The US economic expansion is likely to have reached its peak.

The idea “buy on rumours, sell on facts” has really overwhelmed the financial markets; even the pleasant surprise from the US GDP hasn’t helped the U.S. dollar. Economy has suggested one of the best half-year results over the past decade; expansion in in 2019 is likely to become the most continues, ever recorded; however, the greenback have been actively sold due to the risks of the US GDP rate decline in future, because of tighter financial conditions. The latter may correct the Fed’s plans.

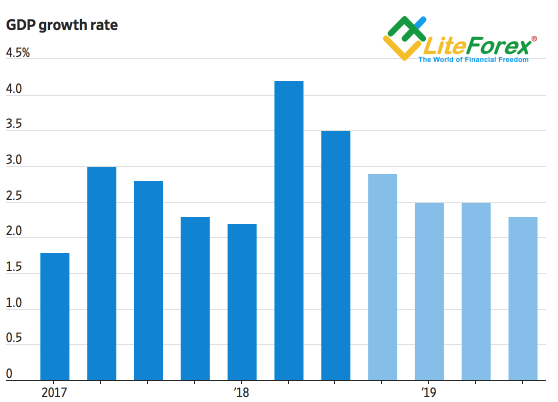

3.5% GDP growth rate resulted from an increase in consumer spending index; however, Barclays (LON:BARC) notes that, as a rule, the index looks strong during two quarters after the tax reduction, and follows with slowdown during the next eight ones. In fact, according to the forecasts of Wall Street Journal experts, The US GDP rate will be down to 2.5% in the January-March period, and down to 2.3% in the July-September period in 2019. The Fed expects the economy to expand by 2.5% in 2019, by 2% in 2020, and by just 1.8% in 2021.

Dynamics Of The US GDP Rate

Source: Wall Street Journal

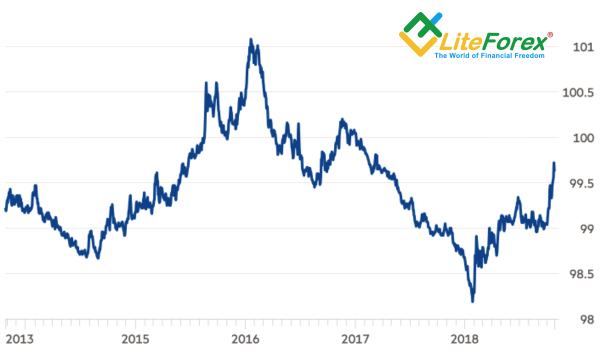

Growing risks of the US GDP slowdown encourage investors to take the profits not only for the greenback but for the US equities as well. Finally, S&P 500 has lost over 8% since early October, heading to its worst monthly efficiency since 2009. It results in sharp tightening of the US financial conditions. Goldman Sachs (NYSE:NYSE:GS) indicator, analyzing the Treasury yield, foreign exchange rates and equity prices, has been up to the highest level since April 2017. The index trajectory should hypothetically add doubts to the Fed, in terms of hiking the fed funds rate up to the neutral level. The derivative market has already cut the chances of monetary restriction in December down to 69.2%, from over 80%.

Source: Financial Times

However, according to Morgan Stanley (NYSE:NYSE:MS), the U.S. central bank will hardly pay attention to the financial conditions. When the inflation rate is going to increase, the Federal Reserve is likely to go on normalizing its monetary policy at the same pace. The opinion contrasts with the position of Minneapolis Fed president Neel Kashkari. He claims that the Fed should pause in hiking the interest rate and put up with the inflation. Otherwise, there will be problems with wages and improvement of labor shortage.

I agree that the US economy has reached its peak, and, without, additional stimulus, like 10-percent tax deduction for the middle class, will hardly repeat the success, featured in the April-September period. This fact makes investors more likely to take the profit for the U.S. dollar. The matter is that there isn’t any real rival for the greenback, except for, may be the yen, among the G10 currencies. The euro is pressed down by political risks, weak economic expansion, in general, and the core inflation, in particular. That is why, until the EUR/USD is above 1.43 and 1.15, the euro bears will be dominating.