Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

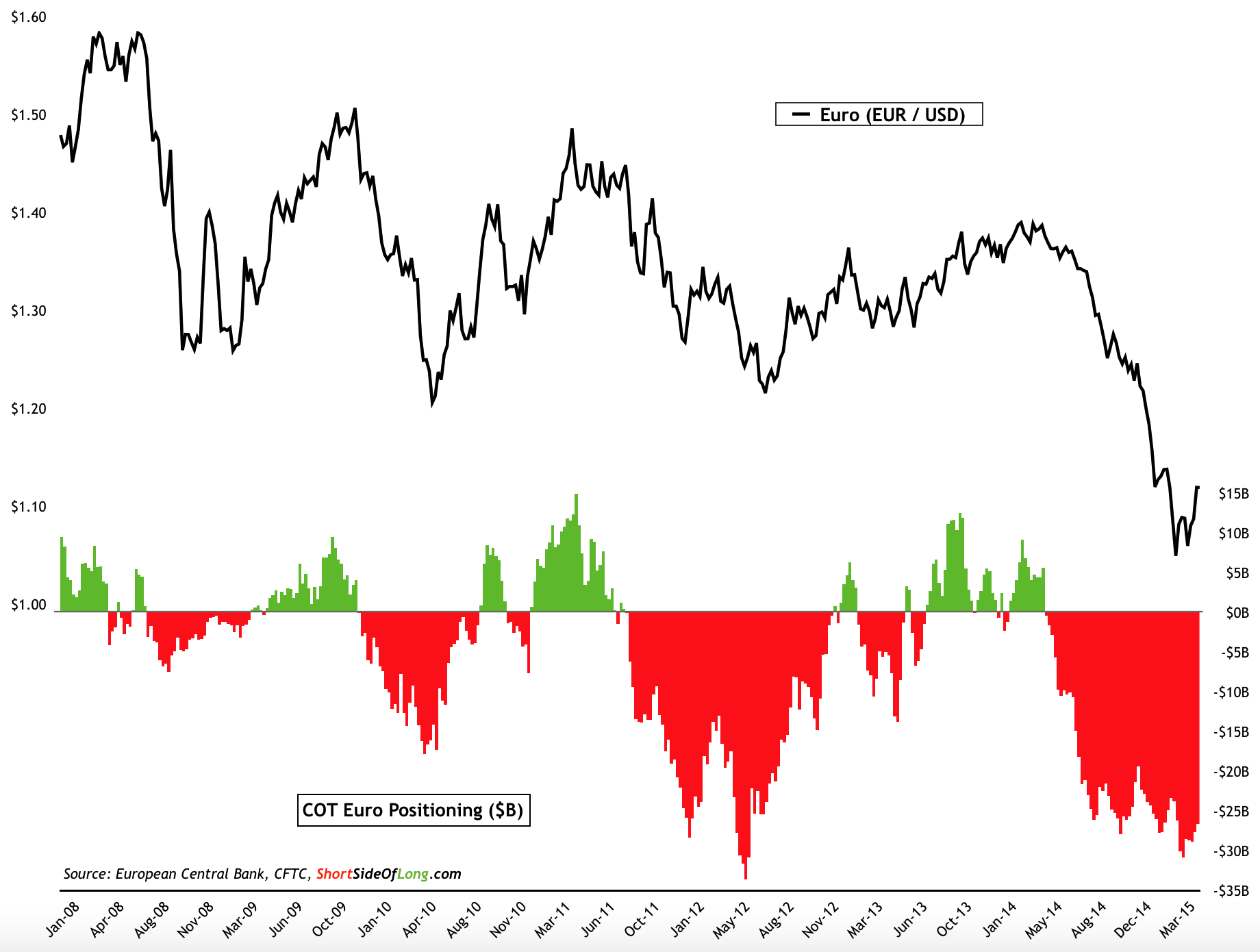

Today's chart of the day focuses on the currency market and the extreme volatility we have witnessed in recent months. Basically, when we observe the euro, it is almost as if we are looking at the US Dollar Index.

I was very fortune to pick the top tick of the US Dollar Index, when I described the middle of March FOMC decision as short-term, dollar negative. One month later, in April, I reminded investors that the Dollar has a lot of potential downside from the short term perspective.

Chart Of The Day: Euro has rallied as hedge funds close bearish bets!

A lot of clients and investors I met on my travels recently were extremely optimistic on the US dollar, which further cemented my views that a correction for the greenback was coming. Basically, what has driven the weak US dollar trade is the short covering by hedge funds and other speculators in currencies such as the euro.

In the middle of March, net short positions were built to near record highs at around 30 billion dollars. With the recent rally in currencies such as euro, pound, Aussie, loonie, Sing dollar and so forth; we can expect hedge funds to be closing a large amount of their bearish bets.

The most important question is whether or not this a major bottom for the euro, or will the trend eventually continue lower?