While Friday’s U.S. Payrolls report proved surprising, showing a -33,000 job loss in September, it came in with a strong 0.5 percent rise in average hourly earnings and the lowest unemployment rate since 2001. The climb in wages bolstered the odds for tighter monetary policy with the chances of a Fed December hike standing now at 78.5 percent. While these expectations and the strength of the jobs report are dollar-positive, the greenback was vulnerable to a correction and gave up on its recent gains which has led to reversals in both EUR/USD and GBP/USD.

EUR/USD

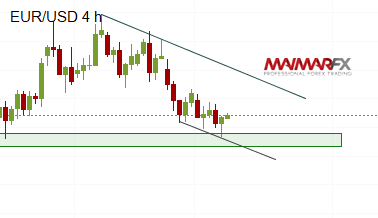

The euro was able to stabilize around 1.1750 after falling to a low of 1.1669. As mentioned in previous analysis, the important support zone extends from 1.1680 to 1.1660/50 and with this barrier still being unbroken, the euro may correct recent losses towards 1.1880 now. In other words, we may see a test of the 1.1860/80-resistance before the euro faces a break of the 1.1660/50-support. In case of a bullish break above 1.1910, however, the bias could shift from bearish to neutral in short-term time frames.

GBP/USD

The slide in the British pound came to a halt near 1.3025 and a long overdue correction started. We currently see the cable testing the 1.31-level and it might extend its correction towards 1.3125. A break above 1.3150 could lead to further gains towards the higher resistance at 1.32 whereas on the bottom side, we expect a crucial support zone coming in around 1.2980.

This week’s calendar is relatively light in terms of market-moving economic data. Minutes from September’s FOMC meeting (Wednesday) may boost the dollar trade but more attention could be paid to Friday’s U.S. CPI report which is expected to be a pivotal event risk this week.

From the eurozone, there are no major economic reports scheduled for release this week, so main attention will be paid to a speech of ECB President Mario Draghi (Thursday).

Here are our daily signal alerts:

EUR/USD

Long at 1.1770 SL 25 TP 20, 50

Short at 1.1730 SL 25 TP 20, 40

GBP/USD

Long at 1.3115 SL 25 TP 20, 50

Short at 1.3060 SL 25 TP 20, 50

We wish you good trades and many pips!

Disclaimer: Any and all liability of the author is excluded.