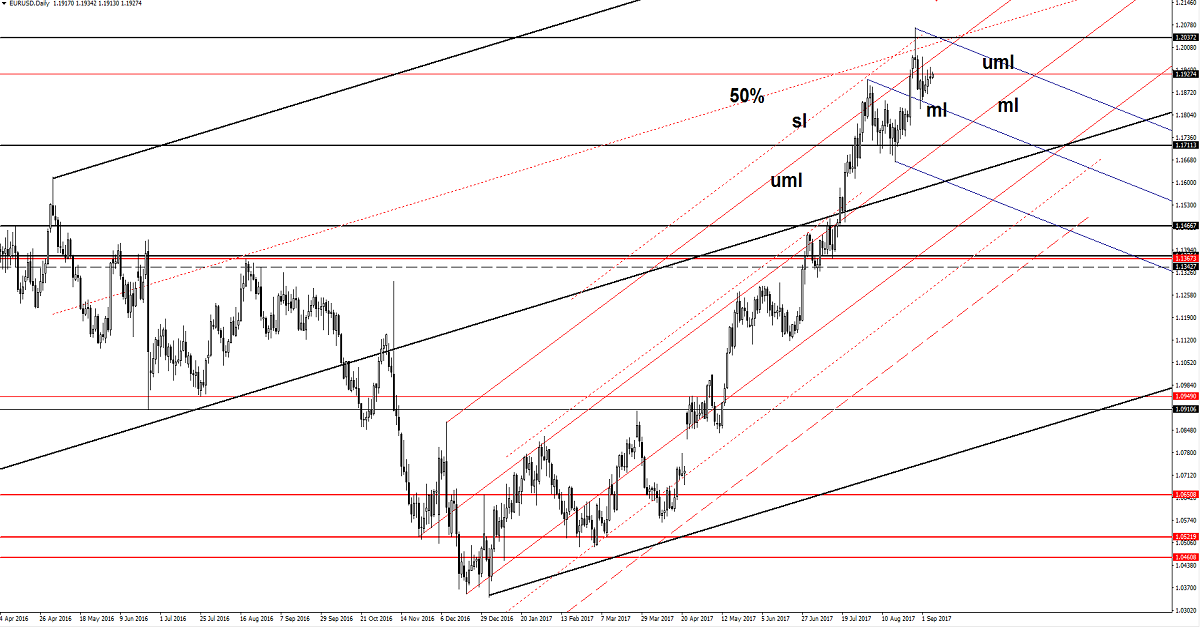

EUR/USD The Crucial Day Has Come

EUR/USD posted humble gains today and seems like has lost the bullish momentum. It shows a little activity as the USDX has changed little as well today. The dollar index is trading in the red, but shows some exhaustion signs, even if is located under the 92.49 broken static support.

However, the USDX could drop much deeper to retest a dynamic support before will really start another leg higher. The dollar index is on a declining path, only some good US data and a dovish ECB could turn it to the upside again.

We have a crucial day for the euro, the ECB is to release the Minimum Bid Rate, which is predicted remains steady at the 0.00% historical minimum. However, there are rumors that said that the European Central Bank will take action today, any stimulus measures will weaken the European currency.

The EUR/USD is fighting hard to hold the ground and to retest the upper median line (uml) of the ascending pitchfork. Technically, is overbought and could decrease at least till will reach the median line (ml) of the ascending pitchfork.

I want to remind you that the current bounce back is natural after the false breakdown below the median line (ml) of the minor descending pitchfork. A failure to reach and retest the upper median lines of the mentioned pitchforks, will signal a sharp drop in the upcoming period.

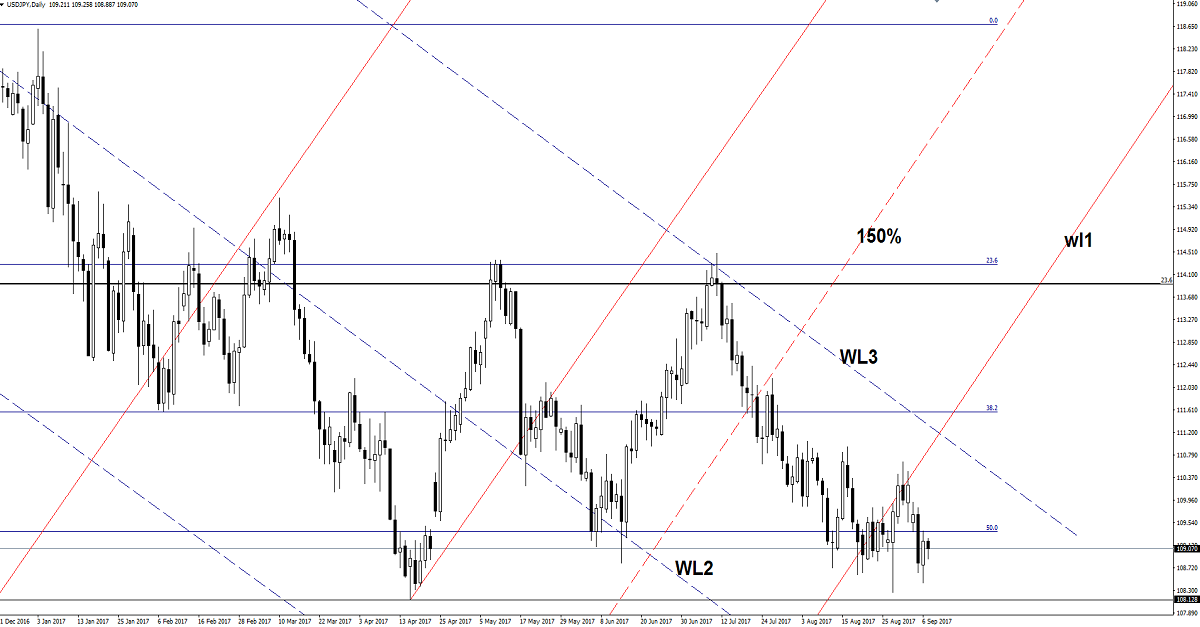

USD/JPY Still Flat

USD/JPY narrows on the Daily chart and fails to show us a clear direction. Price failed once again to reach the 108.12 horizontal support, showing an oversold and a potential up movement. Personally, I hope that we’ll have clear direction after today’s major fundamental events.

The pair moves in range also because the Nikkei stock index move sideways as well on the short term. JP225 lost the bearish momentum and could climb higher again if the USDX will receive a helping hand from the US economy today.

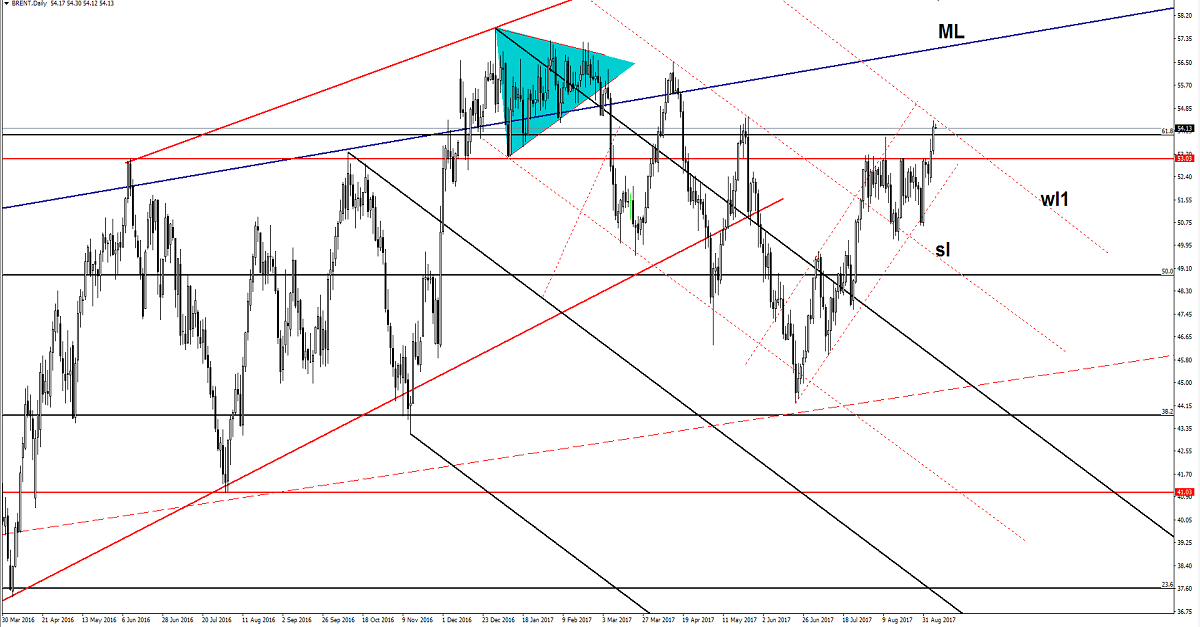

Brent Oil Imminent Breakout

Brent shows little activity after the last’s day’s impressive rally. Price has managed to climb above the 61.8% retracement level, signaling that the bulls are in total control. However, price stands under the first warning line (wl1) of the major descending pitchfork, which represents a major resistance line. Only a valid breakout above it will confirm a further increase in the upcoming weeks. Resistance can be found at the 54.55 as well.

Risk Disclaimer: Trading, in genera,l is very risky and is not suited for everyone. There is always a chance of losing some or all of your initial investment/deposit, so do not invest money you can’t afford to lose. You are strongly advised to carry out your independent research before making any trading decisions. All the analysis, market reports posted on this site are only educational and do not constitute an investment advice or recommendation to open or close positions on international financial markets. The author is not responsible for any loss of profit or damage which may arise from transactions made based on any information on this web site.