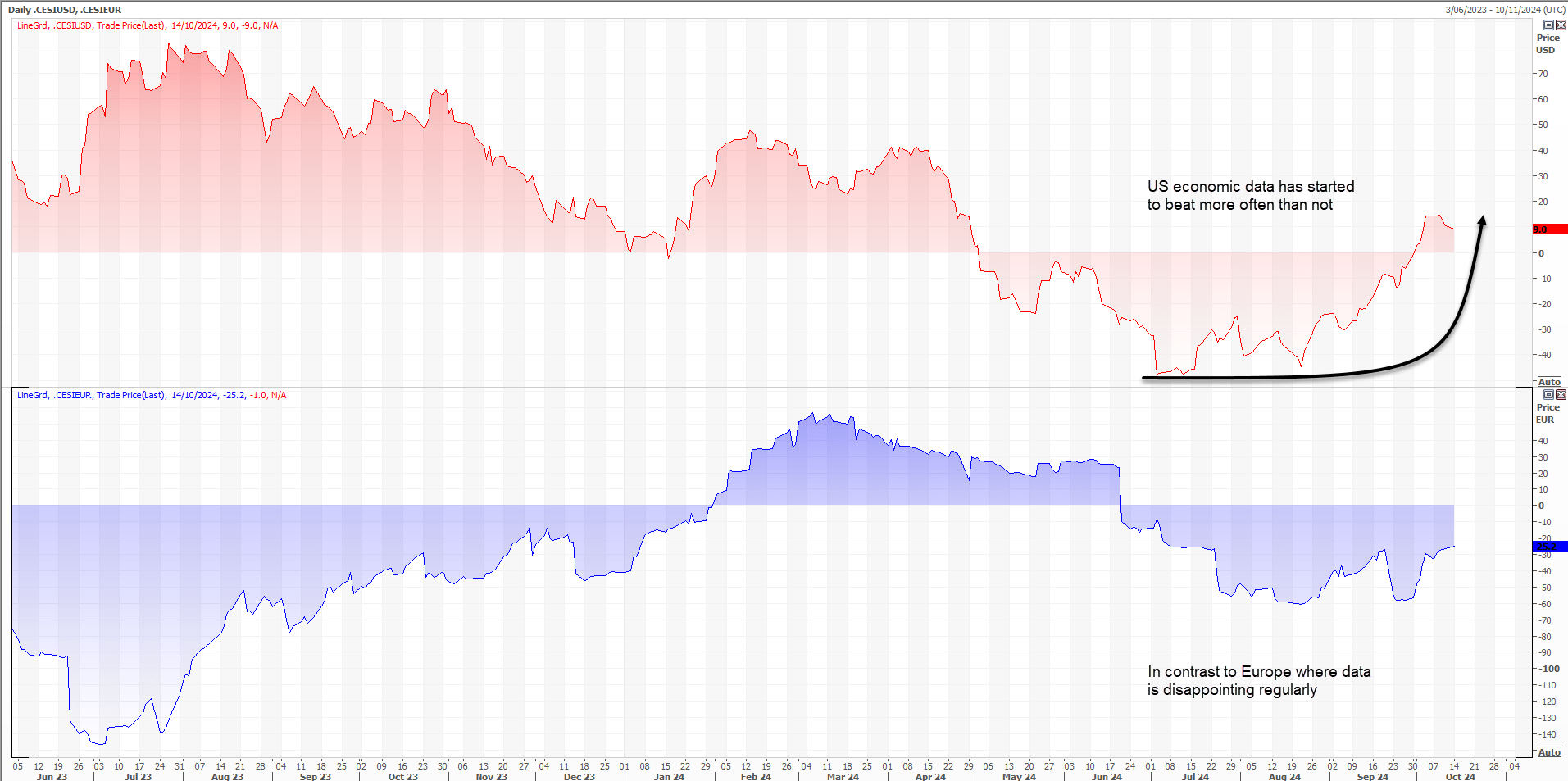

US economic exceptionalism may be reasserting itself, as evidenced by the trends in Citi’s economic surprise index shown below. The top pane is the United States, the bottom the Eurozone. The index tracks aggregate economic data relative to forecasts, with a score above 0 indicating that more data is beating expectations than not. When below 0, the opposite is true.

Source: Refinitiv

You can see that after delivering downside surprises regularly in the middle of the year, the US data has started to deliver far more upside surprises recently. In contrast, euro area data continues to dish up disappointment.

Higher Rates Fuelling USD Strength

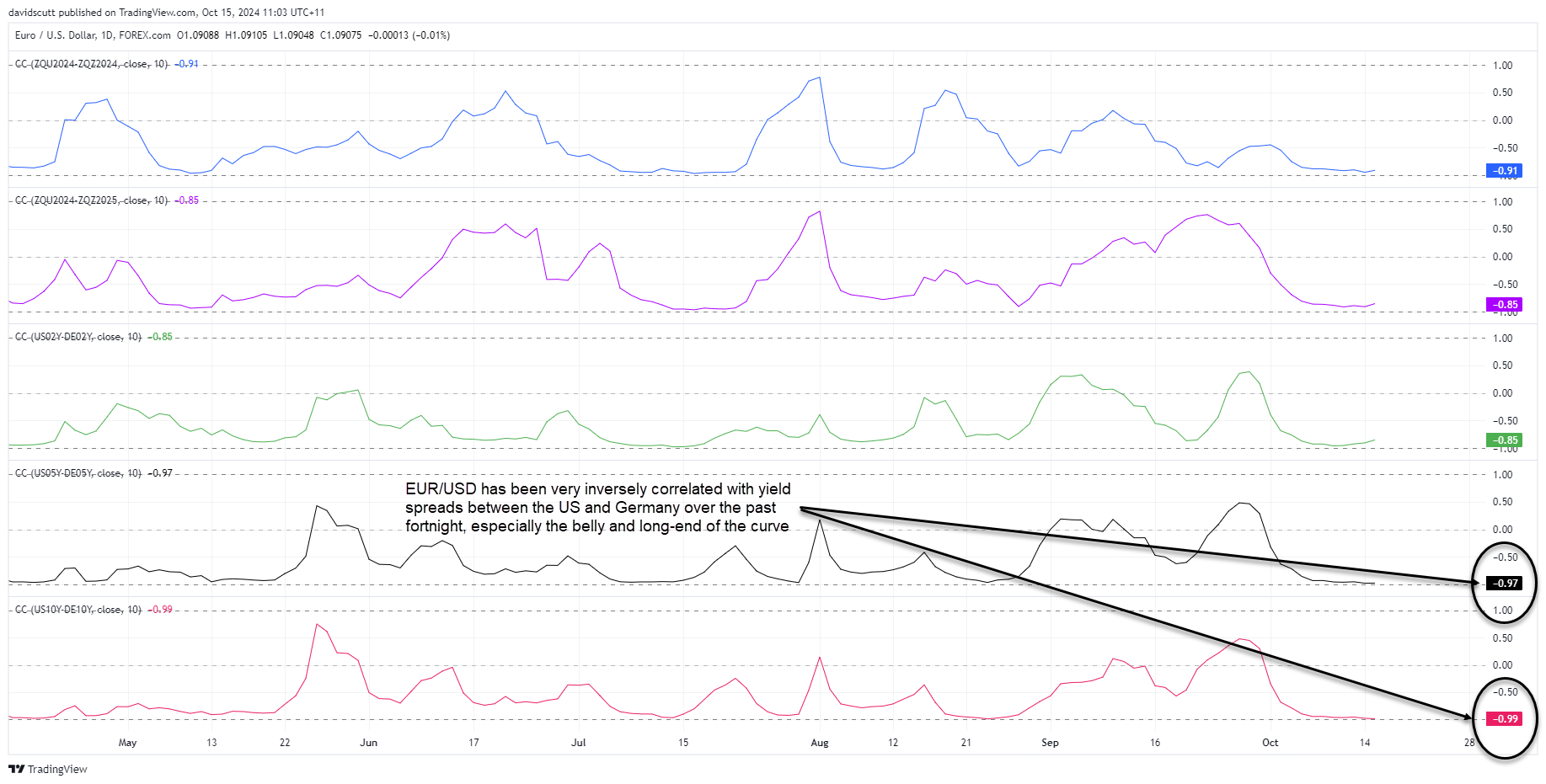

The relative economic performance is flowing through to yield spreads between the US and Europe, proxied in the chart below by German bunds. As yield differentials have widened in favor of the USD, we’ve seen EUR/USD roll over aggressively.

Markets are now more certain the ECB will cut rates by 25 basis points (~95% priced) later this week than they are the Fed in early November, a major shift from what was seen only a few weeks ago when a 50 was favored by the Fed with a cut from the ECB deemed a line-ball call.

EUR/USD moves are not usually driven by relative interest rate differentials but they are right now with the rolling 10-day correlation with Fed rate cut expectations over this year and next, along with US-German yield spreads for 2-year, 5-year and 10-year tenors, sitting with scores ranging between -0.85 to -0.99.

Essentially, when US yields have risen more than German yields, EUR/USD has generally moved lower over the past fortnight.

Divergent Sentiment Creates Squeeze Risk

So, USD looks great, EUR does not. But that’s now priced in, meaning we may need to see a continuation of those trends to see this downside flush extend. Because if they don’t, EUR/USD could be due a squeeze.

With the main risks events this week arriving on Thursday with the ECB rate decision, along with jobless claims and retail sales figures in the US, there must be a temptation among traders who are short to reduce or close their bearish positions, suggesting we may see some form of reversal in the coming days.

As pointed out in a recent note, the risk of an ugly claims figure appears elevated due to disruptions caused by Hurricane Milton last week.

EUR/USD Long Trade Setup

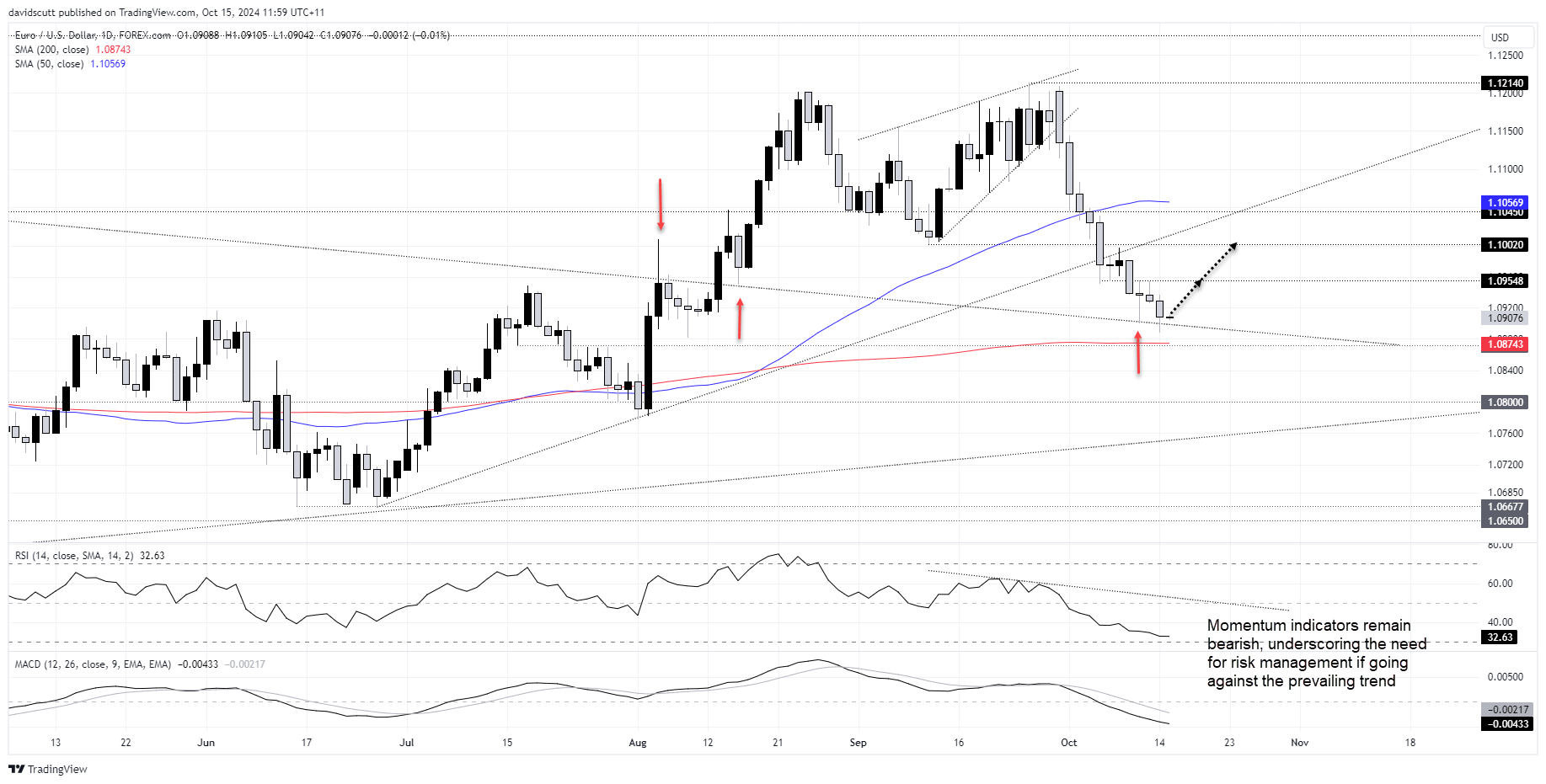

On the charts, EUR/USD finds itself back in familiar territory, testing and bouncing from a long-running downtrend dating back to July 2023 on Monday. Given the initial interaction with the level which has been respected all bar one false break in August, it provides a setup looking for some form of short-covering and/or squeeze.

Those considering longs could buy ahead of the downtrend with a stop below either Monday’s low around 1.0890 or the 200-day moving average located at 1.0874. Potential trade targets include 1.0955 or 1.1000.

Momentum indicators such as RSI (14) and MACD continue to generate bearish signals, meaning for the trade to succeed it will need to go against the prevailing trend. That underline why risk management should be front and centre of those considering the trade.