After three losing sessions, EUR/USD is in green territory in the Thursday session. Currently, the pair is trading at 1.1992, up 0.35% on the day. On the release front, eurozone CPI Flash Estimate dropped to 1.2%, shy of the estimate of 1.3%. Core CPI Flash Estimate followed a similar trend, dipping to 0.7%, short of the forecast of 0.9%. In the US, there are two key indicators. Unemployment claims are expected to climb to 225 thousand, while ISM Non-Manufacturing is expected to drop to 58.1 points.

Eurozone annual inflation is expected to dip to 1.2%, down from 1.3% in March, according to Eurostat. As well, Core annual inflation is forecast to edge lower to 0.9%, after three straight readings of 1.0%. These readings point to sluggish inflation, well short of the ECB target of around 2 percent. The weak inflation numbers are not surprising, as eurozone growth has softened in the first quarter. This is also reflected in manufacturing data, as German and eurozone manufacturing PMIs dropped for a fourth consecutive month.

As expected, the Federal Reserve maintained the benchmark rate at a target of 1.5% to 1.75% on Wednesday. The rate statement was significant, with policymakers noting that “overall inflation has moved closer to 2 percent”. This was more hawkish than the March statement, in which the rate statement said that inflation indicators “have continued to run below 2 percent.” With inflation moving closer to the Fed target of 2 percent, there is a stronger likelihood that the Fed will upgrade its rate projection from three to four hikes in 2018. The odds of a fourth rate hike this year stand at 50%. The Fed rate statement also noted that “market-based measures of inflation compensation remain low,” a reference to soft wage growth, which is at 2.7%, lower than the 3% rate that the Fed would like to see.

The U.S. Dollar is the market’s darling

EUR/USD Fundamentals

Thursday (May 3)

- 5:00 Eurozone CPI Flash Estimate. Estimate 1.3%. Actual 1.2%

- 5:00 Eurozone Core Flash Estimate. Estimate 0.9%. Actual 0.7%

- 5:00 EU Economic Forecasts

- 5:00 Eurozone PPI. Estimate 0.1%. Actual 0.1%

- Tentative – Spanish 10-year Bond Auction

- Tentative – French 10-year Bond Auction

- 7:30 US Challenger Job Cuts

- 8:30 US Preliminary Nonfarm Productivity. Estimate 0.9%

- 8:30 US Preliminary Unit Labor Costs. Estimate 3.1%

- 8:30 US Trade Balance. Estimate -50.0B

- 8:30 US Unemployment Claims. Estimate 225K

- 9:45 US Final Services PMI. Estimate 54.4

- 10:00 US ISM Non-Manufacturing PMI. Estimate 58.1

- 10:00 US Factory Orders. Estimate 1.3%

- 10:30 US Natural Gas Storage. Estimate 47B

Friday (May 4)

- 3:55 German Final Services PMI. Estimate 54.1

- 4:00 Eurozone Final Services PMI. Estimate 55.0

- 5:00 Eurozone Retail Sales. Estimate 0.5%

- 8:30 US Average Hourly Earnings. Estimate 0.2%

- 8:30 US Nonfarm Employment Change. Estimate 189K

- 8:30 US Unemployment Rate. Estimate 4.0%

- 9:00 German Buba President Weidmann Speaks

*All release times are DST

*Key events are in bold

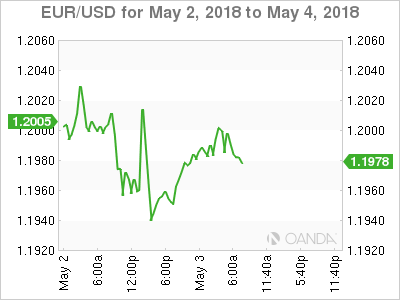

EUR/USD for Thursday, May 3, 2018

EUR/USD for May 3 at 5:55 DST

Open: 1.1950 High: 1.2009 Low: 1.1947 Close: 1.1993

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1718 | 1.1809 | 1.1915 | 1.2025 | 1.2092 | 1.2235 |

EUR/USD edged higher in the Asian session and has ticked higher in European trade

- 1.1915 is providing support

- 1.2025 is a weak resistance line. It could be tested in the Thursday session

Further levels in both directions:

- Below: 1.1915, 1.1809 and 1.1718

- Above: 1.2025, 1.2092, 1.2235 and 1.2319

- Current range: 1.1915 to 1.2025

OANDA’s Open Positions Ratio

EUR/USD ratio is unchanged in the Thursday session. Currently, short and long positions are evenly split, indicative of a lack of trader bias towards EUR/USD.